EURUSD jumps to test critical resistance

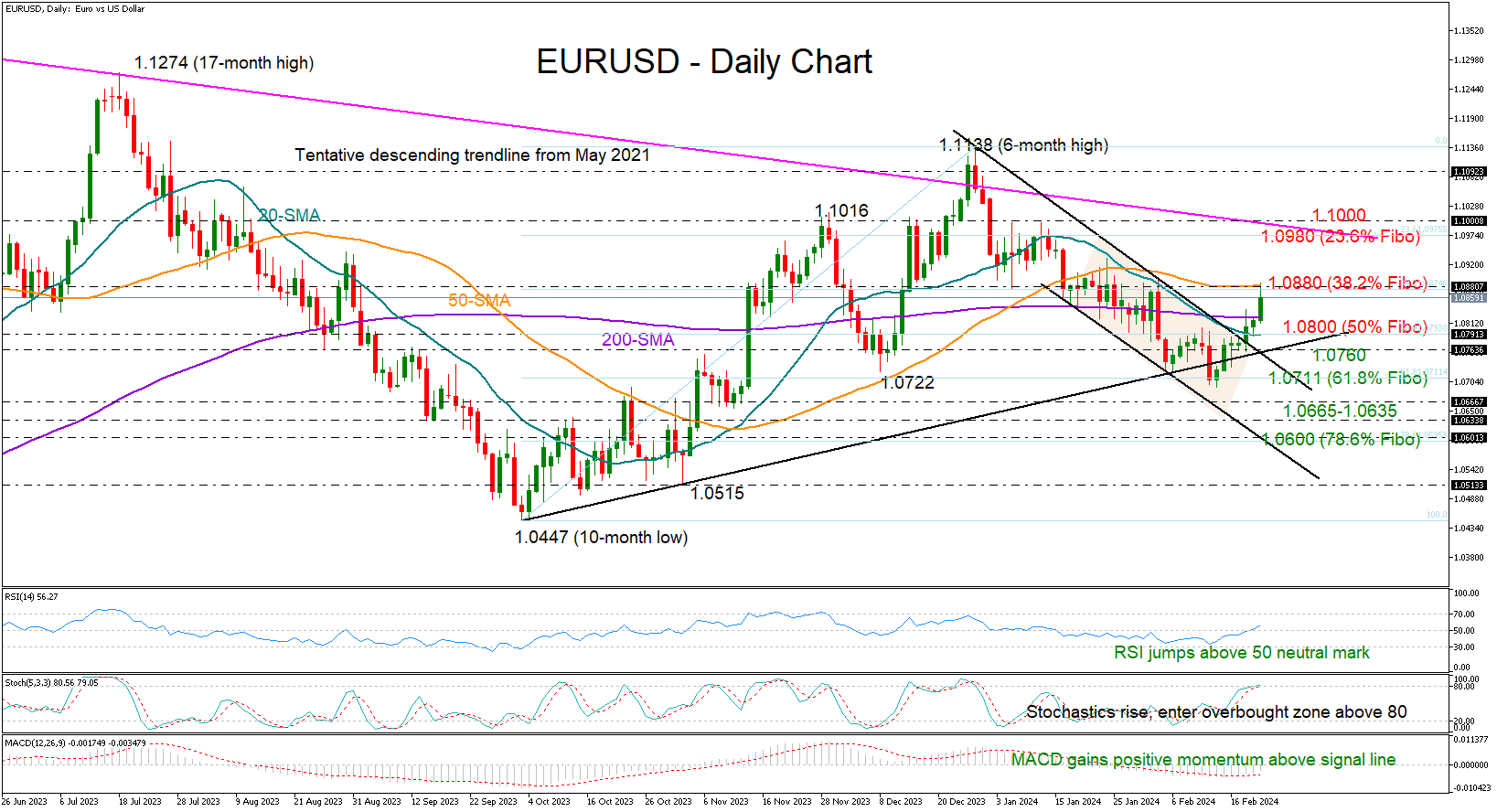

EURUSD is in the seventh day of gains, marking its longest bull run in a while to reach the critical 1.0880 bar. Disappointingly, Eurozone's flash business PMI figures for February could not lift the pair above that threshold earlier today as the manufacturing sector continued to shrink, but the technical indicators are still in the bullish area.

The RSI has clearly jumped back above its 50 neutral mark, and the MACD keeps progressing above its red signal line, painting a rosy picture for the short-term. The positive slope in the stochastic oscillator is endorsing that scenario too, though with the indicator entering the overbought zone, room for improvement could be limited.

If the pair successfully claims the 1.0880 threshold, it is expected to rise rapidly towards the 1.0980 level and the 23.6% Fibonacci retracement of the October-December 2023 uptrend. The 1.1000 psychological mark, which coincides with the resistance trendline from May 2021, will be closely watched as well before the spotlight turns again to the 1.1100-1.1138 peak area from December.

On the downside, the 50% Fibonacci of 1.0790 and the 20-day SMA could calm selling pressures ahead of the ascending trendline from October at 1.0760. Failure to rebound there could see a correction towards the 61.8% Fibonacci of 1.0711, while a steeper decline may pause somewhere between 1.0665 and 1.0635. Next, the bears might attempt to sink the price below the broken bearish channel at 1.0600.

In brief, EURUSD is enjoying its best weekly session so far this year, though an extension above the 1.0880 barricade is still required to break up the 2024 negative trend and therefore brighten the short-term outlook.

.jpg)