EBC Markets Briefing | Sterling up on positive Q2 GDP

The pound hovered around a fresh three-week high on Friday though after hotter than expected inflation data prompted traders to trim wagers on rate cuts by the Fed.

Overnight, markets had to contend with producer prices showing the quickest rise in three years in July amid a surge in the costs of goods and services, pointing to fallout from higher tariffs.

The UK economy expanded by a better-than-expected 0.3% in Q2. U.K. Chancellor Rachel Reeves said the latest data was positive but "there is more to do to deliver an economy that works for working people."

However, economists said it was unlikely that the positive momentum would continue into the third quarter. Labour data showed weakness in hiring but persistent wage growth, a headache for the BOE.

Sir Keir Starmer and Volodymyr Zelensky believe there is a "viable" chance of a ceasefire in Ukraine but Putin must "prove he is serious about peace," Downing Street has said.

The imminent talk between Washington and Moscow could drive market move. The US is prepared to provide Ukraine with security guarantees once peace is established, but NATO membership is unlikely.

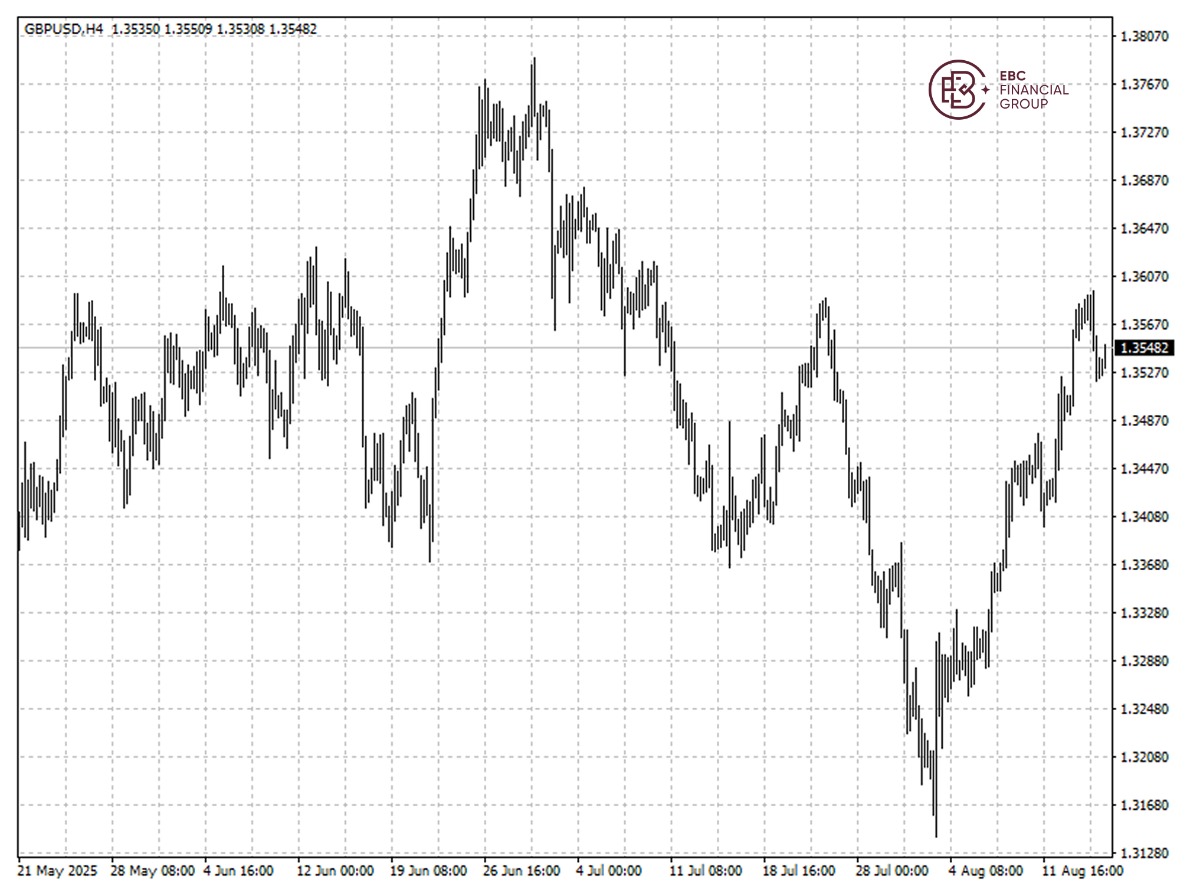

The pound dropped following a double-top pattern, which bolsters the case for further losses. We see it reach the support around 1.3500 in the upcoming week.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.