Is the UK Labour Market Cool Enough for the BoE?

The UK labour market is cooling, showing an increase in claims from claimants. In addition, wage growth is slowing. The data provided further evidence that the UK economy has moved into a new phase of the economic cycle, although the inflation genie remains at large.

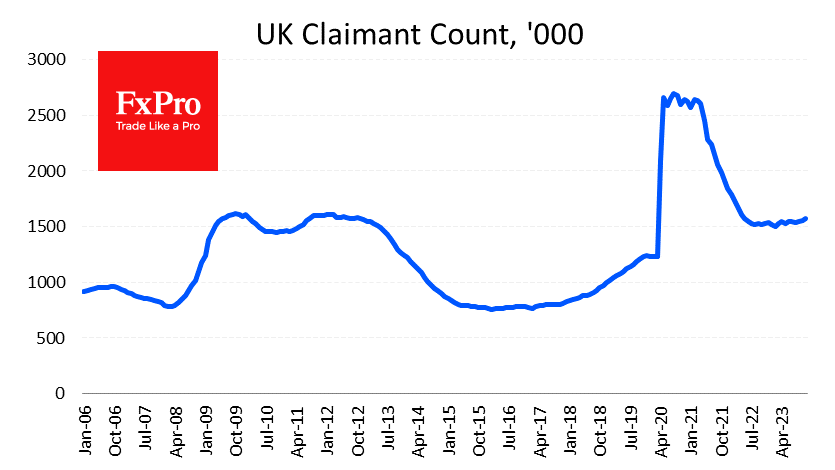

In November, the number of people receiving benefits rose by 16K to 1575K - the highest since April 2022. The UK labour market is cutting jobs more actively, a reversal after a plateau between September last year and February this year

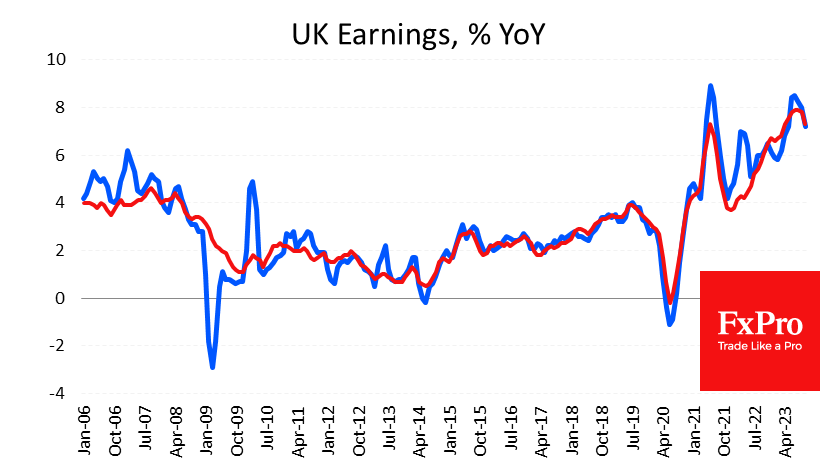

Meanwhile, wages continue to contribute to inflation, adding 7.2% in the August-October period to the same period a year earlier. The rate of wage growth is down 1.3 percentage points from a peak of 8.5% four months ago, although it remains notably above the consumer inflation rate of 4.6% y/y.

On the one hand, the Bank of England has seen slowing inflation and there are growing signs of a cooling labour market, supporting the sentiment that it will reach a plateau and that the next move after a prolonged pause will be lower.

On the other hand, both price and wage growth rates have been held at elevated levels for an extended period (3 years for wages and over two years for inflation), working to raise inflation expectations and making returning to the norm more difficult.

And this divergence creates intrigue ahead of the Bank of England’s looming meeting on Thursday. If the Bank of England acts based on hard data, it should remain in inflation-suppressing mode, warning it is ready to raise rates to bring inflation back on target more quickly.

However, major peers - the ECB and the Fed - are signalling that they are done with hikes and have moved into a 'wait-and-see' mode, and the Bank of England may announce the same shift in two days.

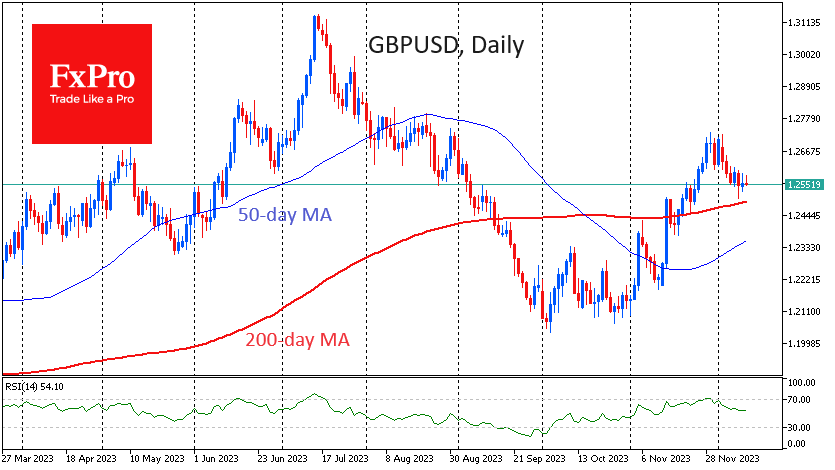

The GBP/USD pair retreated towards 1.25 at the end of last week, approaching its 200-day average from above. This week, the battle for the long-term trend has every chance of intensifying, and a bull or bear victory could signal a lasting signal of further Pound movement. A consolidation under 1.25 opens a quick path to 1.22 or even 1.2060. The ability to hold above due to a strong economy or a hawkish stance from the Central Bank will kick-start a growth momentum with a quick update to 1.27 and the potential to rise above 1.30 before the end of Q1.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)