EBC’s Million Dollar Trading Challenge II | A Moment of Calm Brings New Momentum to Rising Stars

On 28 April 2025, EBC’s Million Dollar Trading Challenge II saw market volatility return to normal levels as the US and China soften their positions on tariffs.

As of 11:00 AM, the top 3 in the Dream Squad category have something to celebrate. @forexwatchbrother’s profits have climbed above $160,000, true to his name, as he continued to focus on forex trading last Friday.

He’s currently short on the yen and long on the New Zealand dollar, suggesting he expects risk appetite to keep improving. While he’s known for holding large positions, his volatility metrics remain reasonable at present.

With the worst of the market panic likely behind us, copy traders may want to keep a closer eye on his strategies. Both @willsdad and @songqiantongzi have stayed out of the limelight recently, with gold trading taking a brief pause.

In the Rising Stars category, a new leader has finally emerged. @SDPC28KK15F, who joined last week, has taken an active approach, riding a strong gold rally and attracting over $16,000 in copy trading capital.

Several others further down the leaderboard are still taking it easy, but with the May Labour Day holiday approaching, some traders will soon have more time to place trades and likely inject new energy into the competition.

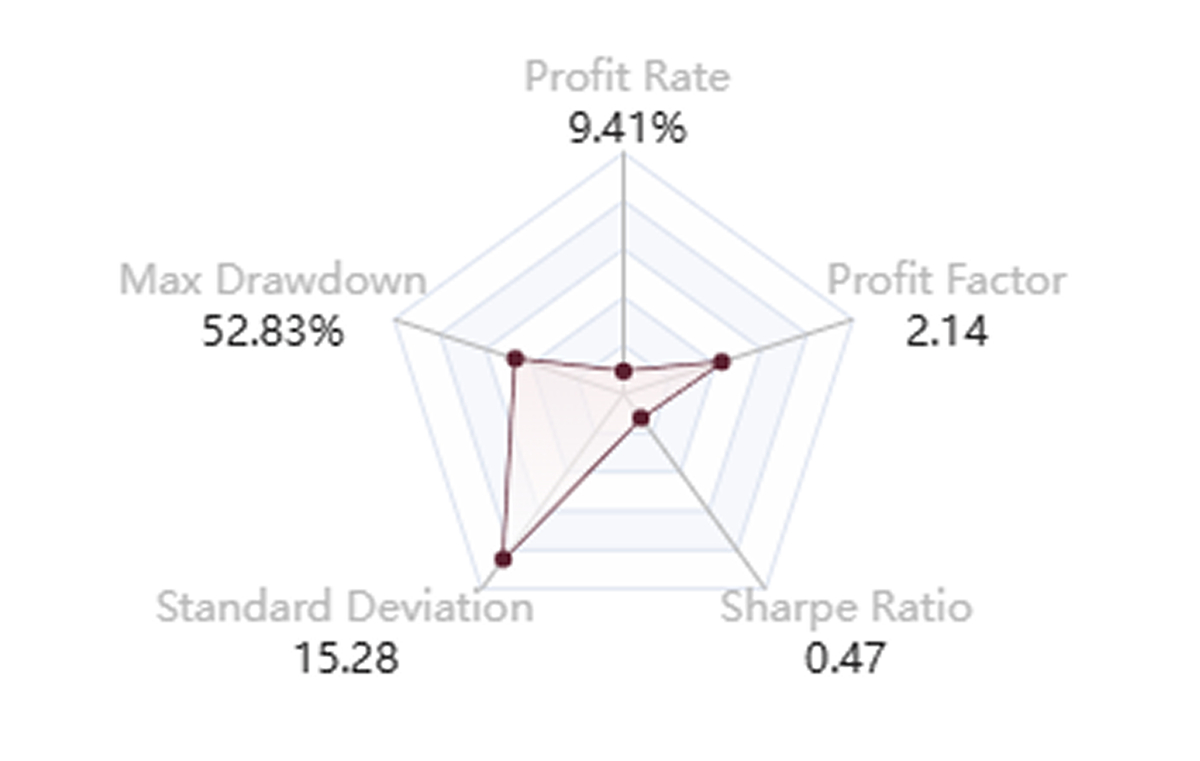

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.