US data: Stubborn inflation vs jobs warning bell

US data: Stubborn inflation vs jobs warning bell

US inflation came in slightly above expectations, but a jump in weekly jobless claims shifted the focus to the need for further policy easing, dampening speculation that the Fed may not cut rates in November.

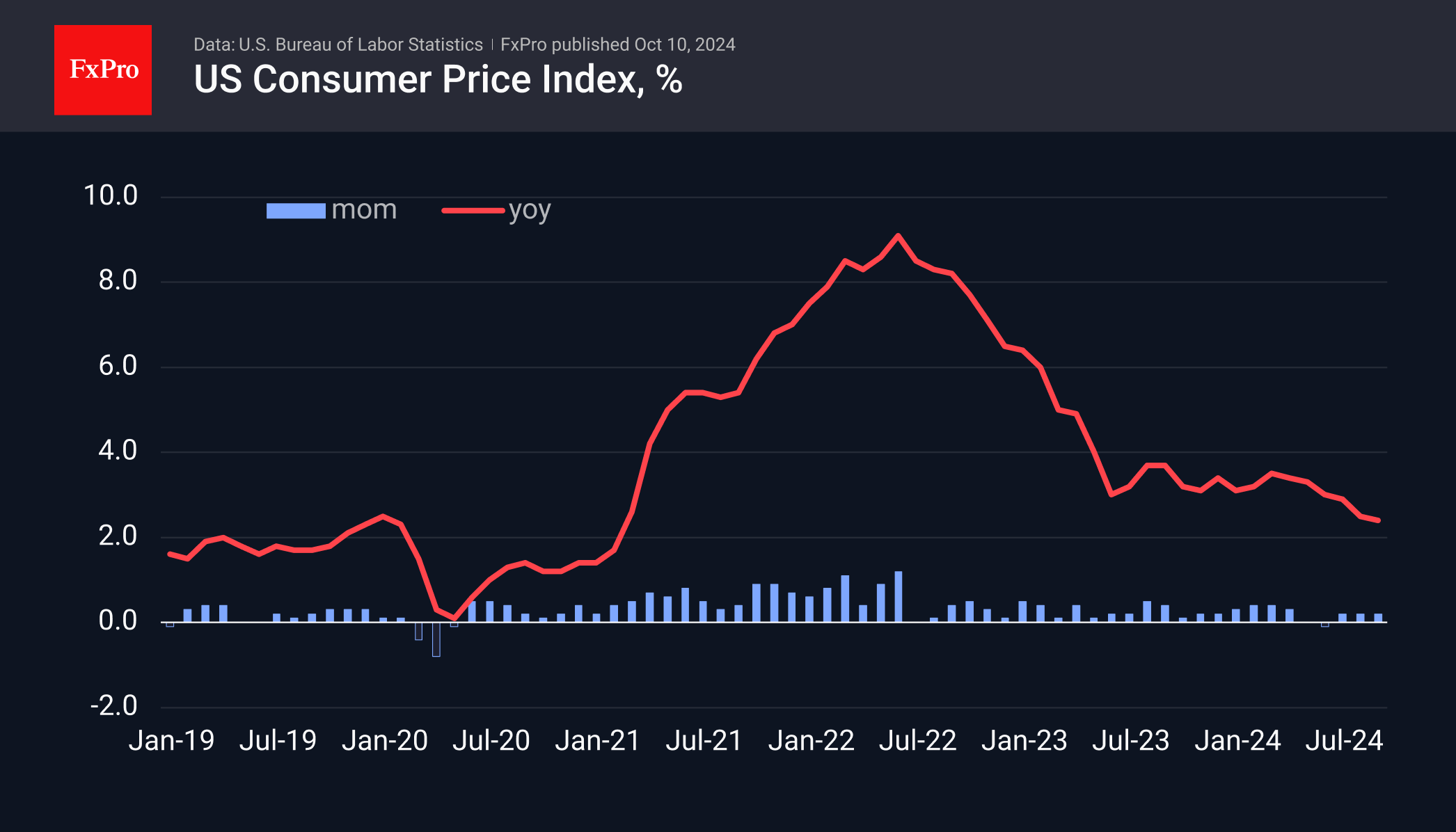

Consumer prices rose 0.2% m/m in September, the same as the previous month, while annual inflation slowed from 2.5% to 2.4%, above expectations of 2.3%. Housing and food were important drivers, accounting for three-quarters of the total price increase.

