EBC Markets Briefing | A50 is set for best weekly gains since 2008

The China A50 headed for the best week since 2008, lifting Asian shares to 2-1/2-year highs, while a sharp fall in oil prices bodes well for disinflation globally.

Hedge funds trading China stocks saw gains this week after China's central bank unveiled its biggest stimulus since the 2020 COVID pandemic, a note from Goldman Sachs prime brokerage showed.

Though hedge fund stock exposure to China this week jumped sharply, it's still hovering near five-year lows compared with higher levels at the start of 2023 and 2020.

It came as a slew of economic data suggested a broken recovery. In August, China's industrial activity, retail sales and urban investment all grew slower than expected.

Iron ore prices rose to more than $100, gold hit another record, and silver hit a 12-year top. Oil was a big loser on a report that Saudi Arabia was preparing to abandon its unofficial price target for market share.

The ASX 200 registered another record high as mining stocks soared. The Nikkei 225 traded near 39,000 on concerns over a tighter policy.

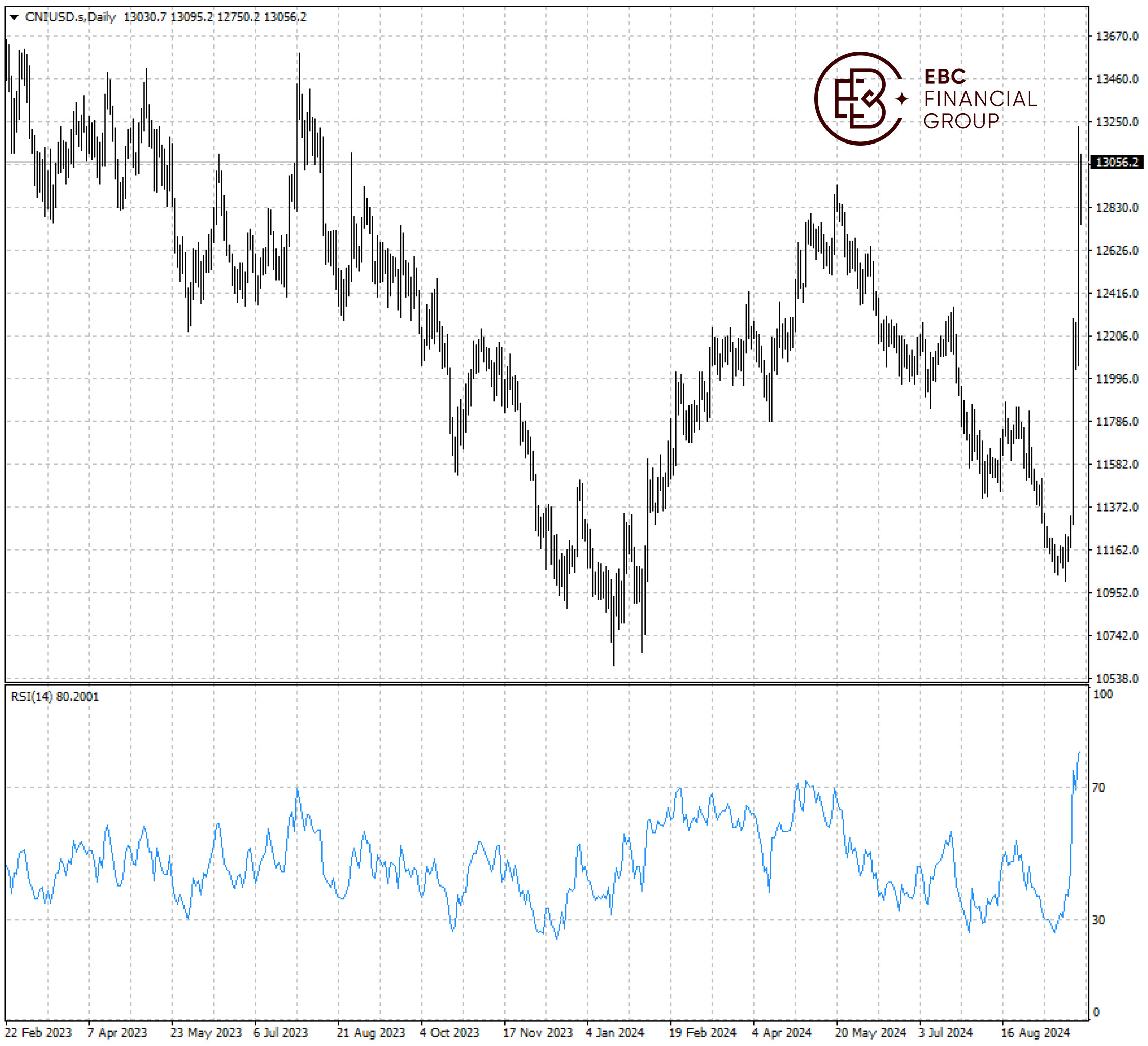

The A50 smashed through major resistance levels, making its way into overbought territory. We expect it to fall back to the 12,300 area before rallying again.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.