EBC Markets Briefing | Hang Seng moves sideways; Intel back in profit

Hong Kong shares failed to get a lift from Wall Street on Wednesday, as market braced for a busy day headlined by the Fed's decision and earnings from technology heavyweights.

The ASEAN bloc and China signed an upgrade to their free trade agreement, which includes sections on digital, the green economy and other new industries, Beijing's Commerce Ministry said.

The RCEP framework is seen by some analysts as a potential buffer against US tariffs, though its provisions could be weaker than other regional trade deals due to competing interests among its members.

China has pledged to "significantly" boost the share of consumption in its economy over the next 5 years while keeping tech and manufacturing as the top priorities, in an effort to reduce reliant on exports.

During Trump's visit to Asia, a key question is what Beijing gets in return for the trade truce other than reducing the threat of higher tariffs — and how long the delay will remain in place.

Fundamental fights over national security appeared untouched, along with Trump's stated core mission of rebalancing trade. Making that harder, Chinese investment into America remains heavily restricted.

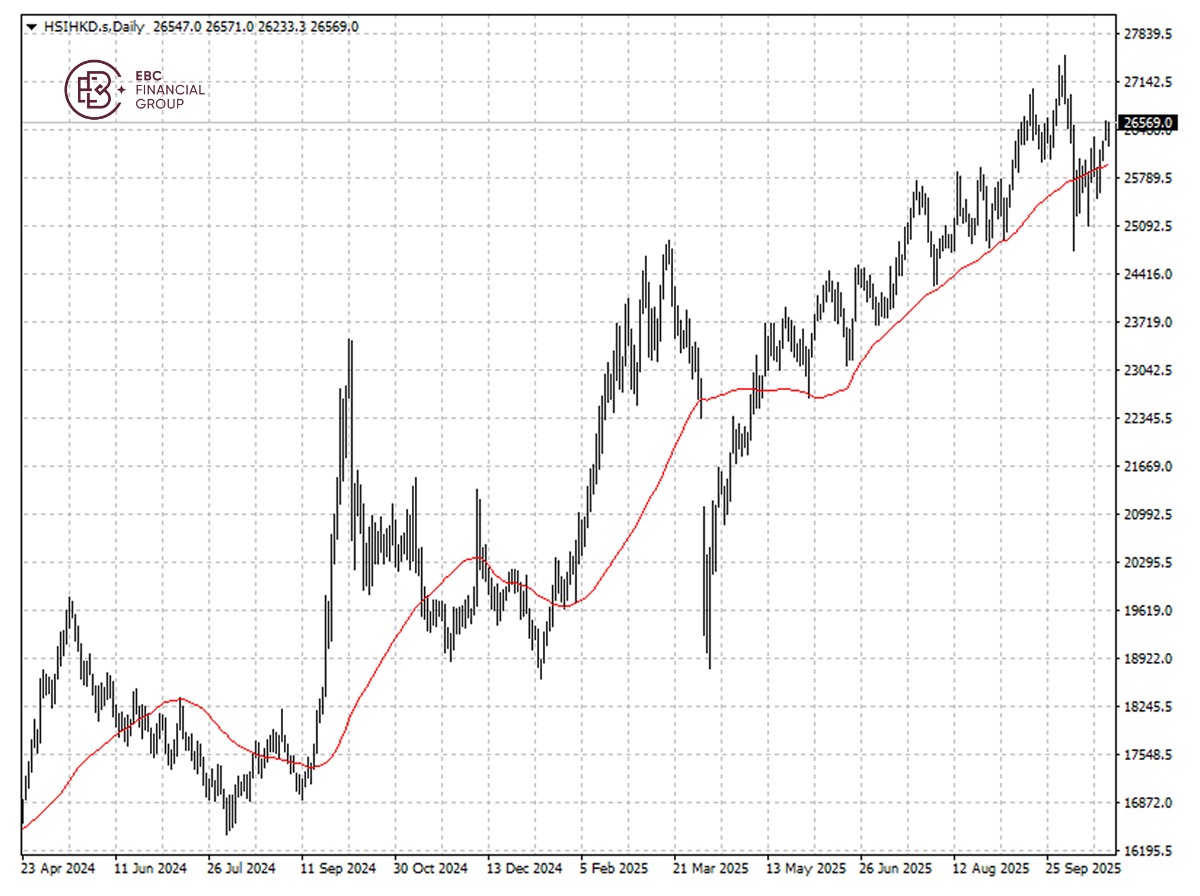

The Hang Seng Index is trending higher, but the double top pattern signals imminent pullback. In that case, 50 SMA will help put a floor under the index.

