The crypto market pulled back further into the range

Market picture

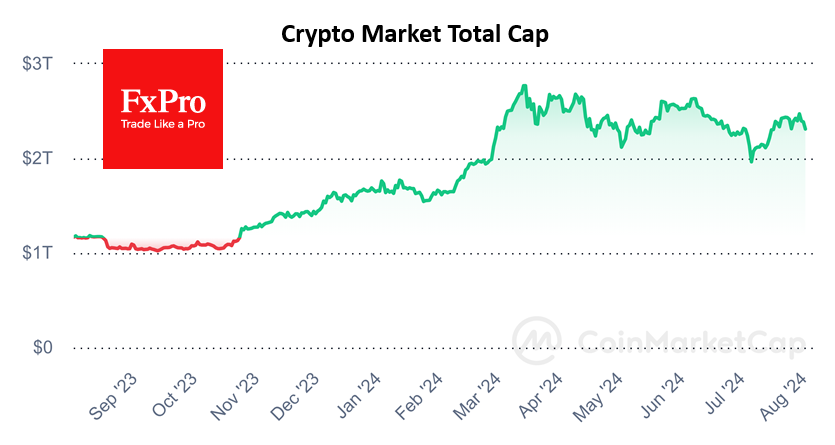

Cryptocurrencies continued to sag, failing to support gains in the stock market, returning the crypto market cap to $2.30trn levels seen a week ago. The market formed another lower local peak, a sequence that has been in place since March. A move towards the lower end of the sloping range suggests the potential for another 20% decline. This is a pessimistic, non-mainstream scenario given Bitcoin's historically strong performance in these months post-halving and the good risk appetite in stocks and commodities.

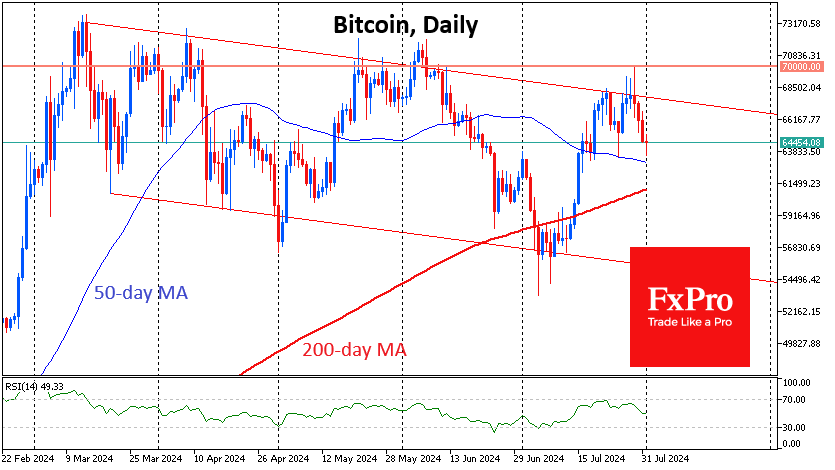

Bitcoin was down to $63.7K on Thursday morning, once again near the 50-day moving average, which remains a tactical support line. If the decline develops, dynamics around the $63K and $61K levels, near where the 50 and 200-day moving averages are, will be important. A failure of this support will open the way to $55K, which is quite frightening.

Bitcoin ended July up 4.4% to $64,600. In terms of seasonality, August is considered one of the two worst months for BTC. Over the past 13 years, bitcoin has ended the month up only five times and down eight times. The average decline was 15.4% and the average rise was 26%.

News background

Ethereum is expected to experience greater price fluctuations than Bitcoin. QCP Capital noted that the monthly volatility premium for the asset in "long-distance" options increased from 4% to 8%.

Another recalculation saw the first cryptocurrency's mining difficulty increase by 10.5% to 90.67T. The average hashrate for the period since the previous value change was 933.84 EH/s.

Bankrupt cryptocurrency exchange Mt.Gox sent another 33,964 BTC ($2.25bn) to an unknown address and made an internal transfer of 47,229 BTC ($3.13bn). According to Arkham, Mt.Gox-related wallets still hold 80,128 BTC worth $5.32bn. The majority of Mt.Gox investors receiving payouts can be classified as hodlers. This potentially mitigates the scale of selling pressure in the coming weeks.

A forthcoming bill from Senator Cynthia Lummis would allow the US to create the first cryptocurrency reserve, The Block reported, citing a draft document.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)