EBC Markets Briefing | Oil surges this week on tougher sanctions

Oil prices were little changed on Friday after Trump signed an executive order Thursday that modified "reciprocal" tariffs on dozens of countries, with updated duties ranging from 10% to 41%.

All goods that are considered to have been transshipped to avoid applicable duties will be subject to an additional 40% tariff. China will perceive it as directed against its interests.

Still, Brent prices are set to gain 4.9% for the week while WTI is set to climb 6.4% with threats of secondary tariffs on buyers of Russian crude, particularly China and India.

Meanwhile, the US implemented its most sweeping sanctions on Iran in seven years. The measures have raised concerns about tightening supply and a potential knock-on effect to products such as diesel.

Washington must agree to compensate Iran for losses incurred during last month’s war, the Islamic republic’s foreign minister said. He also accused Europe of failing to meet commitments under the 2015 accord.

US crude stockpiles expanded by 7.7 million barrels last week, the biggest build since the end of January, according to the EIA. Supplies still remain well below the seasonal average.

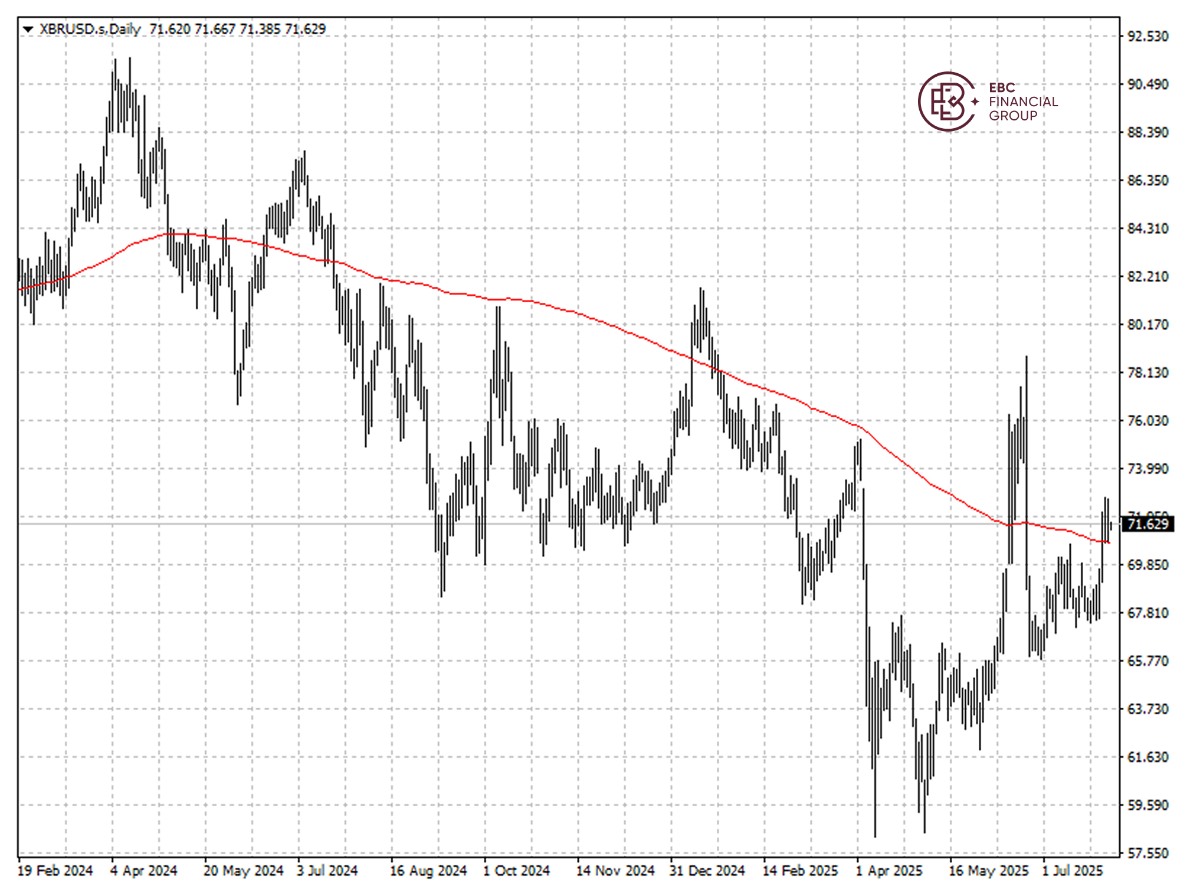

Oil prices has consolidated its recent gains with moderate bullish bias, but it will likely test the support at 200 SMA if there are no fresh catalysts.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.