Britons tighten their belts

UK retail sales fell by 1% in December, excluding fuel by 1.1%. The data surprised analysts who had, on average, expected an increase of 0.5% last month. Sales were 5.8% lower than in the same month a year earlier, when they were 0.7% below December 2020.

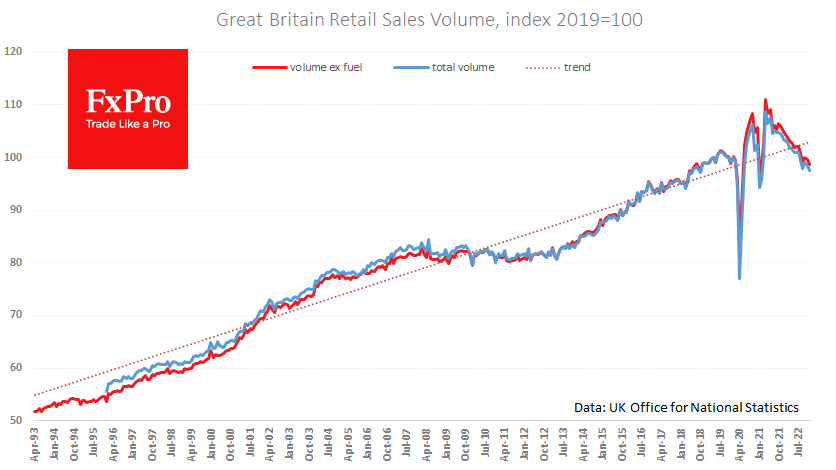

The retail sales index has been on a downward trend since April 2021 and, in that time, has returned to pre-pandemic levels, breaking a natural multi-year upward trend with such a sharp decline that Britain did not even see during the Great Recession. Other reports from the Office for National Statistics also point to a steady decline in industrial production, although it is smoother now than in some episodes from 2007 to 2011.

Surprisingly, the labour market remains strong. A similar picture can be seen in the USA, for which we received news earlier this week. In both countries, central bankers are signalling further rate hikes and preparing for a "mild recession".

This similarity in macroeconomic conditions makes the GBPUSD dynamics a tug-of-war. However, there are more downside risks in the pair now, given how it has stalled on the approach to the highs of December and the pressure on the stock indices with which the pound has a direct correlation. GBPUSD may correct into the 1.20-1.21 range before the end of the month. This would return the pound to a test of its 200-day average, where it could either get support from long-term buyers or return to the downtrend.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)