Dollar under tariffs pressure

Dollar under tariffs pressure

The US dollar has maintained its sluggish uptrend in the first half of the week, continuing to form a bottom, but it has encountered resistance. It is atypical for the dollar and US indices to move in the same direction. However, this is the situation currently, and it is dragging on, caused by tariff uncertainty.

The technical obstacle to growth was the approach to the 200-day moving average and the first line of the correctional bounce at 76.4% from the decline from February to the lows of March. In addition, the dollar index no longer looks so oversold, according to the RSI index on the daily timeframes.

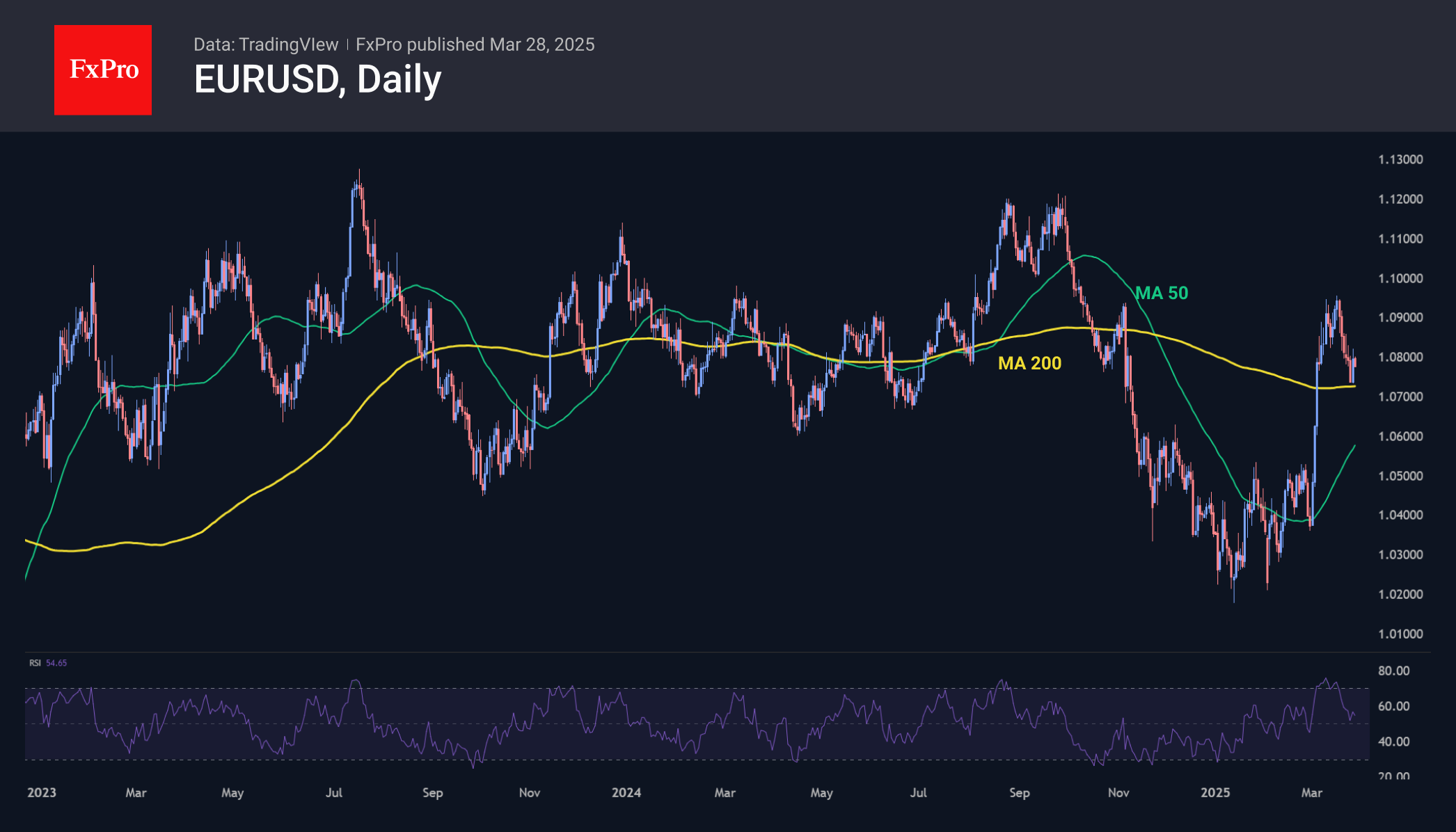

EURUSD dipped to 1.0730 in the week, bouncing off its 200-day average. This is almost a mirror image of the dollar index's performance. The single currency managed to surface at levels around which it had been hovering for the previous two years. However, the softness of inflation data and fears of the effects of sanctions could bring the euro back down.

GBPUSD has been consolidating in a narrow range of 1.28-1.30 for the past three weeks, returning to its upper boundary by the end of the week. The negative bias against the dollar is pushing cable to overcome the psychologically important round level of 1.30, which could be followed by a climb back to last year's highs near 1.34.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)