Wall Street sets another record after soft US retail sales

September rate cut hopes get a boost

US retail sales fell short of expectations on Tuesday, in another sign that consumers in America have started to rein in their spending. Retail sales increased by just 0.1% m/m in May following a downwardly revised decline of 0.2% m/m in April. The data boosted expectations that the Federal Reserve will cut rates sooner rather than later, with September odds rising to 74% and year-end expectations reaching almost 50 basis points.

However, yesterday’s releases weren’t entirely negative as the control group measure of retail sales, which is a narrower indicator and is an input in GDP calculations, rebounded by a solid 0.4% m/m, while industrial output jumped by 0.9% m/m.

But with the recent inflation readings also being on the soft side, there is growing conviction among investors of a rate cut in September. Those expectations were further bolstered by a somewhat more optimistic and less hawkish tone by Fed speakers on Tuesday.

AI mania and Fed cut hopes lift Wall Street

Treasury yields slipped on the back of the weaker retail sales figures, reversing most of Monday’s gains and dropping close to Friday’s 2½-month lows. This added to the momentum on Wall Street where the AI frenzy continues to drive the market higher.

The tech-heavy Nasdaq closed marginally higher at a new all-time high, while the S&P 500 added 0.25% to finish in record territory for the 31st time this year. AI giant Nvidia led the gains, rallying by 3.5% to overtake Microsoft as the world’s most valuable company, but Apple weighed on the main indices as its stock fell by just over 1%.

There will be no trading on Wall Street on Wednesday as US markets will be shut for the Juneteenth holiday.

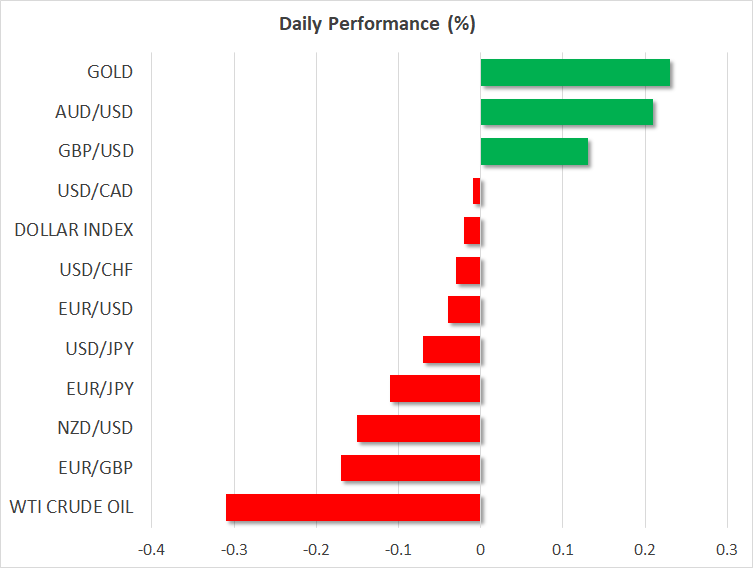

Dollar on the backfoot

The improved risk appetite and optimism around Fed rate cuts did the US dollar no favours, however, as the greenback is in danger of losing ground against a basket of currencies for a third straight session.

The euro remains supported in the $1.0735 region, while sterling is attempting to stretch its rebound to a third day.

Pound up on UK CPI, oil turns bullish

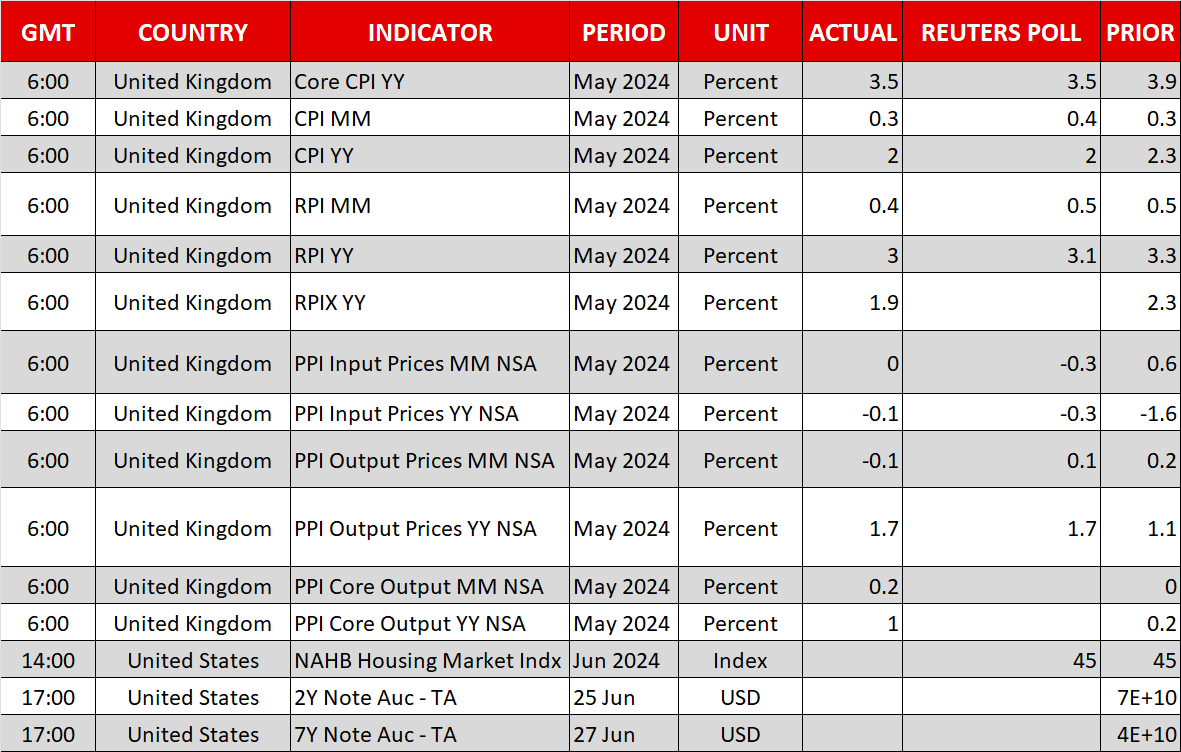

UK inflation hit the Bank of England’s 2% target in May, in line with projections, and core CPI also moderated as expected. But services inflation overshot forecasts of 5.5% to fall to just 5.7% y/y.

This slightly dented easing bets for the Bank of England, making a surprise August cut less likely. The BoE will announce its latest policy decision tomorrow but it’s unlikely that policymakers will give much away in terms of rate cut signals as the UK is in the midst of a general election campaign.

The Swiss National Bank also meets on Thursday to set rates, with investors assigning a 68% probability of a 25-bps cut. The Swiss franc’s recent upside reversal has increased the odds of a cut, but it remains to be seen if this will be enough for the SNB to ease concerns about a flare-up in inflationary pressures.

Oil prices, meanwhile, took a breather after two days of strong gains. Both WTI and Brent crude futures have benefited from the improved risk sentiment in June, climbing to seven-week highs.

.jpg)