Gold feels the blues after record rally

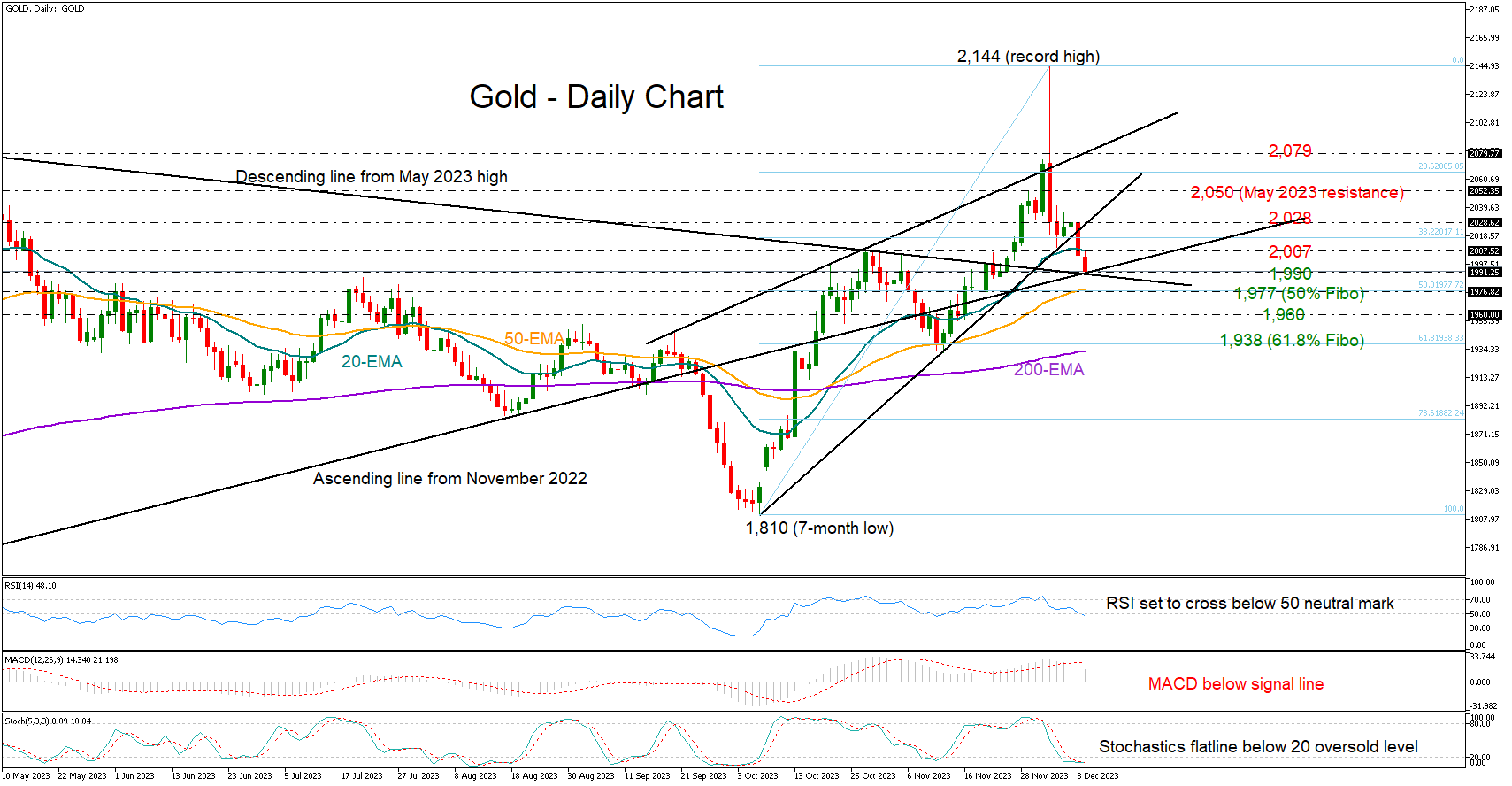

Despite its rocket rally to a new record high of 2,144 last Monday, gold could not successfully remain above the pandemic-era 2,070 bar, which caused a negative trend reversal in 2022 and 2023.

The precious metal has been trending southwards since then, feeding concerns that a new bearish trend could be underway as the price has slipped below a short-term support trendline and marginally beneath its 20-day exponential moving average (EMA) and the 2,000 number.

The technical signals are not very encouraging either as the RSI is looking to cross below its 50 neutral mark and the MACD keeps decelerating below its red signal line. Yet, the stochastic oscillator is already in the oversold area, while the ascending line from the November 2022 low seems to have resumed its protective role around 1,990. This is also where the 200-period EMA on the four-hour chart is blocking the way down, justifying some optimism for the coming sessions, too.

If the 1,990 floor cracks, the 50-day EMA, which overlaps with the 50% Fibonacci retracement of the latest upleg at 1,977, could be the next pivot point. Slightly lower, the 1,960 region has been a tough obstacle to upside movements during the past couple of years and will be closely watched before the 61.8% Fibonacci mark of 1,938 and the 200-day EMA attract attention.

In the opposite case, where the price jumps back above its 20-day EMA at 2,007, the rise could last till the 2,028 resistance region. A break higher could strengthen the bullish momentum towards the important barrier of 2,050. If that proves easy to overcome too, the spotlight will again turn to the critical 2023 top of 2,079.

Summing up, the yellow metal has a bearish tendency in the very short-term picture, but sellers may not act forcefully until a drop below 1,977-1,990 occurs.

.jpg)