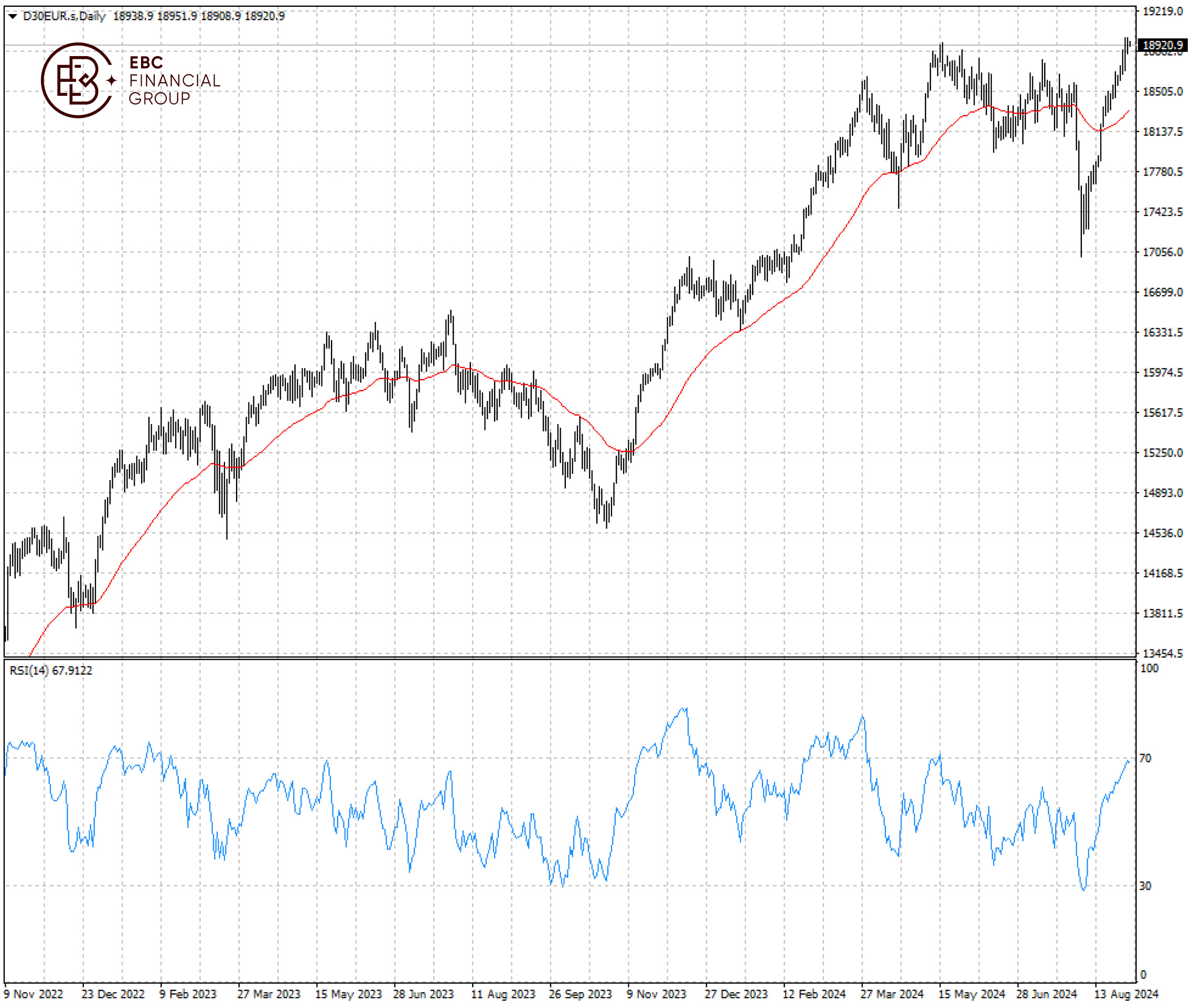

EBC Markets Briefing | DAX 40 hits record high with worrying outlook

Germany’s DAX Index hit a fresh record in the last trading session as it rebounds from a selloff earlier in August amid optimism about the path of interest rates.

The DAX is up 13% so far this year, making it one of the best-performing main European indexes. In contrast, France’s CAC 40 has eked out a small gain of 1.3%, dragged by weak luxury stocks.

Siemens Energy is the biggest gainers in the benchmark index in 2024, rising 110%. Meanwhile, SAP SE — the biggest company by market value on the DAX — advanced 42% amid a global rally in technology stocks.

The bloc’s economy got an unexpectedly strong boost from the Paris Olympics, which propelled private-sector growth to the fastest pace in three months. But it is highly uncertain if the spirit will linger.

S&P Global’s composite PMI jumped to 51.2 in August, exceeding even the most optimistic forecast in a Bloomberg survey of analysts, as a gauge for services climbed to the highest level since April.

The continent’s underlying weakness has strengthened calls for the ECB to lower interest rates again next month. Attention will turn to the UK’s FTSE 100, which is also near their peaks.

The DAX 40 will presumably hit bottlenecks at the 19,000 psychological level given the RSI around 70. The 50 EMA could stem the potential retreat.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.