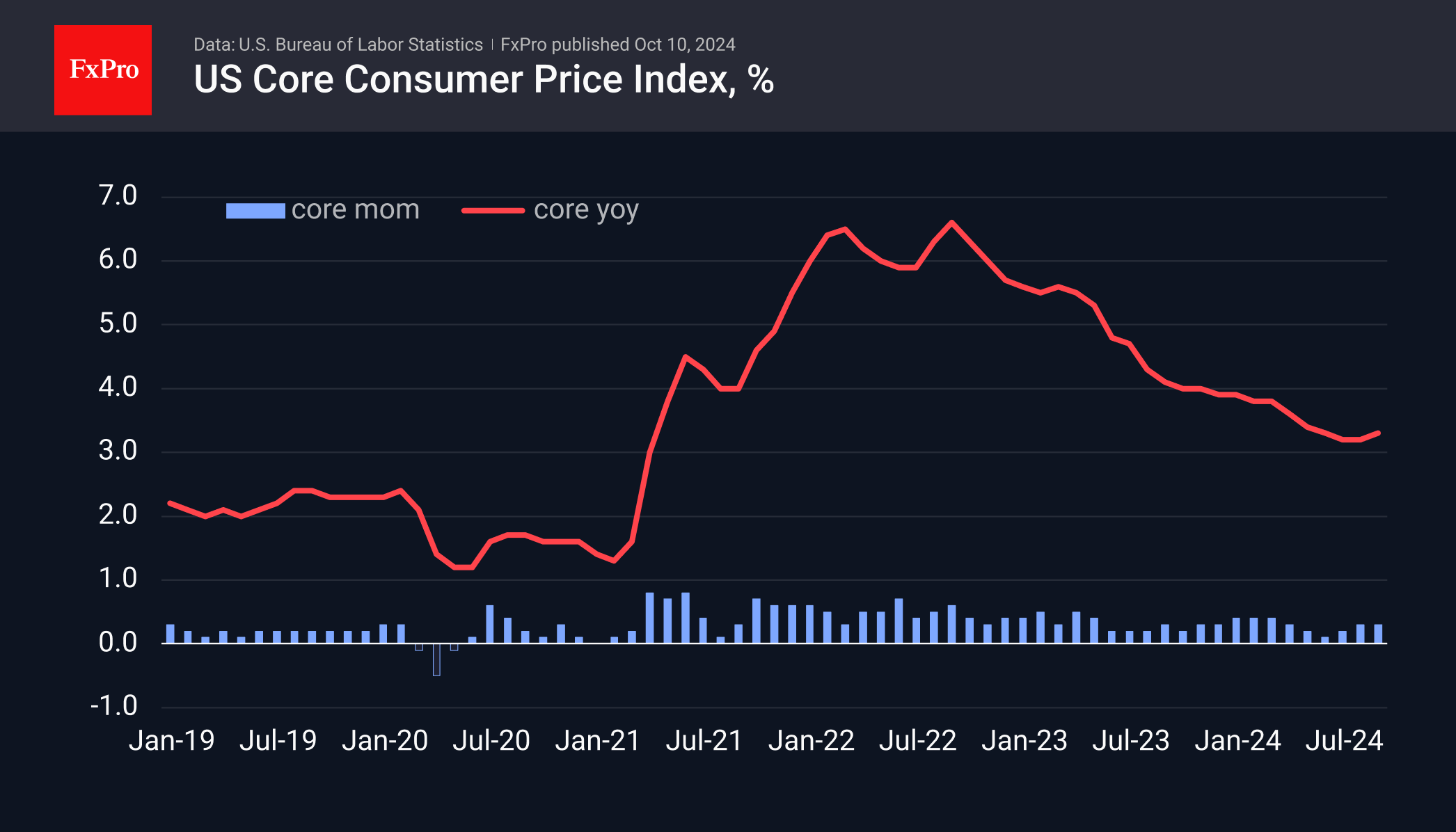

The core index, which excludes energy and food prices, accelerated its annual growth rate from 3.2% to 3.3%, the first acceleration in a year and a half. This proves that slowing inflation is no easy task in the context of full employment and is mediated by low oil and fuel prices.

