Dollar steady but stocks rally on soft PPI and AI optimism, CPI awaited

Markets in cheery mood ahead of US CPI data

Risk assets extended their rally on Thursday amid solidifying expectations that the Federal Reserve will embark on a fresh rate-cutting campaign next week and renewed optimism about the outlook for anything AI related. Shares on Wall Street climbed to new record highs on Wednesday, with Chinese and Japanese indices also surging today.

Equity markets are benefiting from the combination of relief from yesterday’s downside surprise in the US producer price index and the upbeat earnings guidance by software giant, Oracle, on the back of strong AI demand.

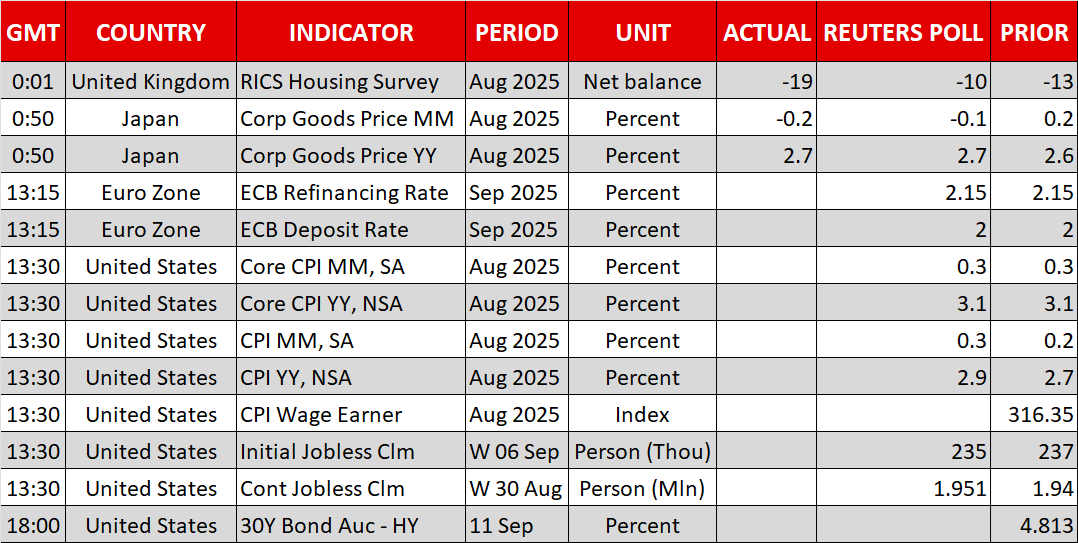

US producer prices rose less than expected in August, moderating sharply from the prior month and easing fears of tariff-induced inflation. Both headline and core PPI fell below 3.0%, reducing the risk of a nasty upside surprise in today’s CPI numbers.

US consumer prices likely rose by 2.9%, while underlying prices are expected to have increased by 3.1%. If the CPI data is also weaker than expected, bets of a 50-basis-point cut by the Fed next week would enjoy a significant boost. However, with markets positioned so dovishly, there’s a danger of a sharp correction if CPI accelerates more than anticipated.

Investors will also be keeping an eye on today’s weekly jobless claims for an update on the labour market, as they could be more market moving should the CPI report come in more or less in line with expectations.

Oracle earnings refuel AI rally

In the meantime, there’s a positive mood prevailing in global equity markets. Both the S&P 500 and Nasdaq closed at a new all-time high on Wednesday, with Japan’s Nikkei 225 index doing the same today.

Small caps and traditional stocks are lagging, however, as there is some rotation back towards tech stocks, thanks to yesterday’s earnings release by Oracle.

The company’s results for its first fiscal quarter missed estimates by a slight margin but investors were impressed by its strong business orders, which are set to boost earnings in the upcoming quarters.

Specifically, remaining performance obligations, which measures the value of its contracts backlog, jumped 359% to $455 billion, amid soaring demand for AI-based cloud computing. Any doubts about AI have now been put on the backburner, although it’s worth pointing out that upside momentum in the broader stock market is somewhat limited right now.

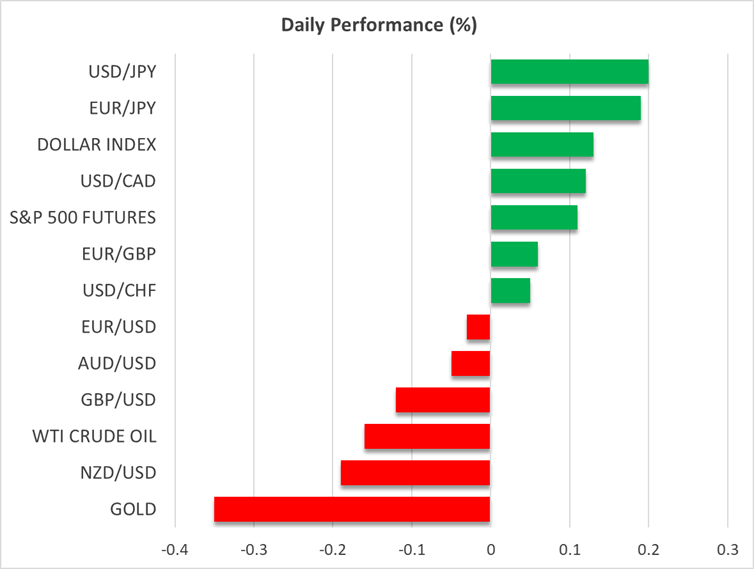

Dollar defies rate cut bets as yen struggles

FX markets have been having a quieter time, however, with the US dollar swimming against the tide of Fed rate cut bets to edge higher. Against a basket of currencies, the dollar has now fully erased Monday’s NFP-led losses and in the bigger picture, it remains flat, potentially signalling some doubts about how aggressively the Fed will cut rates.

Fed funds futures were little moved after the PPI data and there might be a similar reaction to today’s CPI figures. With a 25-bps rate cut baked in for next Wednesday, traders are likely waiting to see what the Fed’s new dot plot will look like before placing large positions.

The dollar is holding firm even against the yen, which has been undermined by domestic political uncertainty. All the evidence backs the case for the Bank of Japan to hike rates again later this year. But investors are staying cautious as they wait to find out who will replace Shigeru Ishiba as prime minister, and specifically, whether the new premier will support the BoJ’s plans to unwind years of accommodative policy.

Euro eyes ECB decision amid French turmoil

The euro and pound have also been jolted by political risks lately, as the risk of a debt crisis has risen in both France and the UK. The appointment of Sebastien Lecornu as France’s new prime minister by President Macron has eased fears of a worsening crisis for the time being, although everything hinges on whether he will be able to garner the support of the opposition to pass the 2026 budget.

The immediate focus, however, is on today’s ECB meeting. The ECB is widely expected to hold rates steady, but the euro could come under pressure if President Lagarde keeps the door wide open to further rate cuts.

Gold and oil slide

In commodities, gold appears to be on the backfoot today as the sharp rally takes a pause following this month’s consecutive record highs. Unless the dollar suffers a fresh selloff, which doesn’t seem too likely given its recent resilience, gold may struggle to resume its uptrend in the short term.

Oil futures are also trading lower today, despite the growing threat of more sanctions by the US and its allies on Russian oil exports, as well as renewed tensions in the Middle East. Any concerns about supply disruptions are being outweighed by the risk of a supply glut later in the year, especially after yesterday’s jump in weekly crude oil stocks in the US.

.jpg)