Markets on edge, await US inflation figures

Dollar attempts rebound; equities in anticipation mode

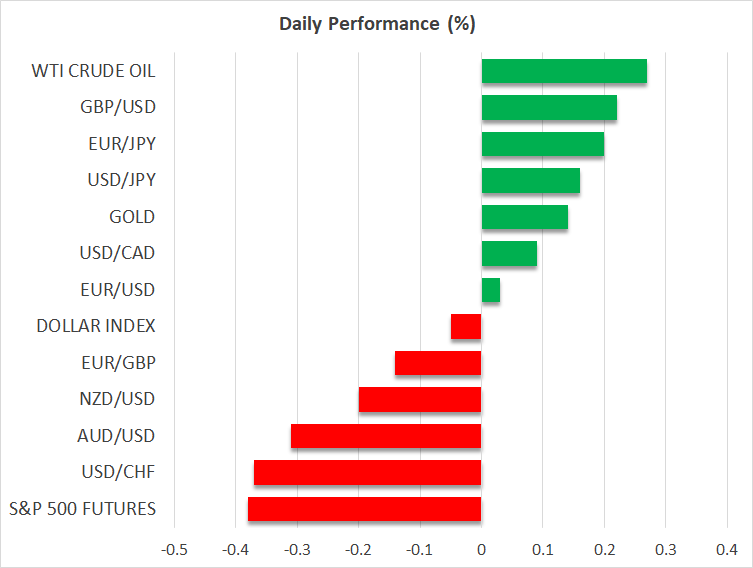

Following a relatively subdued session on Monday, the US dollar is trying to recover against the euro today. Euro/dollar is currently hovering just above 1.1600, as market participants are preparing for this week’s most important data release. Meanwhile, equities are also in anticipation mode, with the US indices starting the week on the back foot.

