EUR/USD rises as the US dollar struggles to hold ground

By RoboForex Analytical Department

The EUR/USD pair continues its gradual climb, reaching 1.1562 on Tuesday despite local support for the US dollar stemming from renewed geopolitical tensions.

Geopolitics and Fed expectations in focus

The greenback experienced a temporary surge in demand as tensions escalated in the Middle East, prompting a rise in safe-haven assets. This followed US President Donald Trump’s call for the complete evacuation of Tehran and renewed pressure on Iran to accept his nuclear deal proposal.

Meanwhile, market attention has now shifted to the Federal Reserve meeting, which begins today and concludes on Wednesday evening. While the Fed is widely expected to keep interest rates unchanged, investors are seeking fresh forward guidance, especially given the recent softening of expectations for future rate cuts.

Persistent inflation concerns, driven by elevated oil prices and lingering uncertainty in the trade sector, are further shaping sentiment.

Today’s key macroeconomic releases include US retail sales and industrial production figures for May, while in the eurozone, the focus is on the ZEW economic expectations index for June.

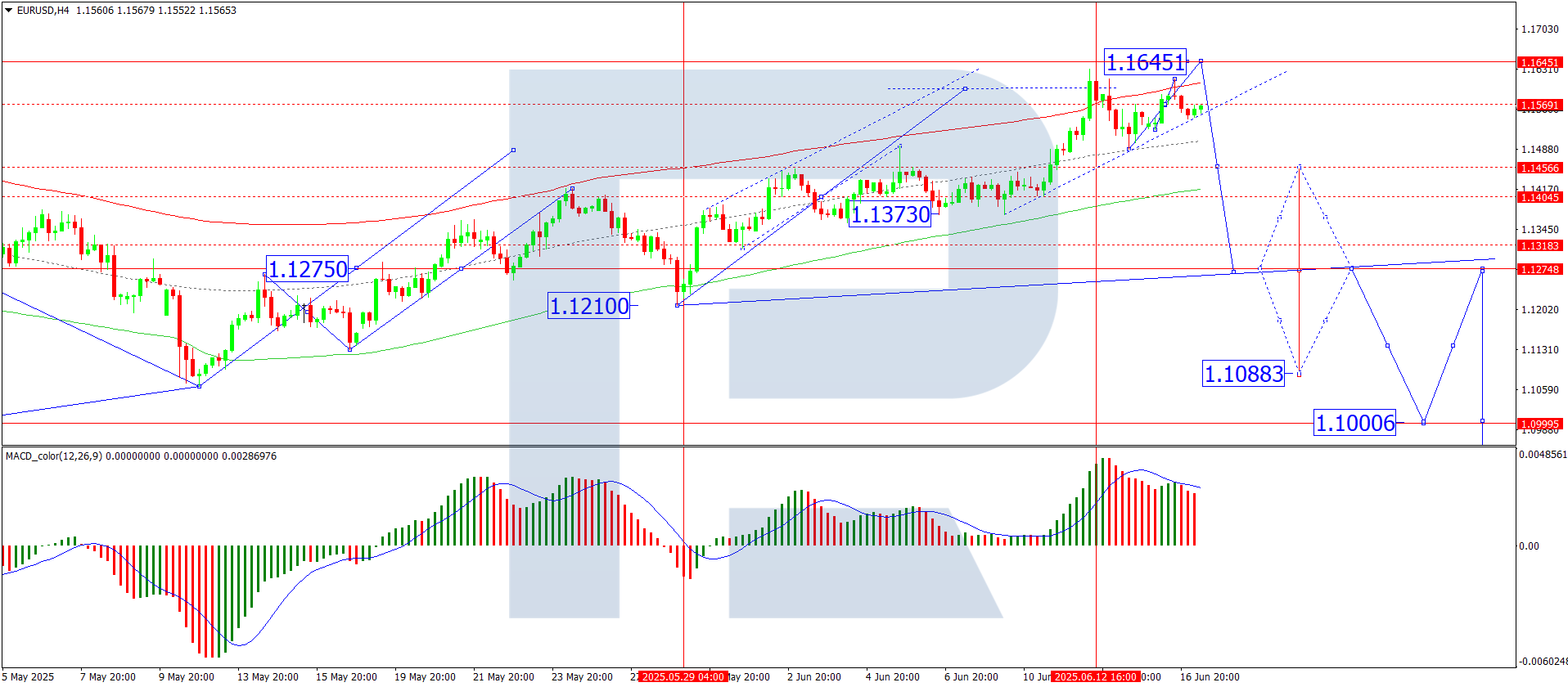

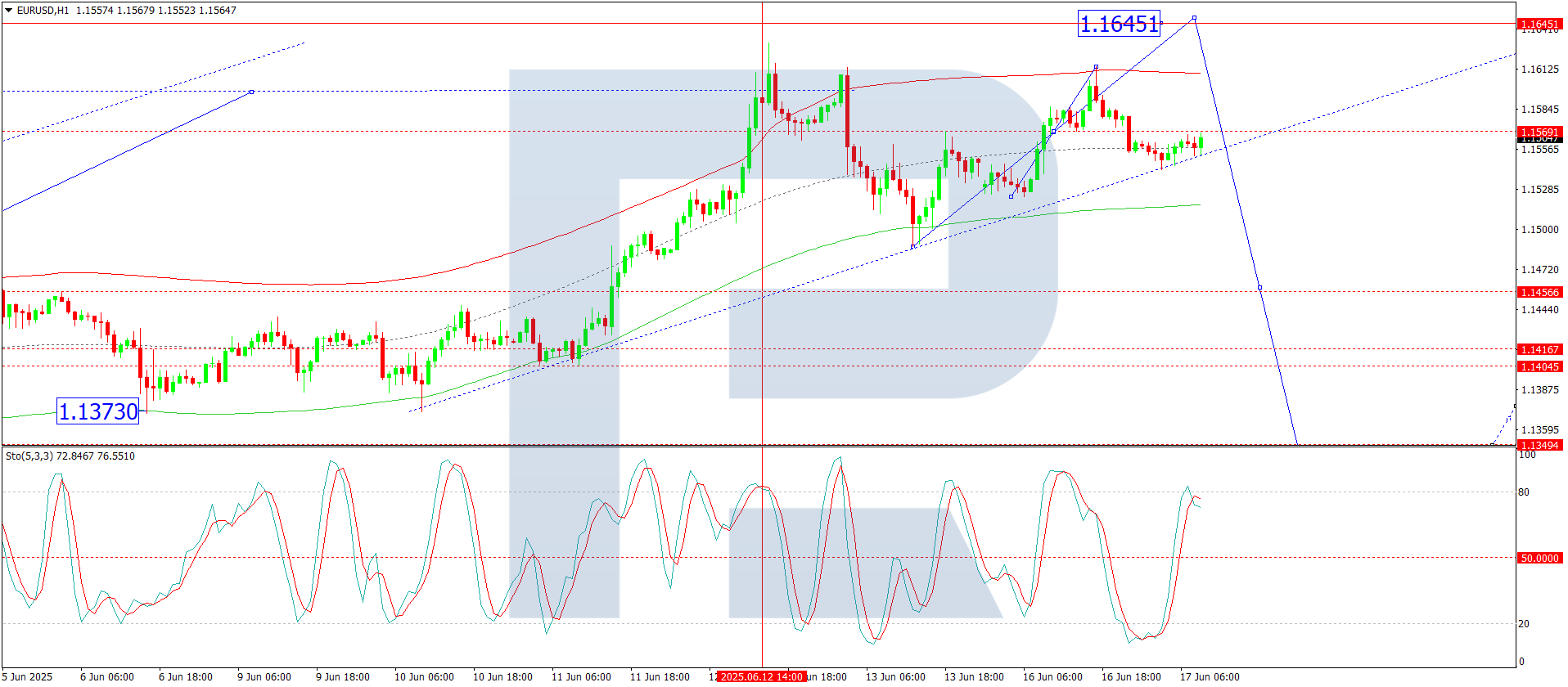

Technical analysis of EUR/USD

