Crypto market gains on heavyweights

Market picture

The crypto market cap has returned to its peak, which reached around $2.49 trillion a week ago, adding 3.3% in the last 24 hours. At this stage, the top coins are the lifting force for the market, with BTCUSD up 3.1%, Ethereum up 4.4%, and Solana up 5.5%.

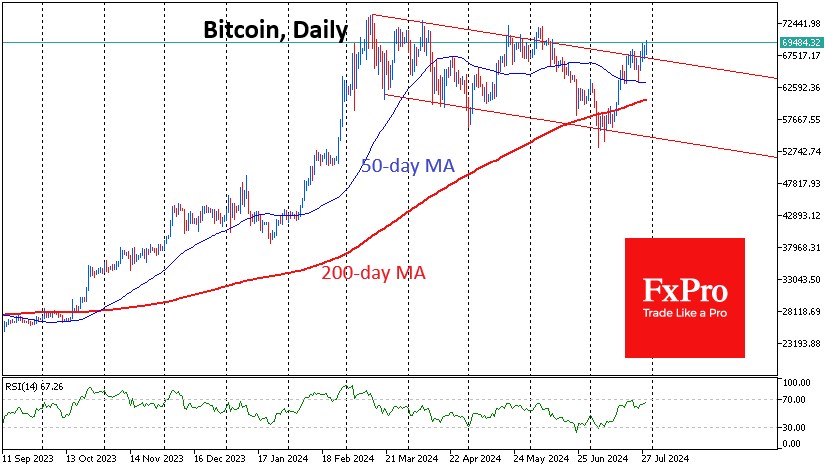

Bitcoin's price has reached $69.5K, its highest since mid-June. The Bitcoin 2024 conference tipped the scales in favour of the bulls. The technical picture speaks in favour of further upside, as the latest spurt came after a local shakeout that removed overbought conditions and broke the resistance of the descending channel.

Ethereum is gaining momentum after pushing back from its 200-day moving average. Twice in the past month, the main altcoin got support on dips below this line. On Monday, the coin is testing the 50-day average, rising to $3380, the taking of which opens a fast route to $3500 and then $4000.

Solana is making steady progress upwards, reaching $192, its highest since early April. This shows a stronger recovery compared to Bitcoin and the broader market, where capitalisation is lower than the peak in early June.

News background

According to SoSoValue, net outflows from spot Ethereum-ETFs rose to $162.7 million on 26 July, continuing for a third day. Total assets under management (AUM) fell to $8.97 billion. In the three days since the ETF was approved, investors have withdrawn $1.6 billion or 17% of AUM from Grayscale's ETHE.

Solana (SOL) surpassed BNB in market capitalisation and ranked fourth on CoinMarketCap.

Donald Trump, during a speech at the annual Bitcoin 2024 conference in Nashville, promised to fire SEC head Gary Gensler and create a strategic Bitcoin reserve if elected. He also said he would be a "pro-Bitcoin" president and would not allow any of the 213,239 BTC seized by authorities and held in US government wallets to be sold. According to Trump, the US will become the world's cryptocurrency capital.

Former NSA and CIA employee Edward Snowden expressed serious concerns about BTC privacy issues during a speech at Bitcoin 2024. He reminded attendees that despite the common misconception, Bitcoin transactions are not completely anonymous because they can be traced back to specific individuals.

Hardware wallet maker Ledger unveiled its new Ledger Flex device at the Bitcoin 2024 conference. The Ledger Flex features an NFC and an E-Ink touchscreen.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)