Business activity in the eurozone is growing, but very slowly

Business activity in the eurozone is growing, but very slowly

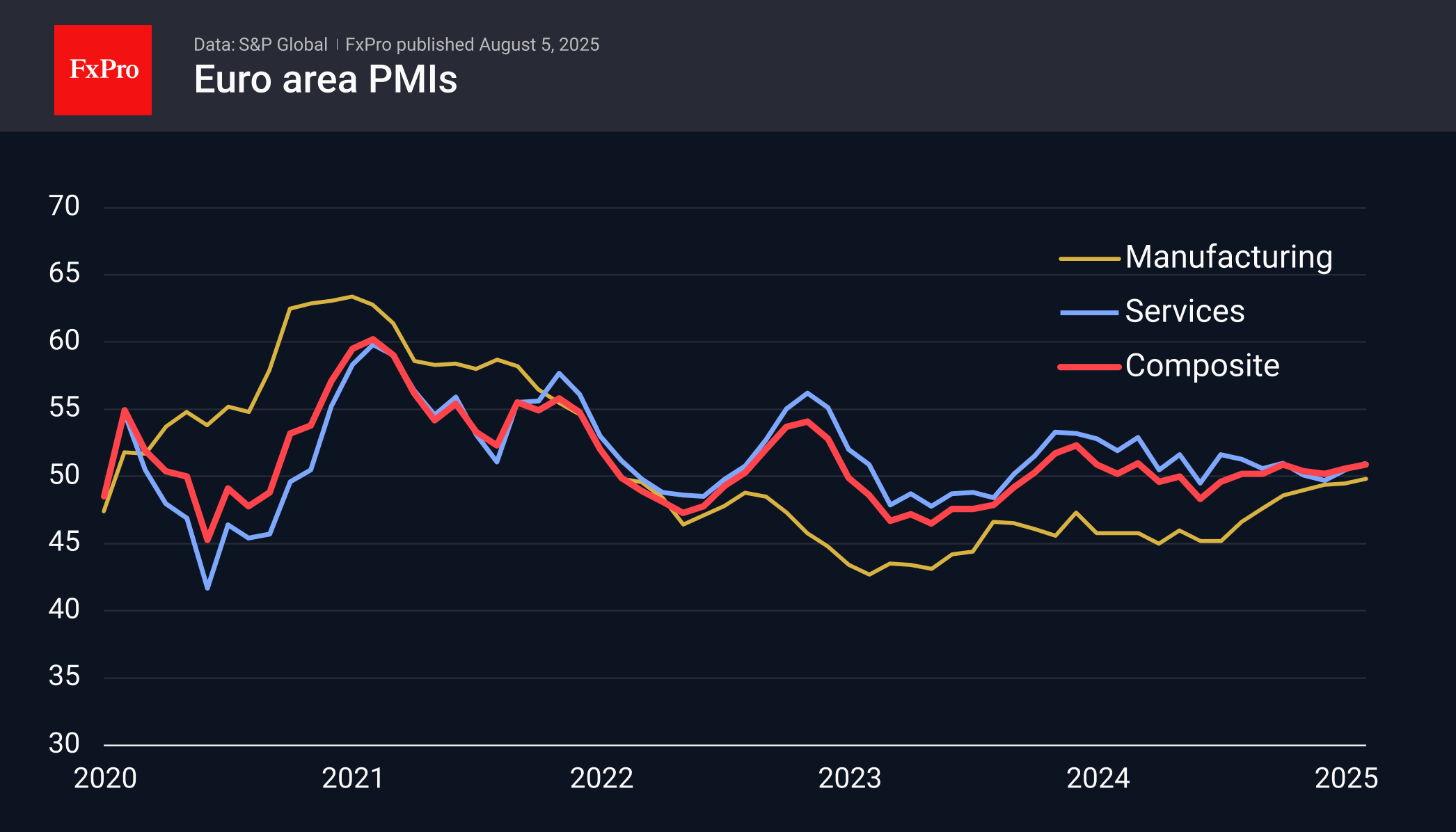

Business activity in the eurozone is returning to growth thanks to a turnaround in manufacturing since the end of last year and a slight acceleration in the pace of growth in services, according to data published by S&P Global.

The final composite PMI data for July showed an increase to 50.9, rising for the third consecutive month and repeating March's figures. Overall, the indicator has returned to levels close to those seen in 2019, indicating fairly sluggish economic growth.

Although the manufacturing sector, for which data was published on Friday, remains below 50, indicating a contraction, this is significantly better than the 45.2 recorded in November and December. This increase clearly reflects the momentum of growth in defence spending in the eurozone and the reduction in the key interest rate, which increases the availability of credit.

The services sector has remained in growth territory for the past eight months, but is experiencing relatively moderate growth rates, which does not suggest any risks of accelerating inflation from this perspective.

An important difference between 2025 and 2019 is the ECB's key rate, which stands at 2.15% versus 0%, respectively. The Central Bank has room to ease policy, so we view the current data as moderately bearish.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)