On the H4 chart, EUR/USD is forming a consolidation range at the top of the upward trend. A possible expansion towards 1.1645 cannot be excluded. Subsequently, a decline towards the lower boundary of the range at 1.1490 is anticipated. A break below 1.1490 would open the path for a new downward wave towards 1.1275, which is the first main target. The MACD indicator supports this outlook – its signal line remains above zero but has exited the histogram zone and is expected to descend back to the zero line, confirming a weakening upward impulse.

On the H1 chart, the market is consolidating around the 1.1570 level. The local growth target at 1.1614 has already been fulfilled, followed by a technical retest of 1.1542 from above. The next expected move is a growth link to 1.1645. A broad consolidation range around 1.1570 continues to take shape. The main scenario anticipates a decline towards 1.1456 once the growth structure is complete. This view is confirmed by the Stochastic oscillator, with its signal line above 50 and heading sharply towards 80, indicating room for further short-term upside before a reversal.

Conclusion

EUR/USD remains supported in the short term amid geopolitical uncertainty and softening Fed rate expectations, with key resistance at 1.1645 and support at 1.1490 and 1.1456. A sustained break below these levels could trigger a deeper correction towards 1.1275. For now, technical signals indicate a continuation of the consolidation phase, with one more upward impulse likely before a reversal sets in.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.