EBC Markets Briefing | Euro rebounds; clean energy has shined in 2025

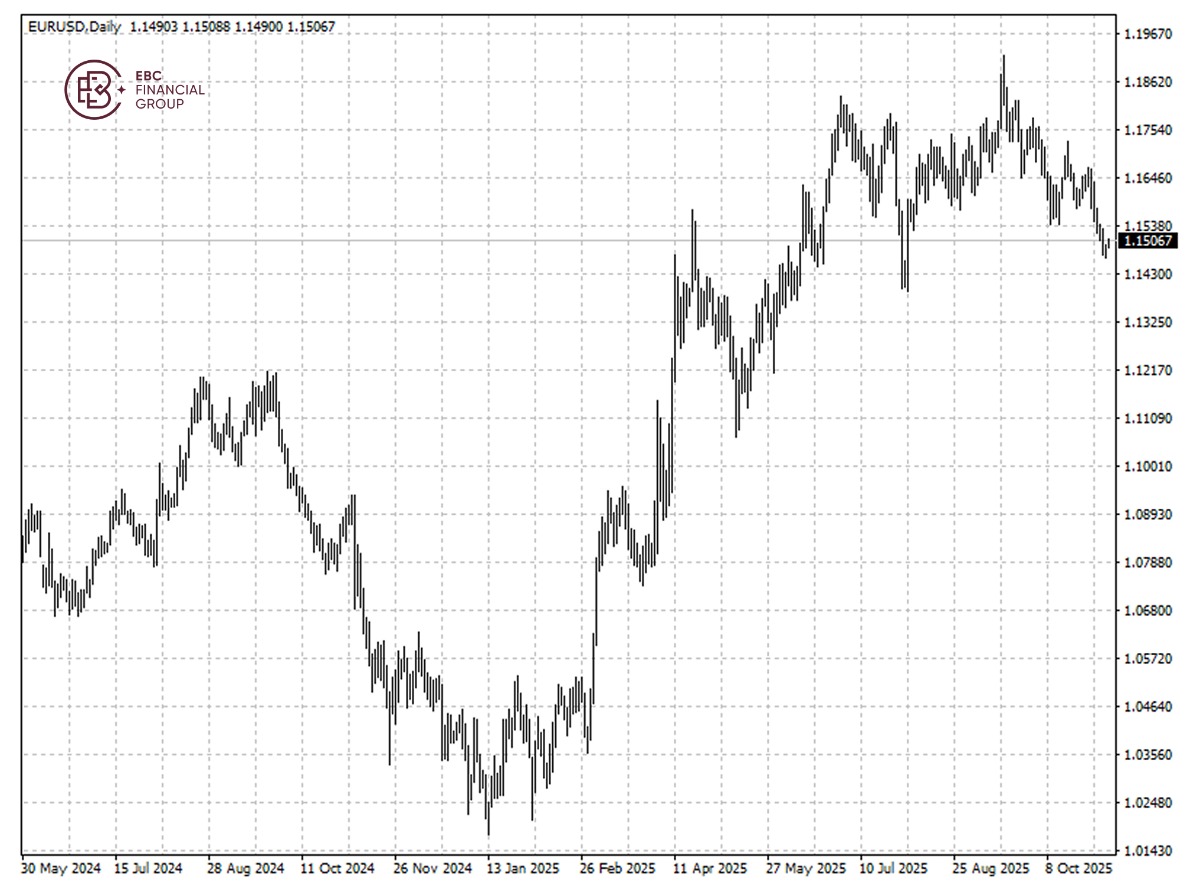

The dollar held just below multi-month highs on Thursday, with a recovery in appetite for riskier assets pulling it off recent peaks. The euro snapped its consecutive sessions of declines.

Traders will be net short on the dollar through November as the currency weakens over coming months on continued bets of multiple Federal Reserve interest rate cuts, a Reuters survey of forex strategists showed

Interest rate futures pricing implies a roughly 70% chance of a December Fed rate cut, according to LSEG calculations. That has cooled the ‘sell dollar’ trade without shifting the broader outlook.

Still, strategists in the survey broadly stuck to earlier views, predicting the euro to rise a little under 3% to $1.18 in three months and to $1.20 in six. The median year-ahead forecast of $1.21 in unchanged.

The euro area economy expanded slowed to 1.3% from 1.5% in Q3, though it still came in slightly above the 1.2% economists had predicted. Germany and France were a major drag on the bloc.

Consumer price rises reached 2.1% last month, moving closer towards the 2% target. The figure was in line with forecasts by analysts, exerting downward pressures on the single currency.

