Daily Global Market Update

Gold's Steady Stance

Despite minor fluctuations, the gold dollar price remained relatively unchanged in the latest trading session. According to the Williams R indicator, the market seems overbought.

Euro Dollar's Rising Momentum

The euro dollar pair experienced a notable increase of 0.7% in the recent session. Analysis from the Stochastic RSI indicates we are currently in an overbought market condition.

Pound's Positive Performance

In the last session, the British pound saw a rise of 0.6% against the dollar. However, the Stochastic indicator points towards a potential downturn in the near future.

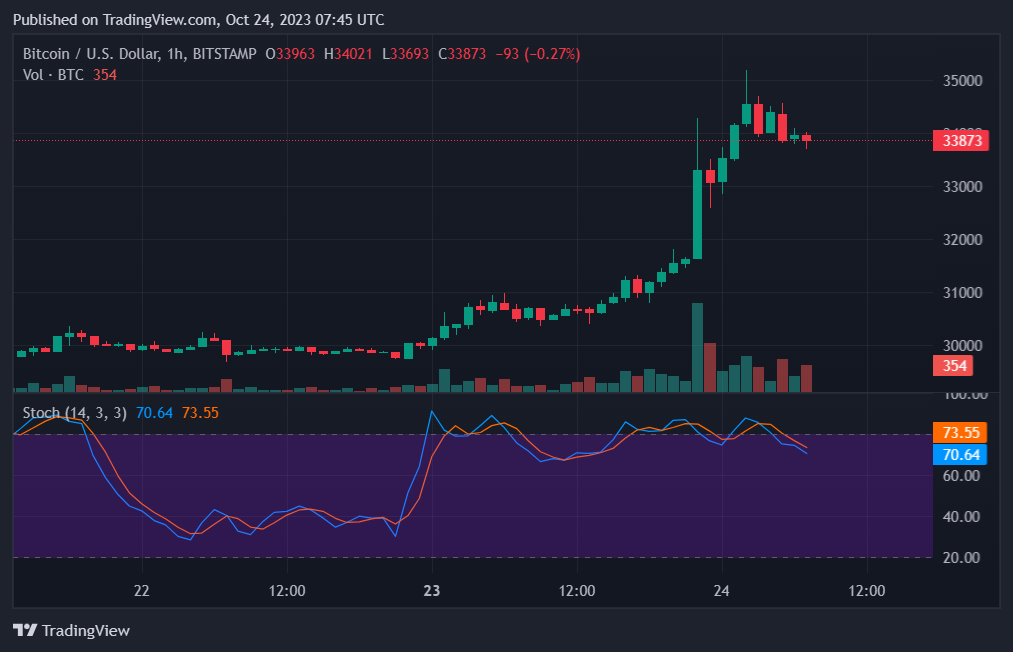

Bitcoin's Bullish Behaviour

Bitcoin, when paired with the dollar, saw a significant rise of 5.1% in the last trading session. The Stochastic indicator suggests continued positive momentum in the near term.

Global Financial Updates

Gold prices have experienced a retreat from their peak of the last five months due to a strengthening US dollar and treasury yields. This change is mainly in anticipation of the critical economic data expected this week. Notably, investors are keeping a close eye on any potential global repercussions stemming from the Middle East conflict. In the realm of payment networks, both MasterCard and Visa have revised their association with Binance due to heightened scrutiny from US regulators. Specifically, Visa has halted the issuance of new co-branded cards with Binance in Europe as of July. Meanwhile, the Tesla share price experienced a substantial decline, dropping 16% over the past week. This dip in valuation follows an earnings report and call that failed to meet investors' expectations, reaching a low not seen since June.

Key Economic Events on the Horizon

Traders and investors should be on the lookout for the following significant economic releases:

• Germany's GfK Consumer Confidence Survey - 0600 hours GMT

• Finland's Producer Price Index - 0500 hours GMT

• Japan's Jabun Bank Manufacturing PMI - 0030 hours GMT

• UK's Claimant Count Change - 0600 hours GMT

• Japan's Jabun Bank Services PMI - 0030 hours GMT

• US Redbook Index - 1255 GMT