GBPUSD signals caution as BoE takes spotlight

GBPUSD made a modest push into the 1.3000 area following the FOMC policy meeting on Wednesday, which kept the door open for rate cuts amid ongoing uncertainty about the US economic outlook.

The Bank of England is next on the calendar today, and the pair is currently trading moderately lower at 1.2964 after UK claimant counts jumped unexpectedly in February. While the central bank is widely expected to hold rates steady, any shifts in its communication tone in response to trade and geopolitical risks could generate fresh volatility.

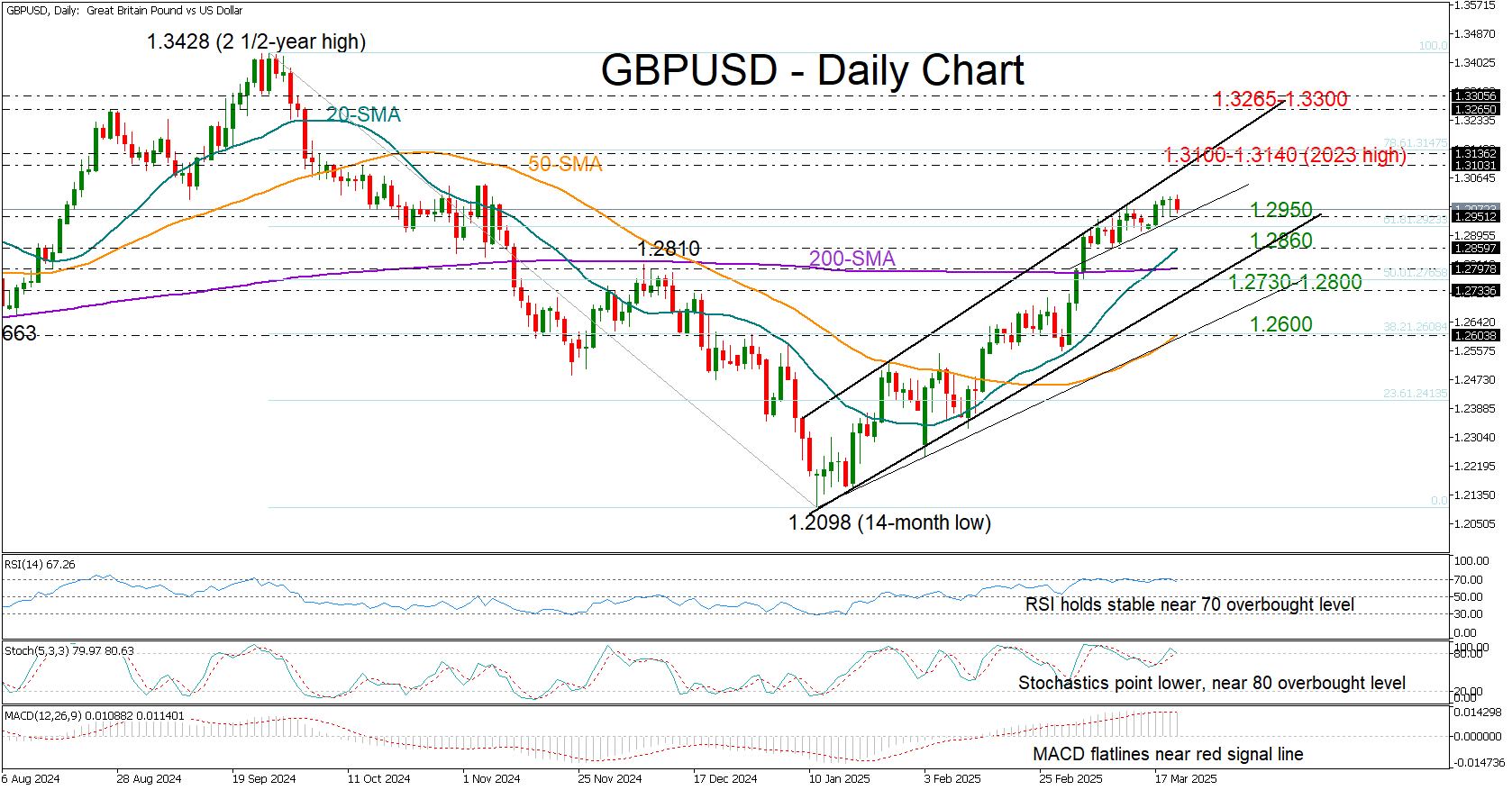

From a technical perspective, the bulls appear to be losing momentum, as indicated by the RSI and Stochastic oscillator, which have been flattening around overbought levels for the past two weeks. If the price slips below 1.2950, the 20-day simple moving average (SMA) could provide support near 1.2860, while the 200-day SMA and the key support trendline at 1.2730 could prevent a further deterioration in the outlook. If these levels fail to hold, the pair could tumble toward the 50-day SMA at 1.2600.

In the bullish scenario where the pair resumes its upward trajectory, initial resistance could emerge from the ascending trendline at 1.3100. The 2023 high of 1.3140 is also within reach and could act as a barrier before the 1.3265–1.3300 caution zone.

Overall, GBPUSD could face some headwinds in the short term, as technical indicators suggest the recent upward movement may be overextended. However, any declines are unlikely to significantly dent market sentiment unless the price drops below the 200-day SMA and the 1.2730 level.

.jpg)