The challenge for the ECB

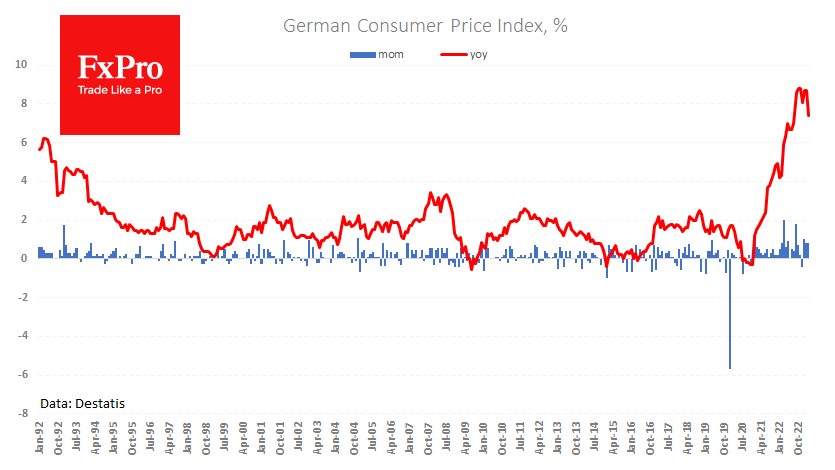

Preliminary estimates for Germany indicated an increase in consumer prices in March by 0.8% m/m and 7.4% y/y, which is higher than the average growth forecasts of 0.7% m/m and 7.3% y/y. In March last year, prices jumped by 2% at once, creating a high base for comparison, which caused a slowdown in the year-over-year rate.

It would be a mistake to celebrate victory over inflation in the eurozone. Germany's monthly price growth remains inconsistent with the ECB's 2% annual growth target. The average monthly price growth rate over the past six months is 0.52%, resulting in a yearly increase of 6.2%, and over the past three months, it has added by an average of 0.9%, bringing an annual rate of 10.4%.

The acceleration of inflation over the past three months is striking, and it isn't easy to attribute this to energy prices or disrupted supply chains. The latest acceleration appears to be due to a tight labour market pushing up service prices and the inflation carryover from the euro's weakening earlier last year.

The ECB may try to overcome these hurdles through monetary tightening, which will simultaneously constrain business activity in the region and strengthen the euro. If no new problems emerge in the banking industry in the coming weeks, we should expect a further decisive tightening of the policy of the European Central Bank.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)