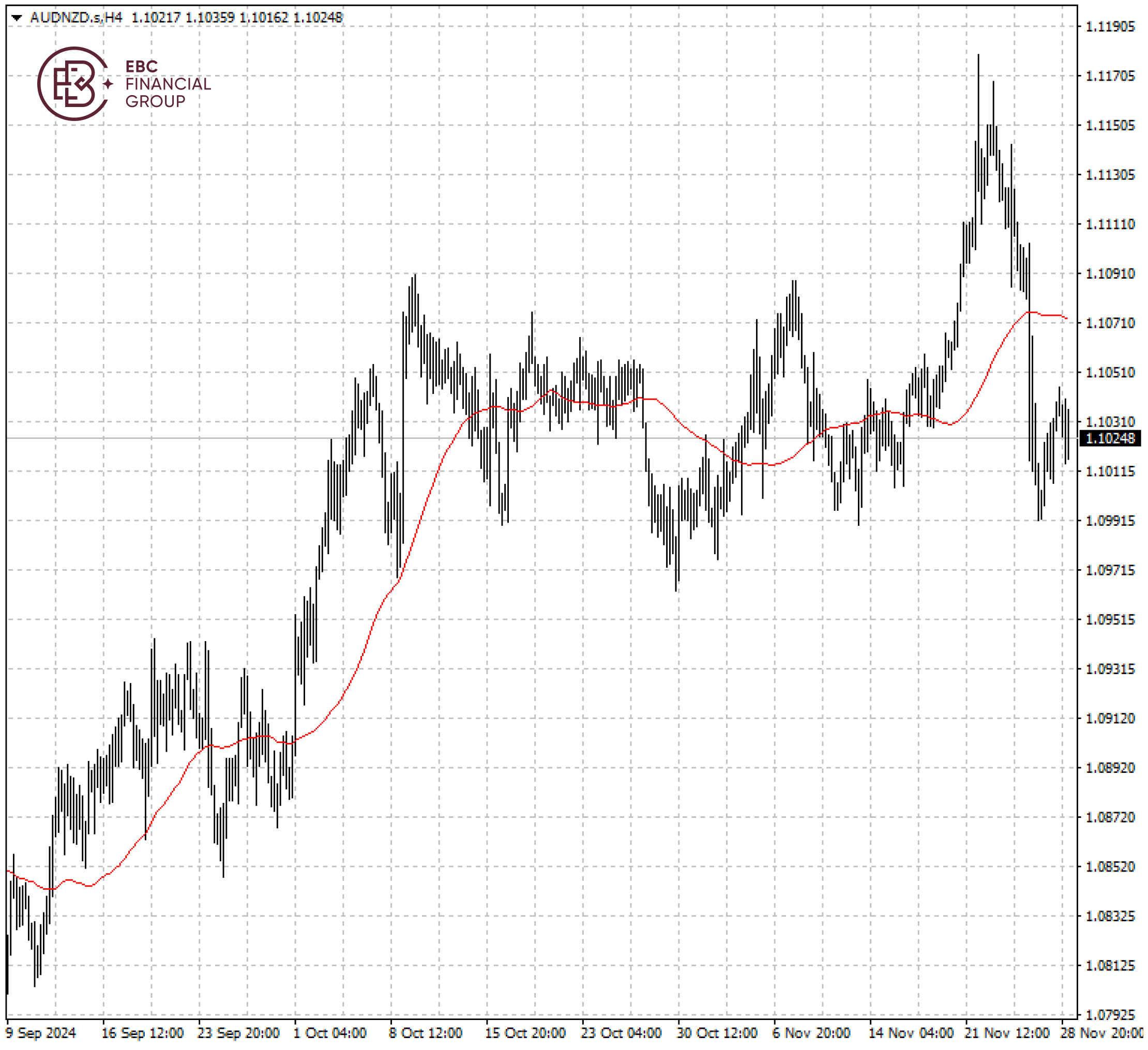

EBC Markets Briefing | Aussie muted against Kiwi amid tariff threat

The Aussie dollar was unchanged against the Kiwi dollar on Friday as inflation gap in the two countries has narrowed. Trump’s tariff threats were weighing on the commodity currencies.

The RBNZ cut rates for a third time in four months on Wednesday and flagged more substantial easing, including a likely 50-bp reduction in February, as inflation moderated to around the bank's target.

It noted that economic growth is expected to recover during 2025, as lower interest rates encourage investment and other spending. But employment growth is expected to remain weak until mid-2025.

While inflation rate cooling to 2.2% in Q3 gives grounds for New Zealand to cut interest rates, neighbouring Australia is an outlier to the broad easing trend with cuts not expected until the first half of next year.

Australia’s easing cycle will begin later and prove shallower than previously anticipated, ANZ said after the RBA chief Bullock warned that core inflation is still too high to consider interest-rate cuts in the near term.

Consumer prices rose 2.1% in the country last month, hitting a 3-year low, though core inflation picked up in a sign of lingering cost pressure. The data came in lower than market forecasts of 2.3%.

The pair’s rally proved to be short-lived but it still traded above its 50 SMA. We see a revisit of the 1.1090 area as likely if that level is respected.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.