US CPI report in focus

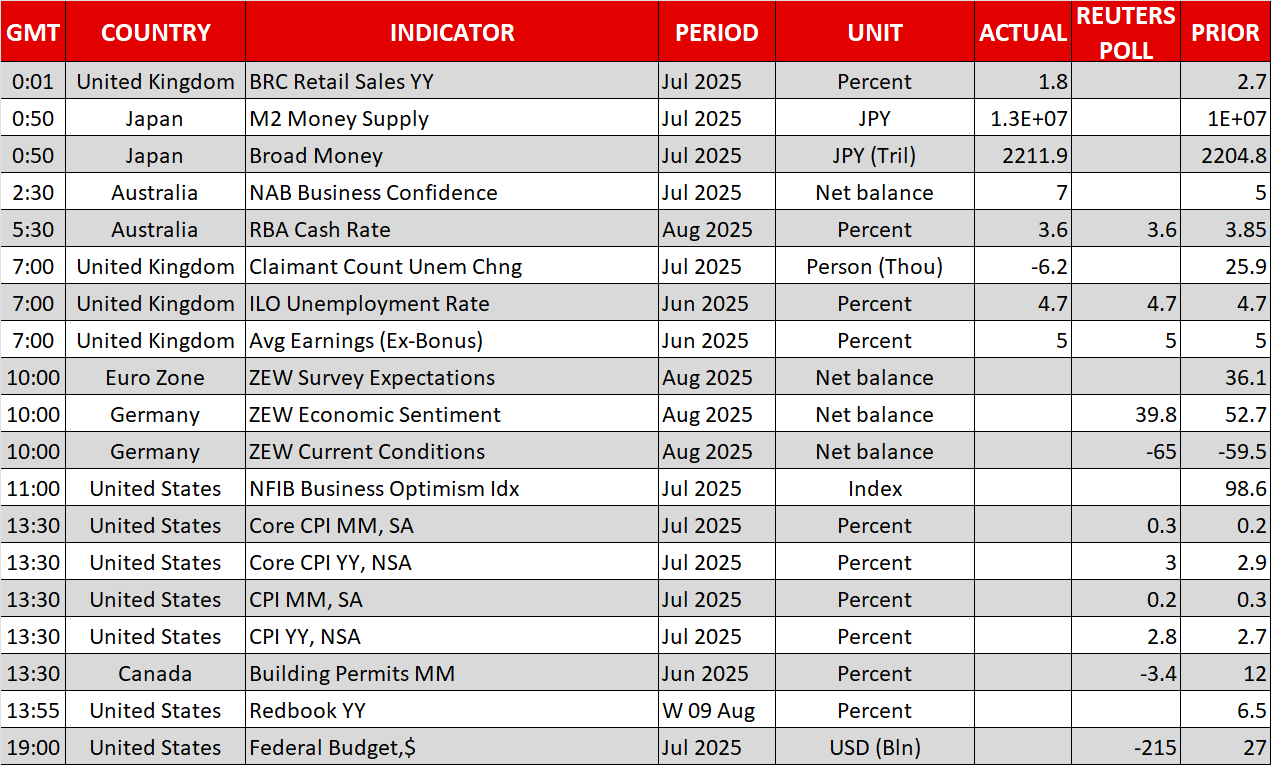

The July US inflation report will be published at 12:30 GMT, with economists forecasting a small acceleration across the board. Specifically, the headline and core indicators are seen rising by 2.8% and 3% YoY, respectively, reversing the deceleration recorded over the past six months.

With Fed doves actively pushing for at least two rates cuts in 2025, today’s inflation figures could be pivotal. While a single data point should not determine the rates’ outlook, a significantly softer report - for example, the core indicator decelerating to 2.7% YoY - could further support the argument that tariffs are unlikely to push inflation higher. In this scenario, pressure on Chair Powell, from both within the FOMC and outside the Bank, to restart the Fed easing cycle in September would intensify.

On the other hand, confirmation of forecasts for a small acceleration or an upside surprise in today’s report could play right into the hands of Powell, who continues to support a ‘wait-and-see’ approach as tariffs feed through the system. Notably, there has been a barrage of investment bank analysis highlighting the increased risk of tariffs refueling inflation, with the US potentially experiencing a period of stagflation, which could prove painful to overcome.

With the market pricing in an 89% chance of a September rate cut, a softer inflation report could marginally lift US equities and weigh on the dollar. However, a strong inflation report may prove more market-moving, raising questions about the likelihood of a September cut, and acting as a short-term tailwind for the dollar.

US-China tariff truce extended to November

While a softer CPI report would be welcomed by US President Trump, his best contribution would be a comprehensive US-China trade agreement, which would cancel out any arguments from Fed hawks about tariff uncertainty. Instead, Trump has announced another 90-day extension to the current tariff truce until November 9. This means an additional three months of negotiations and market volatility, overshadowing the Fed’s ability to set out its monetary policy strategy, particularly at a time when the quality of BLS data could be seriously questioned.

RBA cuts; decent UK data, busy calendar ahead

As widely expected, the RBA cut rates by 25bps today, citing moderating inflation, further clarity on tariffs and a loosening labour market. While Governor Bullock highlighted that the Board’s decisions remain data dependent, the RBA remains on an easing path. With today’s announcement failing to spark a significant move in aussie/dollar, the next key release is Thursday’s jobs data, which could further support the current 34% probability of a September rate cut.

Meanwhile, the pound is marginally higher against both the euro and the dollar today after the latest UK jobs data. While both the unemployment rate and the average earnings excluding bonuses held steady at 4.7% and 5% respectively, the July claimant count turned negative – i.e. a reduction in claims – with the June figure also revised lower. With the last BoE meeting showing a schism within the MPC, strong data plays into the hands of the hawks and supports the pound.

Gold, oil stabilize, eye Friday’s meeting

With Trump confirming that gold will not be tariffed, the precious metal’s decline has stalled at $3,350, at the midpoint of its recent trading range. Meanwhile, oil is slightly in the green today, stabilizing after seven consecutive red candles that pushed it towards $63. Investors are now preparing for Friday’s Trump-Putin meeting, with a clear risk of disappointment pushing both commodities higher.

.jpg)