GBPUSD recovery faces key test

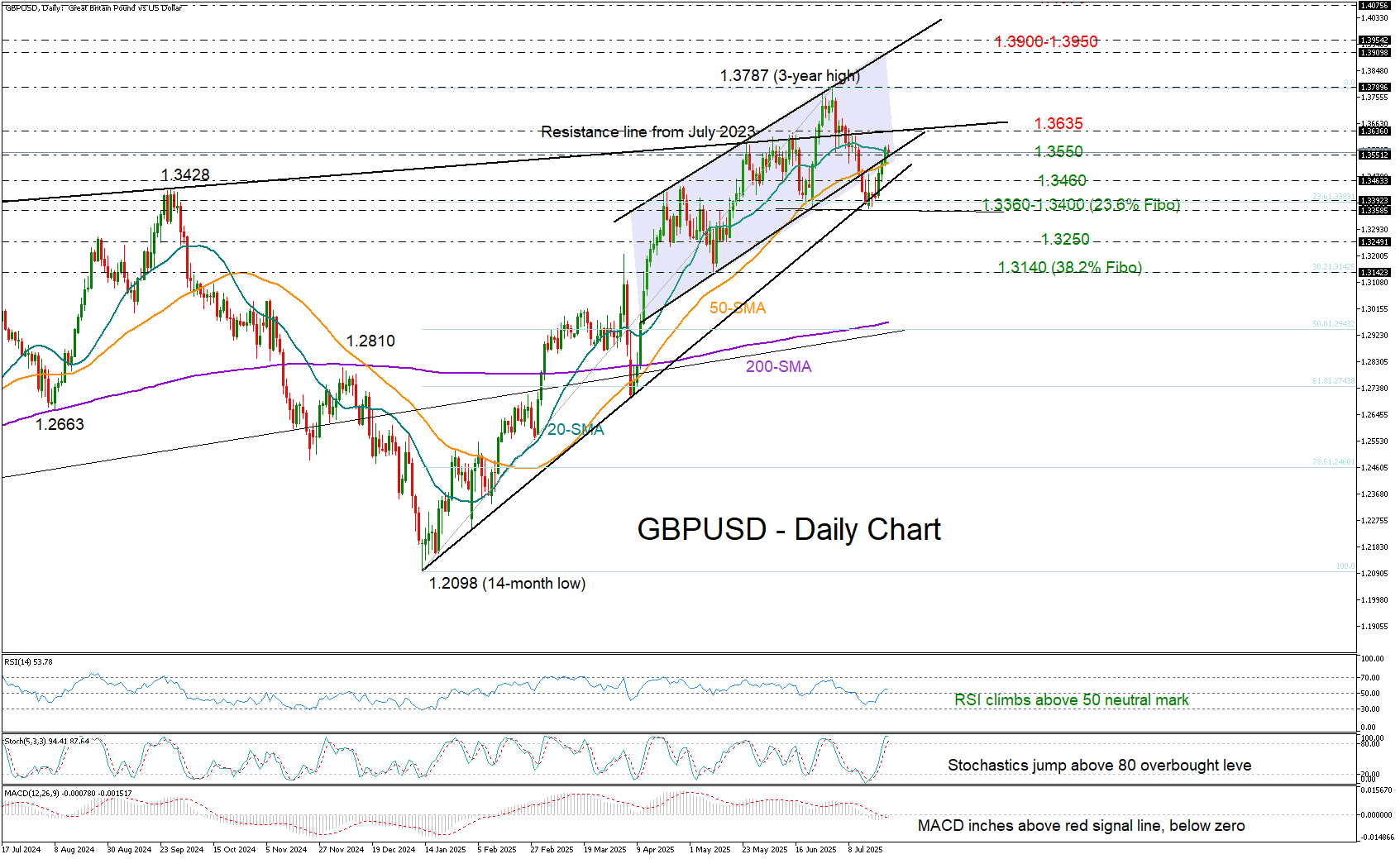

GBPUSD escaped a drop below the 1.3390–1.3400 support area last week, helped by dollar weakness, and is now attempting a close back above its 20- and 50-day simple moving averages (SMAs) near 1.3550.

The latest rebound preserved the nearly 14% year-to-date rally, but for bullish sentiment to strengthen, the pair must also clear the resistance line drawn from July 2023 at 1.3635. A decisive move above the three-year high of 1.3787 could then pave the way toward the 1.3900 round level, where the upper boundary of the short-term bullish channel lies. Beyond that, the price could pause near the 161.8% Fibonacci extension of the prior decline at 1.4070, before potentially heading toward the psychological 1.4200 mark.

Both the RSI and MACD indicators suggest that upward momentum could continue. However, with the stochastic oscillator surging into overbought territory, some caution is warranted following five consecutive monthly wins. In any case, sellers are likely to remain on the sidelines unless the price breaks below the 1.3360 support zone, which would bring the 1.3245 area into focus. Further losses could trigger a deeper decline toward the 38.2% Fibonacci retracement of the 2025 uptrend at 1.3140.

In brief, GBPUSD bulls may retain control in the short term if the pair establishes a solid foothold above 1.3550 and overcomes the 1.3635 barrier too. Failure to do so could signal a false breakout, raising the risk of a bearish head and shoulders formation.

.jpg)