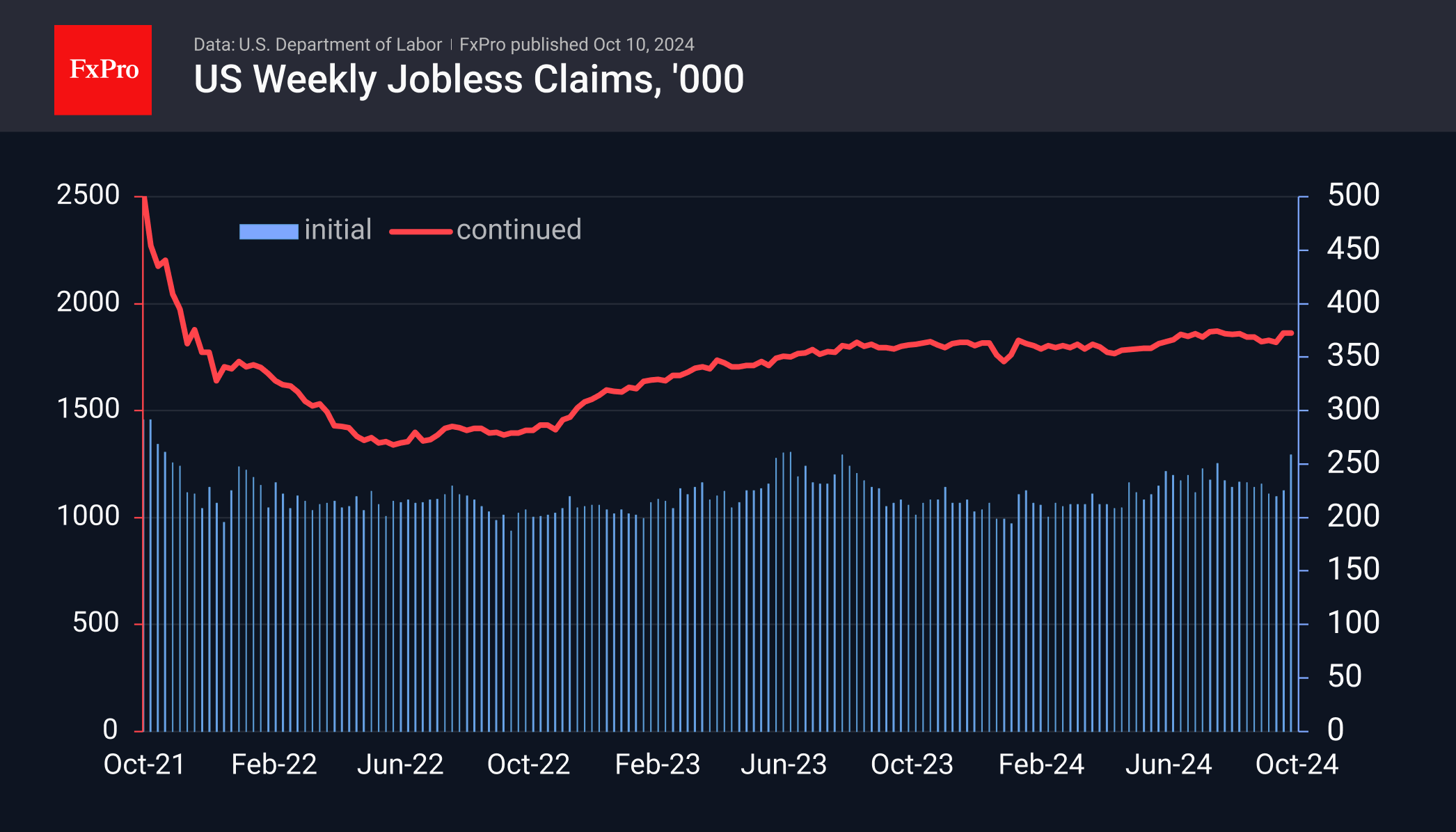

The impact of accelerating core inflation—usually a bullish factor for the dollar—was overwhelmed this time by an unexpected jump in jobless claims last week. Initial claims were reported to have risen to 258K from 225K the previous week and an expected 231 K. The current level is the highest since last August and the fourth highest in almost three years as the US labour market recovered from the shutdown shock.

About two months ago, financial markets reacted nervously to employment signals, but the return of weekly claims to normal levels reassured investors that we were seeing a short-term spike rather than a trend reversal. Now, the situation is reversed: strong NFPs versus the alarm from the weekly numbers.

The dollar fluctuated between 0.4% and 0.1% in the first moments after the data was released but has only lost 0.1% at the time of writing on such conflicting data. Perhaps investors will now eagerly look for signals from Fed members to learn their assessment of the situation, which the market will follow.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)