Time for one more TACO-trade?

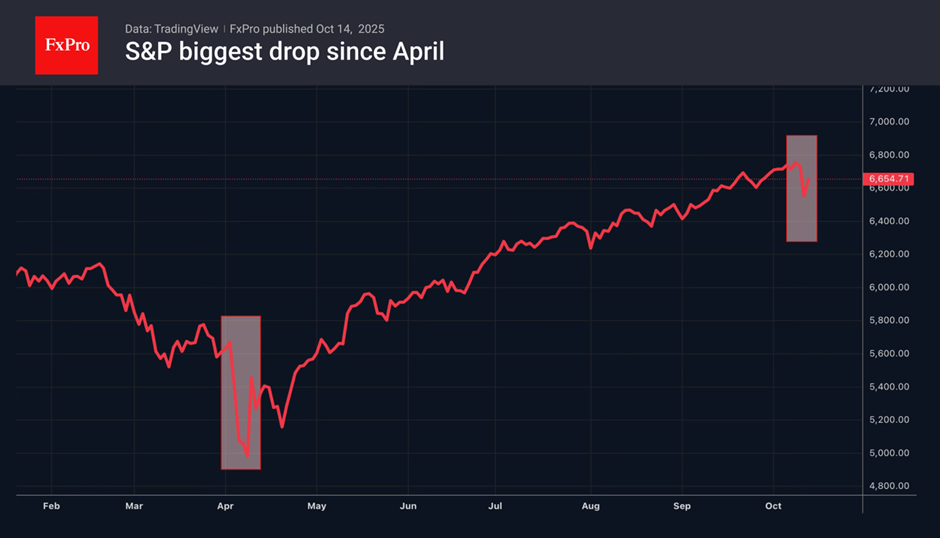

Donald Trump's announcements about the resumption of the trade war with China and additional 100% tariffs came as a complete surprise to investors at the end of last week. The S&P 500 fell at its fastest pace since April. According to Morgan Stanley, the broad stock index will fall 8 to 11% if Washington and Beijing fail to reach an agreement by November.

In fact, neither the US nor China is interested in escalating the trade conflict. Donald Trump is breathing down the neck of the American stock market. He will not allow a deep correction of the S&P 500. The White House owner does not want to distract attention from his role in ending the war in the Middle East. Beijing is eager for Xi Jinping to meet with the US president.

As a result, the markets have turned from selling America to TACO trade, or Trump Always Chickens Out. Indeed, the White House wrote that everything will be fine with China. Treasury Secretary Scott Bessent said that tariffs may not increase as there is time for negotiations. The S&P 500 opened the next trading session with a gap up and is ready to develop an offensive.

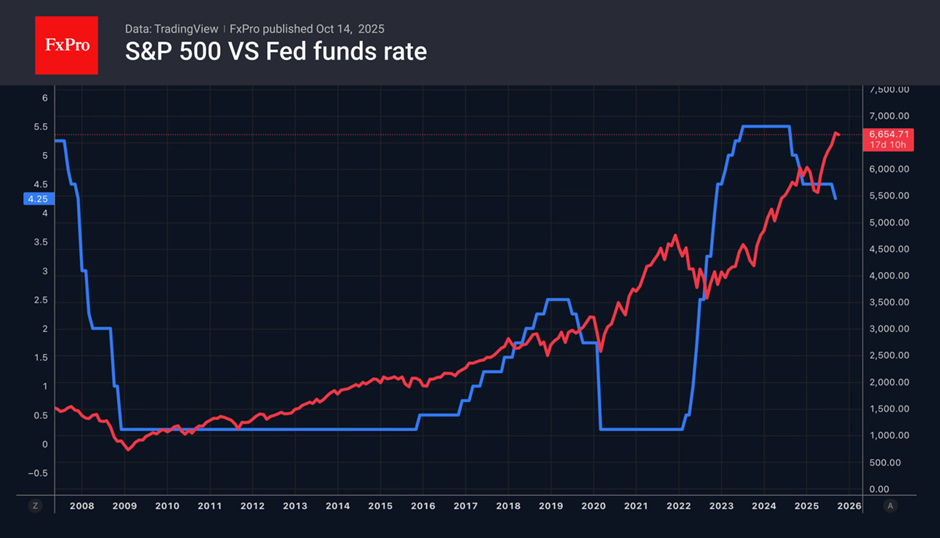

According to Bloomberg experts, the US economy will expand by 1.8% in 2025. Fed officials Christopher Waller, John Williams and Anna Paulson are advocating for lower rates in the background of a weak jobs market. They call the surge in inflation a temporary phenomenon. Investors are counting on a strong corporate reporting season for the third quarter.

According to Wall Street experts' forecasts, the profits of 95% of S&P 500 companies will grow by an average of 16% in 2026. The profits of the Magnificent Seven and Broadcom will increase by 21%. These eight issuers account for 37% of the broad stock index. Their return on equity in 2024 increased by an average of 68%, twice as much as for the eight largest companies at the peak of the dot-com crisis.

Thus, inflated P/E ratios are not evidence of a bubble in the US stock market. American companies' financial results are significantly better than they were a quarter of a century ago. Coupled with a strong economy, AI technologies, and the Fed's monetary expansion, this allows investors to buy up S&P 500 dips.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)