Dollar and stocks recoup some NFP-led losses, yen and gold ease back

Markets calmer after NFP shock

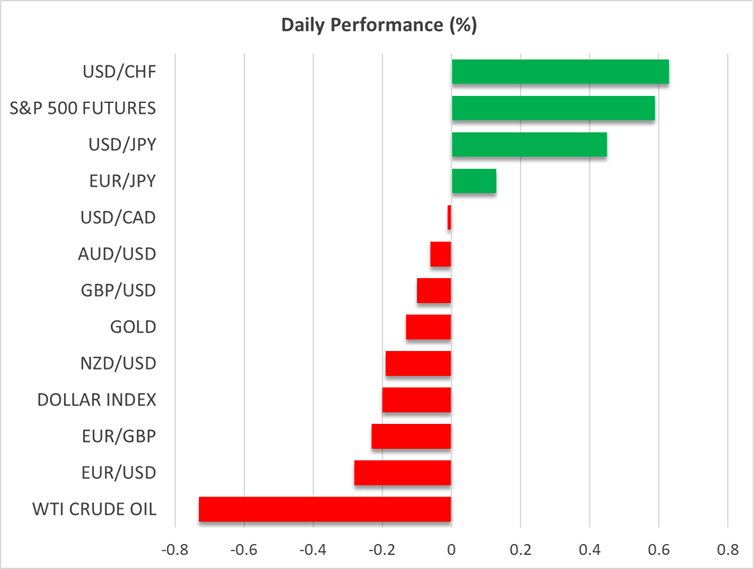

The US dollar clawed higher on Monday while stock markets in Europe and Asia attempted to recover some of last week’s losses as investors digested Friday’s dismal US jobs report as well as President Trump’s latest tariff barrage.

Hot on the heels of the White House’s slew of tariff announcements late on Thursday that set import duties well above the 10% universal rate on a host of countries, markets were not braced for a second shock from the July payrolls numbers.

The US economy added fewer jobs than expected last month, with employment rising by only 73k instead of the projected 110k. The bigger surprise, however, was the sharp downward revisions to both the April and May readings by a total of 258k, which cast doubt on the Fed’s claim just two days prior in the FOMC statement that labour market conditions “remain solid”.

Fed rate cut bets jump, but not dramatically

The weak jobs data has made things even more awkward for Fed Chair Jerome Powell, who is under immense pressure from Trump to slash interest rates, as it adds to the argument that policymakers have fallen behind the curve. But even if the cracks in the labour market are very much real now, there can be no denying that inflation risks remain elevated, as demonstrated by last week’s PCE price indices and the upward revision to the wage growth data in the payrolls report.

This might explain why the move in Fed fund futures hasn’t been quite as dramatic as it would have been had inflation been under control. A rate cut in September is still not fully priced in even though the odds have jumped from around 65% to about 88%. Neither is a third rate cut this year fully priced and whilst a 50-basis-point-reduction definitely remains on the table in September, a lot is riding on the next three (two CPI and one PCE) inflation reports.

Predicting Trump’s next moves

The ISM manufacturing PMI’s prices index, which fell in July, offered some relief on Friday that the tariff impact might be muted, and the large drop in Treasury yields suggests bond markets aren’t too worried about inflation for now. But just as the data is finally moving in Trump’s favour when it comes to supporting the case for rate cuts, the President fired the head of the Bureau of Labor Statistics hours after the jobs report was released, claiming that the numbers were “phony” and “rigged”.

The bizarre move adds to the rising concerns about Trump’s increasingly authoritarian-style hold on the economy. Adding to the uncertainty was the surprise decision on Friday by Fed Governor Adriana Kugler to step down early from her term, potentially opening up an empty seat on the board for Trump to appoint Powell’s successor.

Hopes for tariff reprieves

Yet, the panic has already dissipated in the markets, with US stock futures up by at least 0.5% today. The S&P 500 and Nasdaq 100 shed 1.6% and 2.0%, respectively, on Friday, amid the combination of recession fears, tariff chaos and some lacklustre tech earnings from Apple and Amazon. Disney will be in the spotlight this week as the Q2 earnings season begins to wind down.

Many investors remain hopeful that some of the steep tariffs announced last week will be renegotiated and reduced. For example, reports suggest that Canadian Prime Minister Mark Carney will meet with Trump later this week to potentially reach a deal that would bring down the 35% levy on Canadian imports into the US.

The Canadian dollar is unchanged versus the greenback today, but the Swiss franc is tumbling following the White House’s decision to slap 39% tariffs on Switzerland – something not expected by the Swiss government.

The yen, meanwhile, enjoyed a revival in its safe-haven status during Friday’s risk-off trading, although it is paring those gains today, with the dollar rebounding to just below 148 yen.

Gold off highs, oil under pressure again

Gold was another safe haven that soared on Friday. The precious metal extended its gains to a more than one-week high above $3,365/oz earlier in Monday’s session before easing slightly. The headlines that the United States has ordered two nuclear submarines to move closer to Russia, as Moscow refuses to agree to a ceasefire deal with Ukraine, is keeping gold supported.

Oil futures started the day unusually steady despite the decision by OPEC+ on Sunday to boost output by a further 547k barrels per day from September. However, both WTI and Brent crude futures are slipping now, resuming the selloff that began last Thursday.

.jpg)