EBC Markets Briefing | Yen gains after Fed stood pat

The yen rallied from its lowest level since early April on Thursday after the Fed hold interest rates as expected. But two policymakers appointed by Trump favoured a rate cut of 25 bps.

Trump on Wednesday announced that Washington had reached a "Full and Complete" trade deal with Seoul, setting blanket tariffs on the country's exports at 15%, the same as that is imposed on Japan and the EU.

He also said that India will pay a tariff of 25% beginning 1 Aug, in addition to a "penalty" for what he views as unfair trade policies and for India's purchase of military equipment and energy from Russia.

The US GDP grew at a much stronger-than-expected pace in Q2, powered by a turnaround in the trade balance and renewed consumer strength, the Commerce Department reported.

While the BOJ is set to keep rates steady next week, markets are pricing in the chance of a near-term hike. The board may also revise up this year's inflation forecast and offer a more sanguine view on economy.

While praising the trade deal as reducing uncertainty, deputy governor Uchida warned it was still not clear how new tariffs could affect the business mood and spending plans.

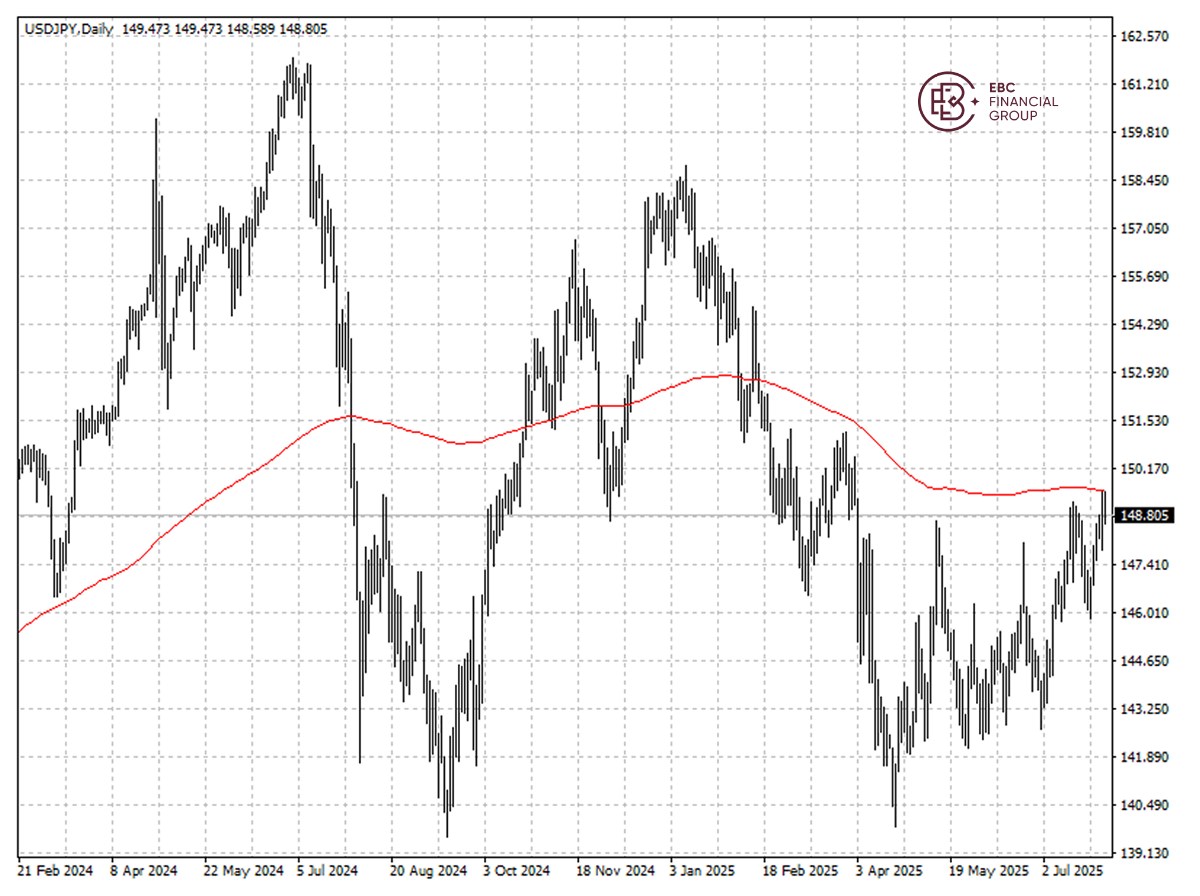

The yen found support at 200 SMA, but it has not negated the bearish bias. We expect the rally to stall around 148.5 per dollar before resuming its downtrend.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.