Bitcoin moved from consolidation to correction

Bitcoin moved from consolidation to correction

Market Picture

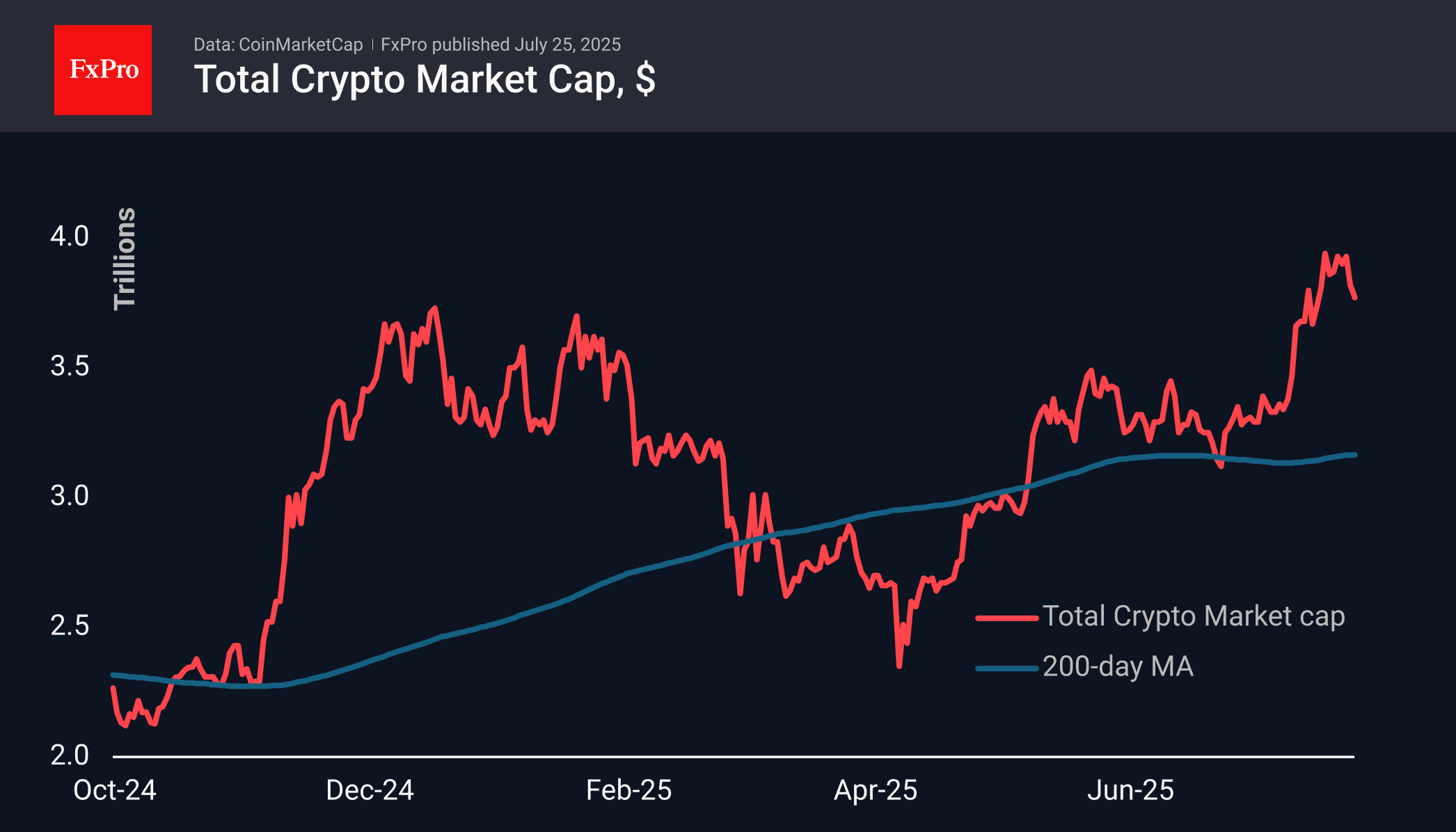

The crypto market capitalisation has fallen by another 1.3% over the past 24 hours to $3.77 trillion, which is 5.3% below the highs of $3.98 trillion set on July 23rd. We consider the decline from the December peaks to be a necessary and healthy correction. Even a pullback to 3.40 can be seen as part of profit-taking, pulling the market back to recent peaks and the 61.8% area of the total growth from April lows. As long as the market remains above this level, there is no point in talking about a change in the medium-term trend.

The sentiment index at 70 indicates a high probability that the market is ready to return to buying as soon as it consolidates part of the latest rally. It should be acknowledged that the market is not falling into such blatant greed as it did in previous growth cycles after halving. On the other hand, the drawdowns are not as deep now either.

Bitcoin fell to $115.2k, losing 2% in a day and 4% in seven days. This is a downward exit from the latest consolidation, forcing us to tune in to a correction with the price moving towards $111K, where the May highs are concentrated, the 76.4% retracement level from the April growth. The 50-day moving average is also heading there.

News Background

Institutional investors continue to build positions in Bitcoin amid retail participants' sales, CryptoQuant notes. The rally has the potential to continue until retail investors enter the market en masse.

Google Trends data confirms the lack of excitement among small players. The number of searches for the word “bitcoin” remains significantly below the “euphoria” of 2021.

For the first time in a long time, Ethereum's trading volume has surpassed that of Bitcoin, CryptoQuant notes. Santiment is convinced that the upward trend of ETH will continue, and that the current market correction is related to profit-taking.

On July 24th, trading in shares of Tron (TRON), a company associated with the blockchain of the same name, began on the Nasdaq exchange. The firm went public through a merger with SRM Entertainment, which was already listed on the trading platform.

Jack Dorsey's Block announced the launch of Bitcoin payments in the Square app based on Lightning Network technology. On July 23rd, Block officially joined the S&P 500 index.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)