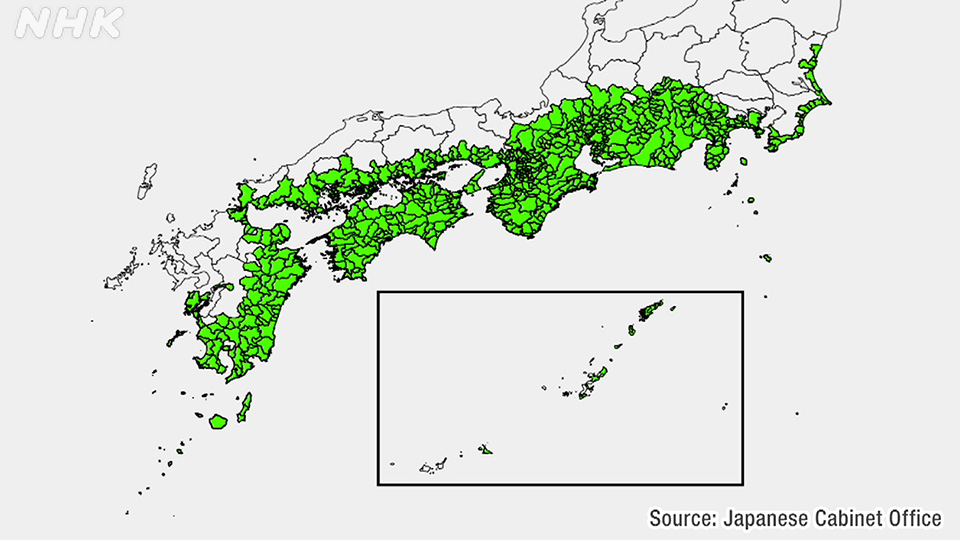

Potential mega-quake in Nankai Trough: the Yen’s safe haven status Yen's safe haven status: shifting dynamics post-2010

The Japan Meteorological Agency has issued a warning about a potential mega quake in the Nankai Trough, following a magnitude 7.1 quake in the region. The area highlighted in green could face severe impacts, potentially causing hundreds of thousands of deaths and over a trillion dollars in damage.

