Oil once again needs to confirm its uptrend

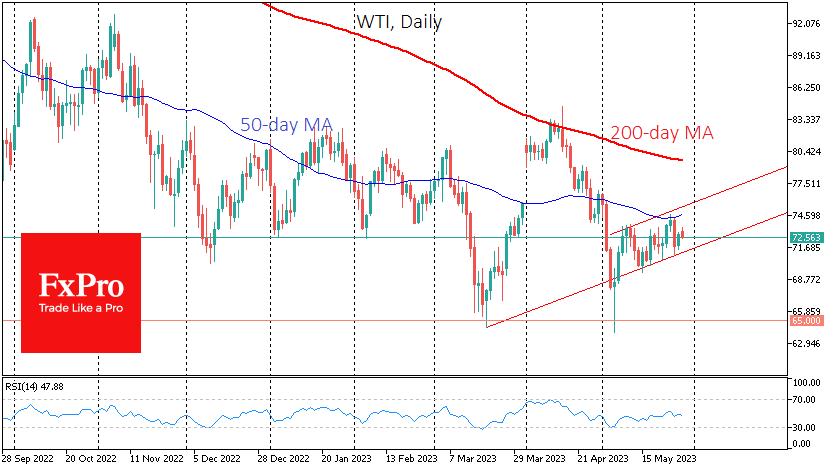

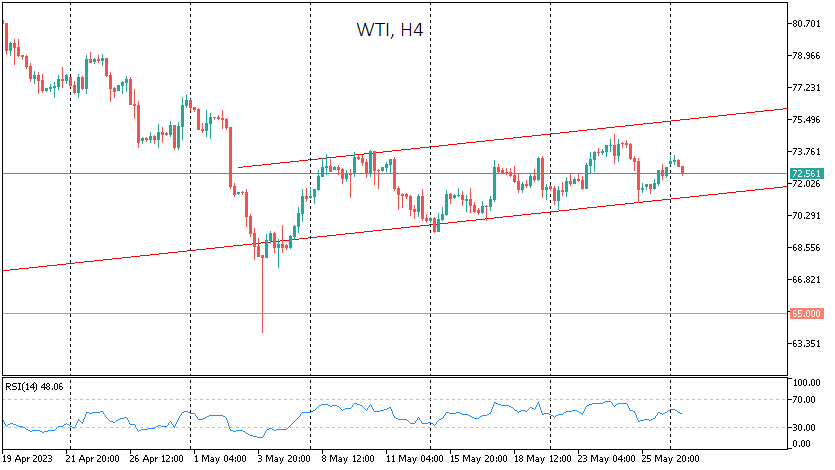

WTI remains within the upward trend formed in early May. However, be prepared for another test of this trend support at $71 and a possible move lower.

The current upward trend in oil has been shaped by signs that the economy continues to outperform expectations, showing resilience despite tighter financial conditions.

On the side of oil buyers, there was a wide range of factors, from increased demand for risky assets to signals from the US president's administration that the strategic fuel reserve would soon begin to be replenished.

Despite all that, in the middle of last week, the rise in the price of a barrel of WTI stalled in the territory above $74.20. The local peak almost coincided with the 50-day moving average. In early May, we have already seen how aggressively the bears defend this trend indicator.

Last Thursday's sell-off brought oil back to test support again, allowing only a slight retracement of the previous local highs.

Among the fundamentals, oil traders should consider the start of the US holiday season, which is already evident in the methodical decline in gasoline inventories over the past three weeks. In addition, commercial crude stocks have fallen by 12.4 million barrels. Crude oil stocks are now 8.4% higher than in the same week a year earlier, but they were above 16% in February. At the same time, an additional 1.6m barrels were sold from the strategic reserve.

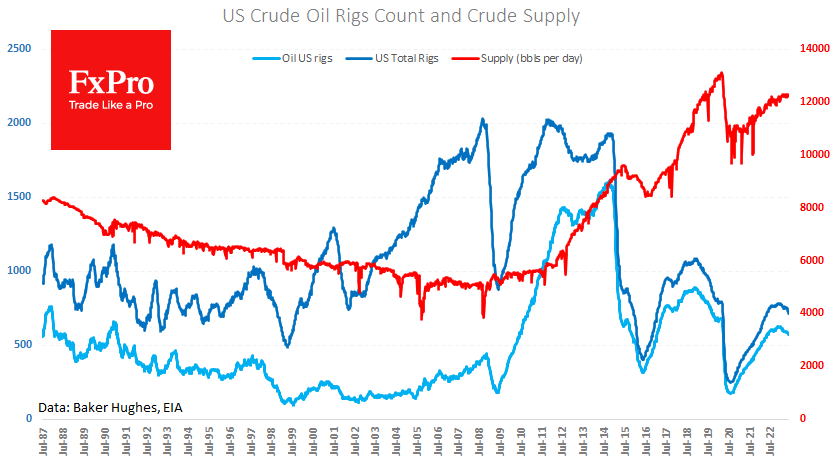

Moreover, Friday's data from Baker Hughes showed a new fall in the number of drilling rigs in the USA: from 575 to 570 and Crude plus Gas count from 720 to 711. Thus, producers are still not interested in ramping up production. The answer to this indifference on the part of oil producers is most likely to be found in unfavourable financial conditions due to high-interest rates and the promotion of a green agenda.

Short-term, oil is under pressure from reports that Russia is successfully selling its diesel to Saudi Arabia, and the latter is exporting it to Europe. Meanwhile, offshore oil exports from Russia continue to rise. Saudi Arabia has also joined the IEA in noting that Russia has not cut production by 500,000 BPD, as promised earlier in the spring.

Local negative factors can send oil to a new test of trend support, which is now near $71. A fall below that would be significant evidence of a victory for the bears, potentially triggering a downside momentum towards $68 or even $65.

If oil gets another bout of downside support, it could be followed by a rally to $74.60-75.0.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)