The pound is rising as traders only focus on the positive

Fresh data from the UK painted a mixed economic picture, but the market, in line with the trends of recent days, paid attention only to the positive data.

The bright side was a 1.3% increase in retail sales for November instead of the expected 0.4%. This jump took the index into positive territory versus last year with a minimal +0.1% y/y. Sales excluding fuel are up 0.3% y/y. The pound rose a quarter of a cent to 1.2710, bouncing back from better-than-expected statistics. That's the end of the positive news.

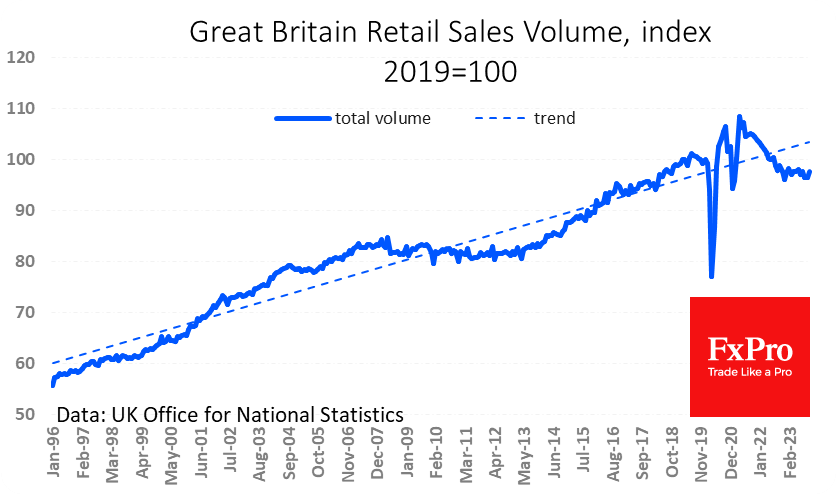

The nominal retail sales index has been stagnating for the last fifteen months, which does not allow us to talk about a recovery in demand but only about its retention. The deviation from the long-term trend is comparable to the prolonged stagnation following the global financial crisis.

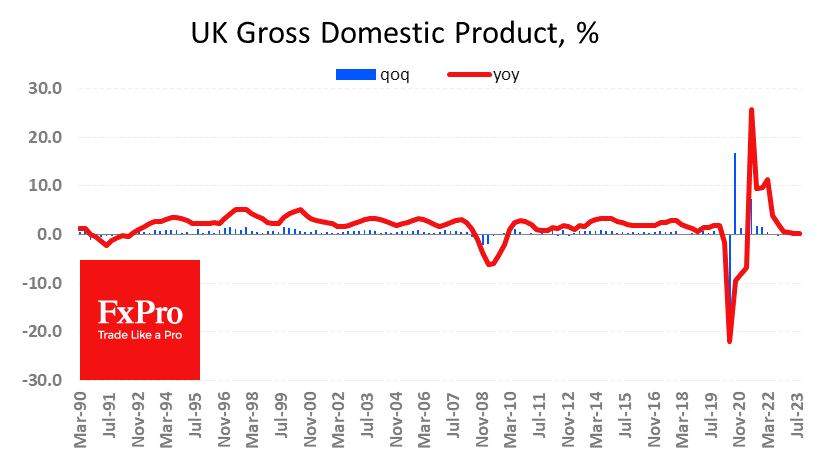

According to the final estimate, UK GDP lost 0.1% in the third quarter and is only 0.3% higher year-over-year (0.6% was expected). The economy contracted due to a decline in personal consumption (-0.4% QoQ). However, the deep balance of payments deficit played a role in the negative revision.

A fall in CBI sales estimates was also reported a day earlier. The indicator fell from -11 to -32, much stronger than the expected -13.

Fundamentally, the UK economy is more in need of an interest rate cut than the US economy. However, GBPUSD has been adding since November as traders in the markets primarily speculate around a US monetary policy reversal, selling the dollar, while data from Europe only affects the markets briefly after the release.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)