Source: NHK

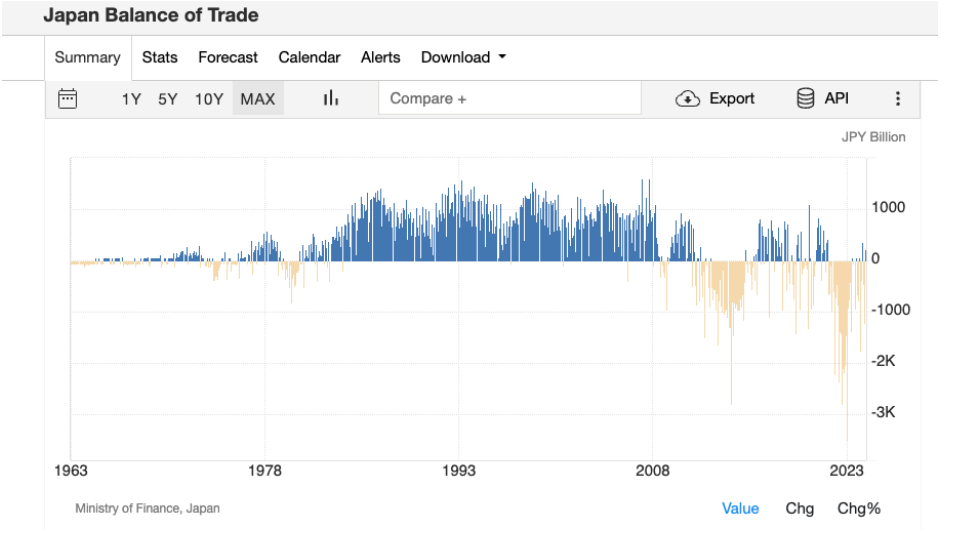

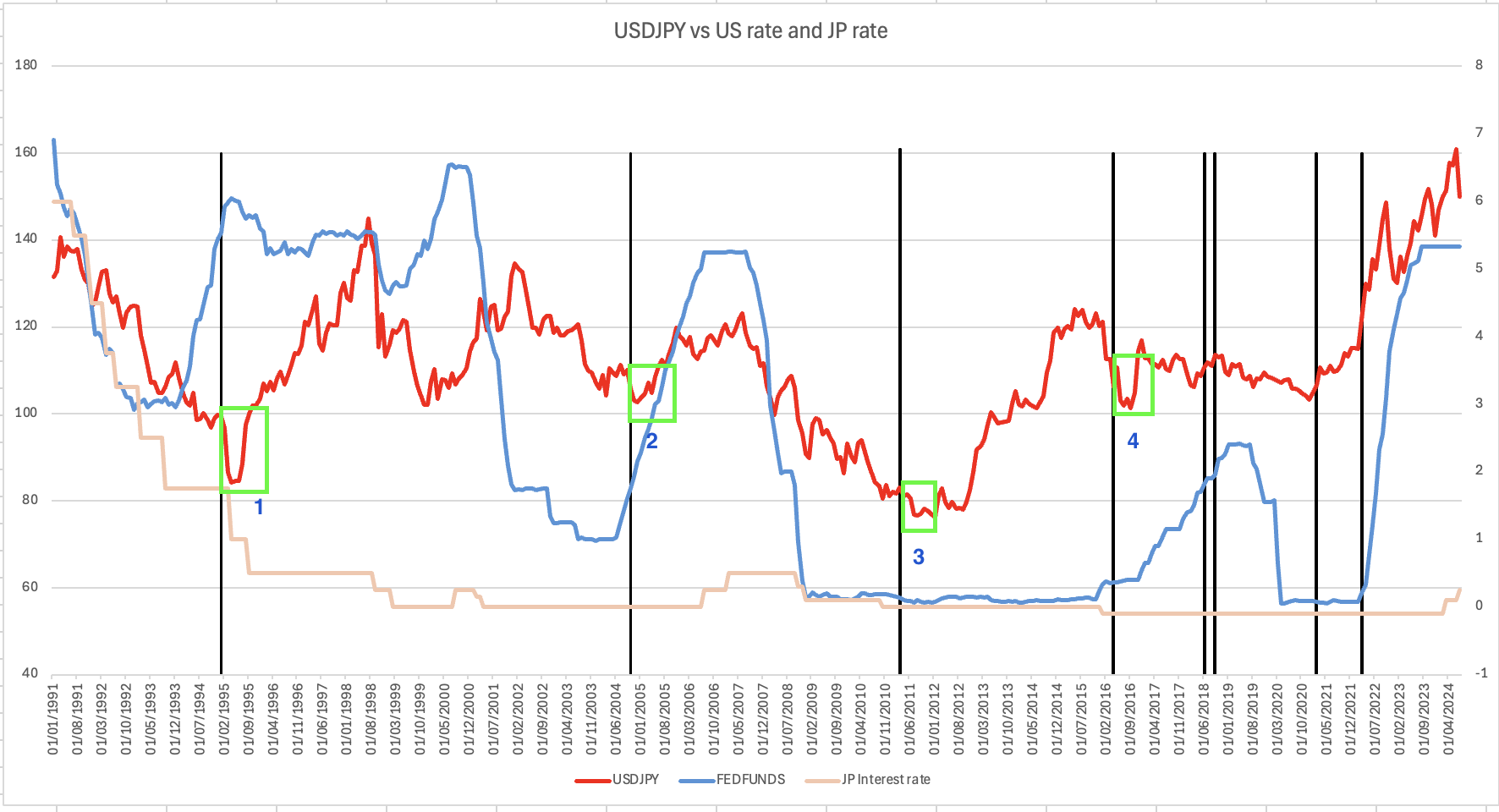

The yen was traditionally seen as a safe haven currency, often rising in value after earthquakes in Japan. This was mainly due to Japan's trade surplus. However, since 2010, Japan has experienced a trade deficit, altering this dynamic. While the yen strengthened after earthquakes in 1995, 2004, 2011, and 2016, this pattern has been less prevalent since 2018.

