Dollar unable to capitalize on hot inflation prints

Dollar not impressed

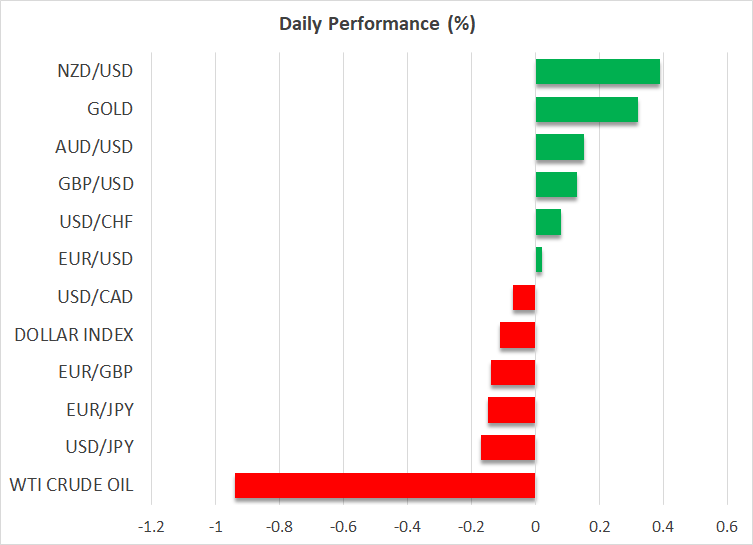

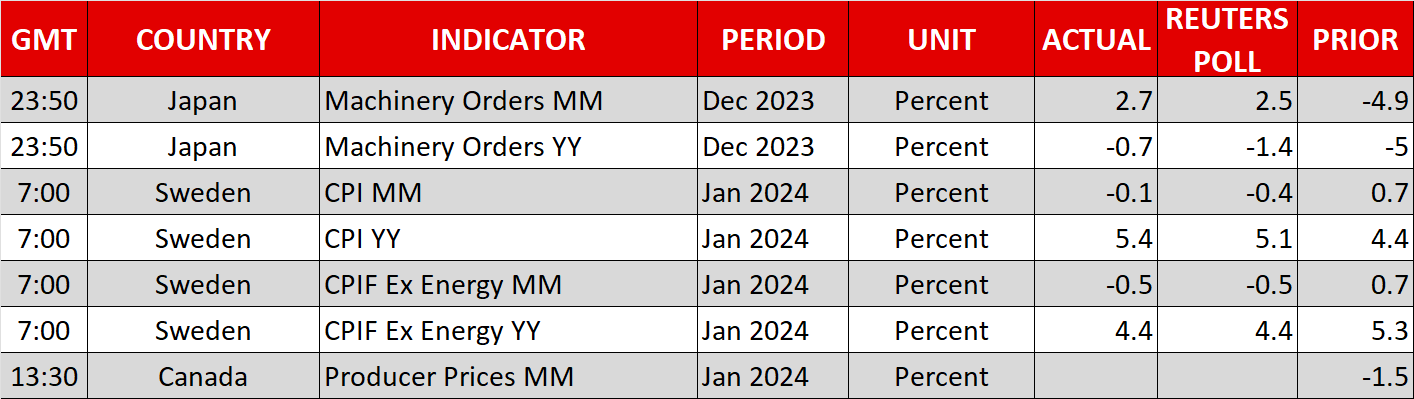

The US economy continues to run hot. Incoming data point to solid economic growth, the labor market remains tight, and inflation is not cooling down as quickly as investors had hoped. Last week’s releases reaffirmed this narrative, with both consumer and producer prices rising by more than expected in January.

Faced with a resilient economy and persistently high inflation readings, traders have been forced to unwind bets of imminent Fed rate cuts. The timing of the first cut has been pushed out to June, while the market is now pricing in less than four cuts in total for this year, down from six recently.

With markets shifting towards a ‘higher for longer’ path for US interest rates, the dollar has received a boost to become the best-performing major currency of this year. That said, the dollar’s gains have not been too impressive, something that was on full display last week when the greenback barely advanced despite the upside inflation surprises.

One element that has prevented the dollar from appreciating more significantly in this environment is the cheerful tone in stock markets, which has dampened demand for safe haven assets. Hence, a correction in equities might be the missing ingredient for the dollar to shine brighter, especially now that foreign economies are slipping into technical recessions.

Stock markets waiting on Nvidia results

Speaking of equities, shares on Wall Street encountered some turbulence last week after the hot US inflation prints poured cold water on the notion of imminent Fed rate cuts. Nonetheless, the retreat was shallow and all the major indices remain very close to their record highs.

The stock market has been incredibly durable this year even with Fed rate cuts getting priced out and valuations being historically stretched. However, it’s crucial to note that the rally is driven by a handful of tech companies with exposure to artificial intelligence, and that many “older economy” stocks have not participated.

Hence, this is a two-speed market, with investors favoring businesses that are seen as recession-proof thanks to their artificial intelligence income streams, at the expense of more traditional shares and small caps that could suffer as the economic cycle turns.

Nvidia has been at the tip of the spear, having gained more than 46% already this year. This elevates the importance of Nvidia’s quarterly earnings, which will be released on Wednesday. The chipmaker needs to deliver stellar results to keep the rally going.

US markets will remain closed today, in celebration of Presidents’ Day.

Gold licks its wounds, eyes Fed minutes

Gold prices went for a wild ride last week. The precious metal fell sharply after the CPI prints, but managed to recover its losses in the subsequent days with some help from a softer US dollar. Ongoing tensions in the Middle East may have added some fuel to gold through the safe haven channel, following more attacks against cargo ships in the Red Sea.

Looking ahead, the main event this week will be the minutes of the latest Fed meeting on Wednesday. Investors will search for clues on the potential timing of the first rate cut. Since that meeting, several Fed officials have preached patience, warning against premature rate cuts given the resilience of the US economy.

If the minutes echo a similar tone, the dollar could regain some momentum, which in turn might prove negative for gold.

.jpg)