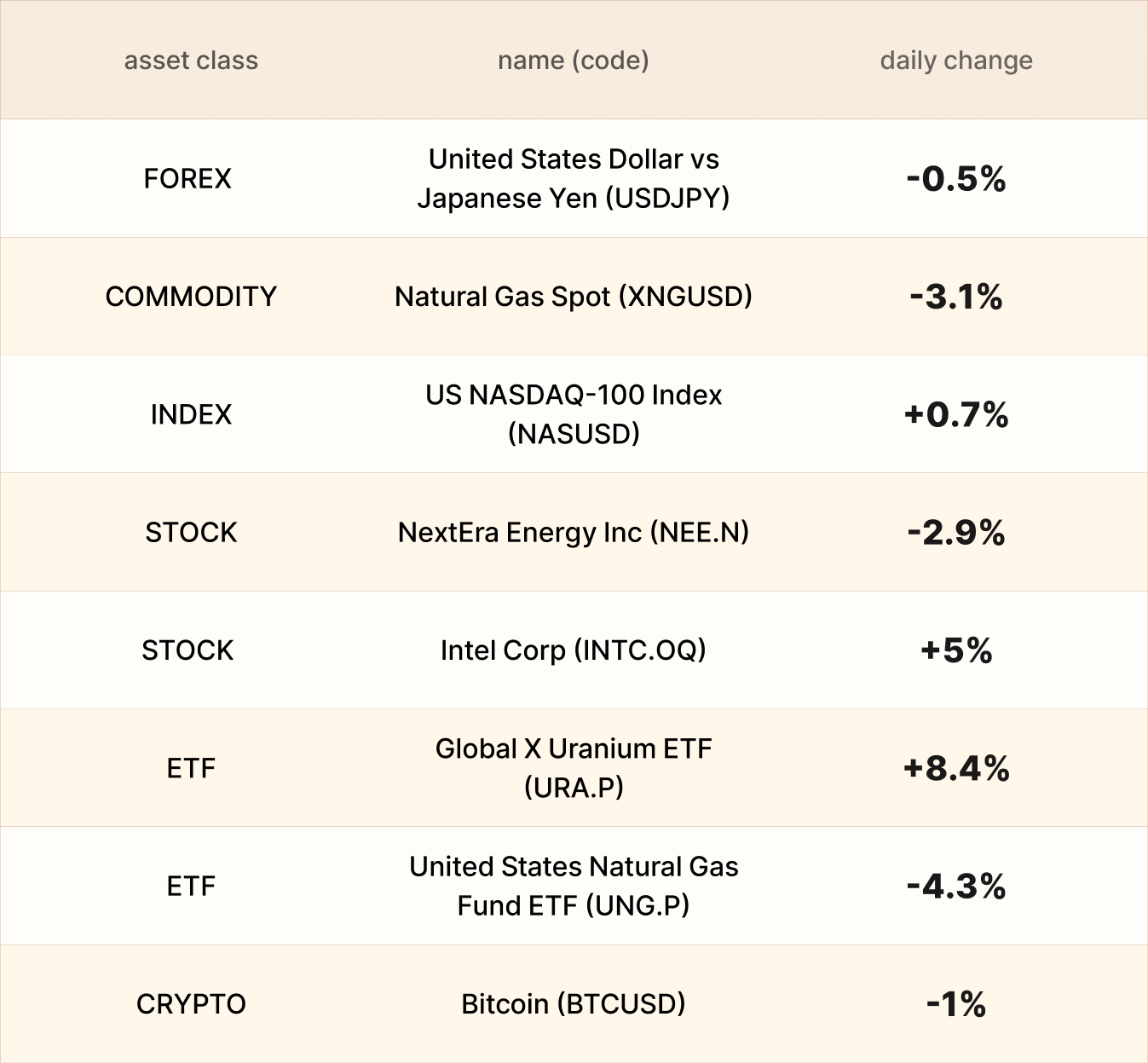

Asset recap

As of market close on 28 October, among EBC products, Global X Uranium ETF led gains. A perfect storm of tight supply and surging demand still takes hold.

Intel shares popped after the chipmaker reported a return to adjusted profit and flagged progress on its product roadmap. Based on the 12-month price target, the average of analyst forecasts is $34.45.

Natural gas prices saw a sharp decline as IEA medium-term outlook sees unprecedented expansion of LNG capacity by 2030, with implications for energy security, demand and affordability.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.