Dollar tests limit after NFP

Friday's US employment report sparked a sell-off in both the dollar and stock indices, as the pace of job creation missed forecasts, but hourly earnings growth beat expectations.

The economy added 209k jobs in June, compared to 306k the previous month and 224k expected. The private sector added 149k (200k expected). It should be noted that some traders had priced in stronger growth after the ADP report, which showed a jump in employment of 497k. Confidence in this indicator continues to melt away.

Official data showed that employment was growing in line with long-term trend rates, with no sign of a trend break in the services sector due to high-interest rates. However, job growth in the manufacturing sector has stalled, hovering just below 13 million. That's only 8% of the total labour market, but economists focus on trends in manufacturing as one of the leading indicators of the business cycle, along with housing.

Another area of focus is wages. Hourly earnings growth maintained its 4.4% y/y pace for the third consecutive month while adding 0.4% m/m. Wage growth remains elevated, keeping domestic inflationary pressures at bay.

In such an environment, the Fed can hardly see its inflation target as being met, and this is bad news for the equity market as it increases expectations of further rate hikes, despite growing signs of a slowing economy from the manufacturing sector.

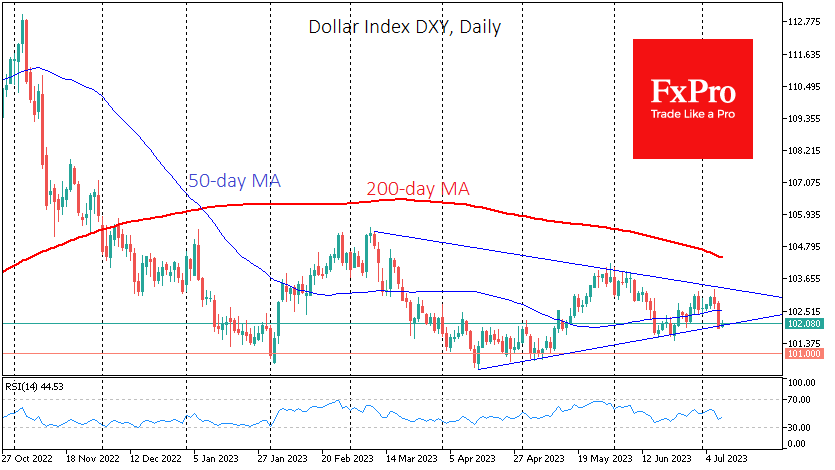

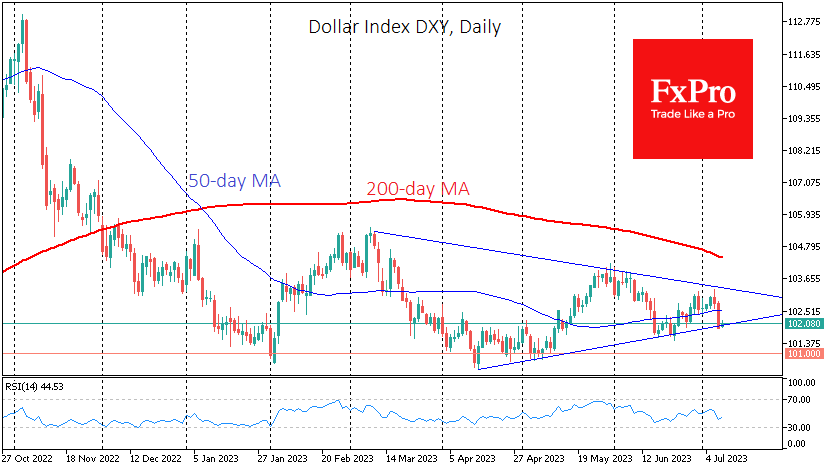

The Dollar Index sold off after the NFP, losing 0.75% and falling to a two-week low below 102 before turning lower after a failed attempt to consolidate above 103. On Monday, the dollar stabilised near an uptrend line through the local lows of April, May, and June.

On Friday, the DXY moved sharply below the 50-day moving average, which looks like an early signal that the trend is changing to a downtrend. However, from a technical point of view, we can talk about a break of the trend once the DXY breaks below 101.6 (previous lows).

A sustained break out of the dollar's consolidation range would seriously affect the entire FX market. EURUSD is currently approaching 1.10, and establishing a downtrend in the DXY opens a steady upward path towards 1.13-1.14 by the end of the quarter and the potential for GBPUSD to rise above 1.30.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)