Source: tradingeconomics

The yen's safe haven status was also linked to its role in carry trades, where it would strengthen as these trades unwound. After 2009, low U.S. interest rates reduced carry trade activity, weakening this effect. However, the Fed's rate hikes in 2022 revived carry trades.

The size of the carry trade is uncertain. Analysts estimate $350 billion in short-term external loans by Japanese banks as yen-funded trades. The actual size is likely larger due to domestic borrowing and hedge funds’ leveraging. Japan's foreign portfolio investments were 666.86 trillion yen ($4.54 trillion) at the end of March.

Former Bank of Japan board member Makoto Sakurai commented that the BoJ likely won’t hike rates again this year following recent market turmoil.

Source: adopted from Reuters

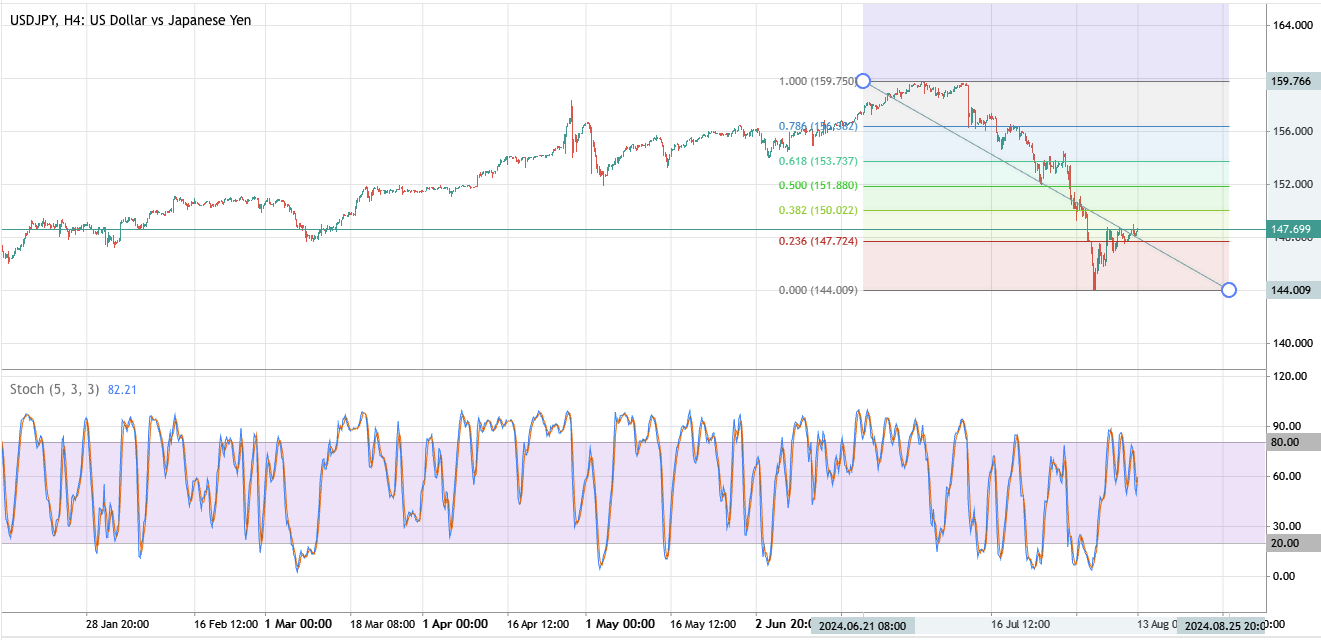

Technical analysis

Source: deriv MT5

USD/JPY faces initial resistance at the psychological 150 level and strong support around 138 on the long-term weekly chart.

Conclusion

The recent unwinding of carry trades is estimated at 50-70%. Should a mega quake occur in Japan, further unwinding could strengthen the yen, potentially enhancing its safe-haven status. However, the impact of new government bonds for reconstruction and possible adjustments in interest rates could also influence the yen’s strength and its role as a safe-haven currency.

Disclaimer:

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. It is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information. The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. No representation or warranty is given as to the accuracy or completeness of this information. Do your own research before making any trading decisions.