Still strong US labour market

Still strong US labour market

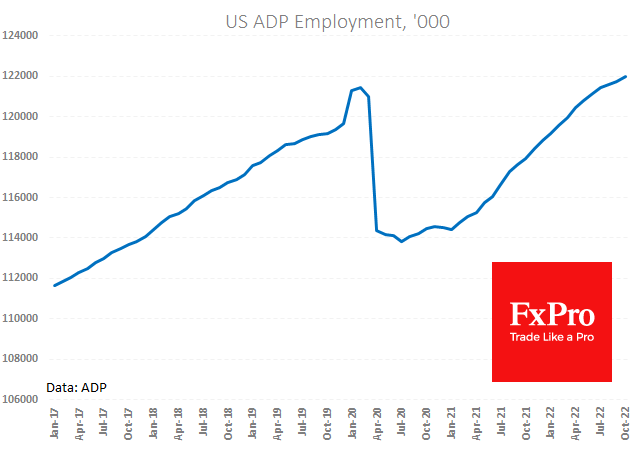

Fresh ADP estimates noted a 239K increase in US employment in October, showing more substantial job growth than in September (192k) and contrary to the expected slowdown to 178K. This data primarily guides traders as the most similar indicator before the official release is publicised on Friday.

The ADP estimated that manufacturing cut 20K jobs, the first reaction to higher interest rates and a strong dollar. Meanwhile, mining and construction created jobs (+11K and +1K, respectively). The services sector was producing jobs in recreation (+210K), trade and transportation (+84K), while information (-17K), financial (-10K) and professional services (-14K) declined.

Even earlier in the week, there was an unexpected rise in vacancies of 437K in September, the first increase after five months of decline. At the same time, the global vacancy rate remains by a large margin at abnormally high levels.

The market reaction, however, was much more subdued than the figures suggested, as all attention is now focused on the Fed's rate decision and the accompanying commentary later today. However, this data is an indirect and early warning of the labour market’s strength, to which the Fed is now paying so much attention. A solid rise in employment could be an early warning that we should not expect the Fed to soften its tone and slow the pace of rate hikes from the next meeting (the markets fully account for the 75-point hike).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)