USDJPY bulls regain control ahead of FOMC minutes

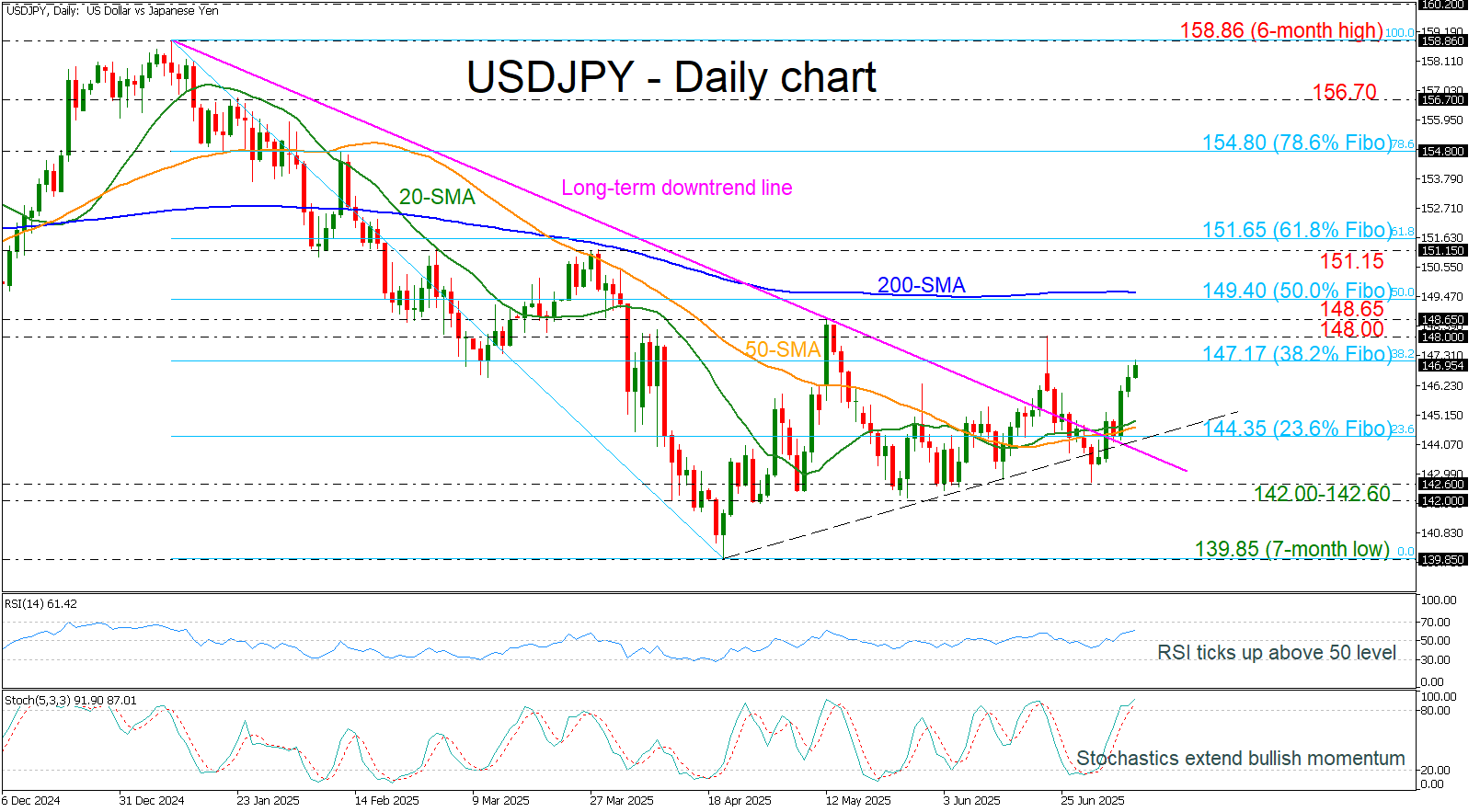

USDJPY is extending its bullish rally after rebounding from the 142.60 support level, decisively breaking through key technical barriers including the short-term simple moving averages (SMAs), the 23.6% Fibonacci retracement level at 144.35 of the 158.86–139.85 down leg, and the long-term ascending trendline.

The dollar is also drawing support from anticipation surrounding today’s FOMC minutes, which are expected to strike a cautious yet potentially hawkish tone. Market participants will be closely watching for insights into the Fed’s stance on inflation persistence and the projected timeline for rate cuts later in 2025.

If bullish momentum persists, the pair could target the next resistance zone at 148.00–148.65, followed by the critical 149.40 level, which aligns with the 50.0% Fibonacci retracement and the 200-day SMA. A sustained break above this region would likely shift the broader outlook to strongly positive.

Conversely, a pullback may bring the pair back toward the short-term uptrend line and the 144.35 support. A deeper decline below this level could expose the 142.00–142.60 area, potentially reigniting bearish pressure.

Overall, USDJPY remains bullish in the short term, supported by improving momentum and favorable positioning ahead of the FOMC minutes.

.jpg)