The euro will likely extend losses as the downtrend remains intact. If that is the case, we see $1.1454 as a robust support to pave the way for a rally.

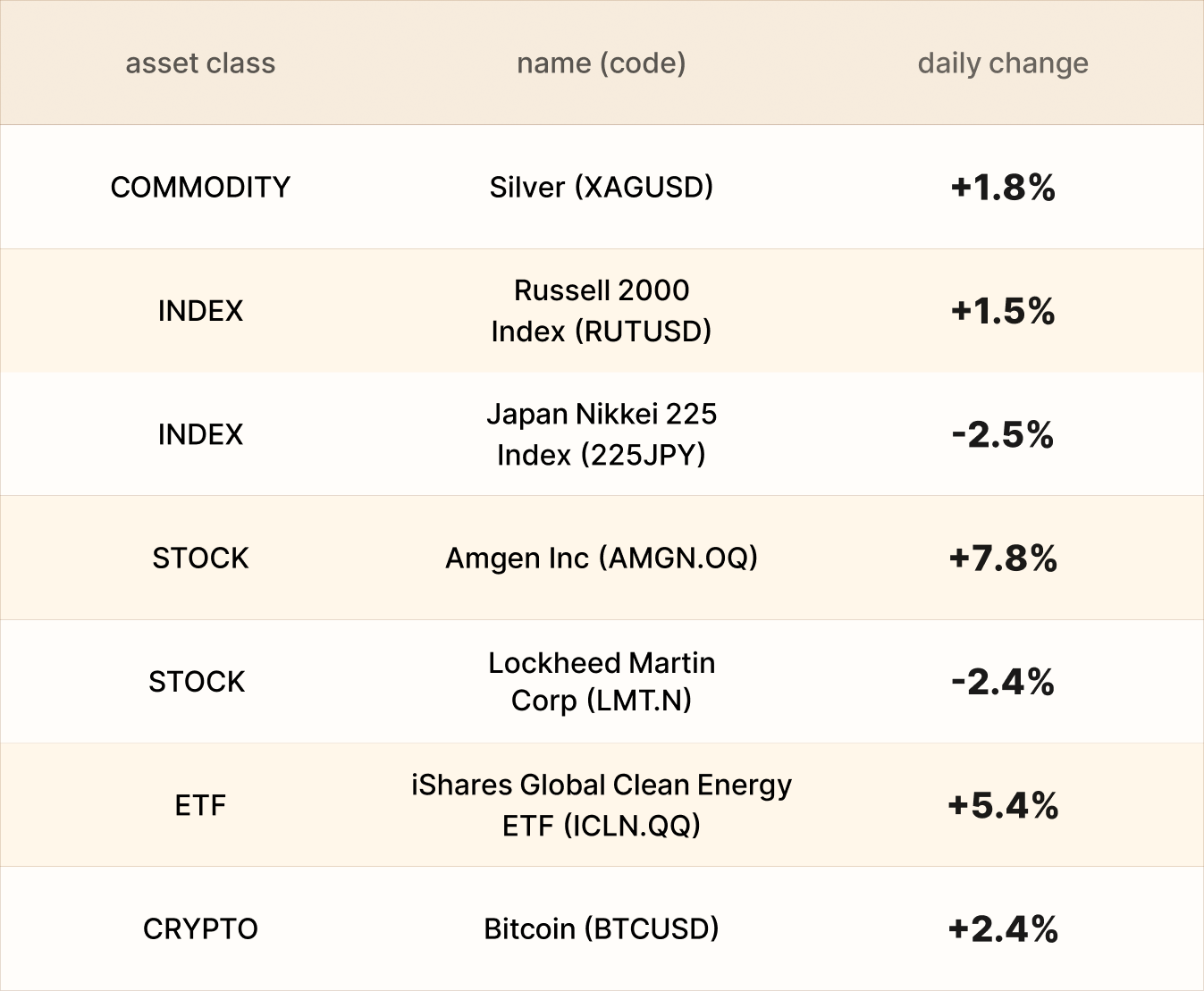

Asset recap

As of market close on 5 November, among EBC products, Amgen shares led gains. The company reported Q3 results that beat Wall Street expectations, and raised its full-year outlook.

The Nikkei225 index plunged, led by tech shares, amid a global slump driven by mounting concerns of excessive valuations. Takaichi trade is fading as investors await clarity on her economic policies.

Clean energy stocks have left the Nasdaq 100 in the dust in 2025, with the iShares Global Clean Energy ETF returning 59% year to date, compared to the Nasdaq 100's 21.9% rise.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.