Edit Your Comment

Analysis

forex_trader_150670

Medlem sedan Sep 12, 2013

110 inlägg

Jan 21, 2014 at 18:54

Medlem sedan Sep 12, 2013

110 inlägg

EURUSD: The EURUSD could not take out the low from yesterday (the year) and the pair was dragged higher. The price moved above the close but remains below the 100 hour MA (blue line) and 38.2% of the move down from last weeks high (at 1.3580).

GBPUSD: The GBPUSD was the catalyst for the dollar reversal today. It was in the midst of a up and down choppy session then broke above the topside ceiling and at the 1.6451-56 and moved another 30 pips higher.

USDCHF: The USDCHF moved above trend line resistance which is bullish, but could not stay above that break level. The failure above turned the buyers into sellers. The price has moved into negative territory and tests the 100 hour MA (blue line) and 38.2% of the move up from the Jan 14 low to the high reached today.

USDJPY: The USDJPY did all the moving in the Asian session and then consolidated in the London and into the NY session. Instead of correcting down, regrouping and surging back higher, the price corrected and kept on going. The pair fell below the 38.2% of the weeks move higher, the 100 hour MA and now the 200 hour MA. UGH (for the buyers). The price is now below the close

forex_trader_150670

Medlem sedan Sep 12, 2013

110 inlägg

Jan 22, 2014 at 19:50

Medlem sedan Sep 12, 2013

110 inlägg

Today Australia’s CPI inflation came in higher than expected at 2.7% vs expectations of 2.4%. The Trimmed version YoY came in at 2.6% vs 2.3% estimate. The level for the head line number is the highest since December 2011 when inflation came in at 3.0%.

Meanwhile, the Canada”s CPI is down at 0.9%. The inflation has been below the target of 2% since April 2012. The expectation is for inflation to tick up later this week to 1.4%. However, the BOC in their interest rate statement today said that inflation should remain below the target rate of 2% for a couple of years.

Does the divergence of inflation fundamentals influence the AUDCAD?

In January, the price of the AUDCAD has been moving above and below the 100 and 200 day MA. Today, the price has moved back above both MAs (see blue and green lines in the chart above). Moreover, the price is above the 38.2% of the move down from the 2013 high to the 2013 low at the 0.97584. This is bullish from a technical perspective.

Since May of 2013, the price for the pair has been above this 200 day moving average on 2 separate occasions. The first was in October when the price traded above for 5 days (2 closes above). The second time was earlier this month when the price traded above the 200 day MA on 4 days (3 closes above).

So this is the 3rd attempt. Is the third time a charm?

If the price is to follow the fundamentals (no guarantee), the price should stay above the 200 day MA (at 0.9738 area). Closer support can be found against the 38.2% retracement at 0.97584. Markets are fickle at times, but if the bulls are to remain in control, stay above the 38.2% or at the worst, the 200 day MA and the move to the upside can continue.

We have been here and done this before. Will the third time be the charm? Hold above the support level below and the price action will write the story.

forex_trader_150670

Medlem sedan Sep 12, 2013

110 inlägg

Jan 23, 2014 at 16:15

Medlem sedan Sep 12, 2013

110 inlägg

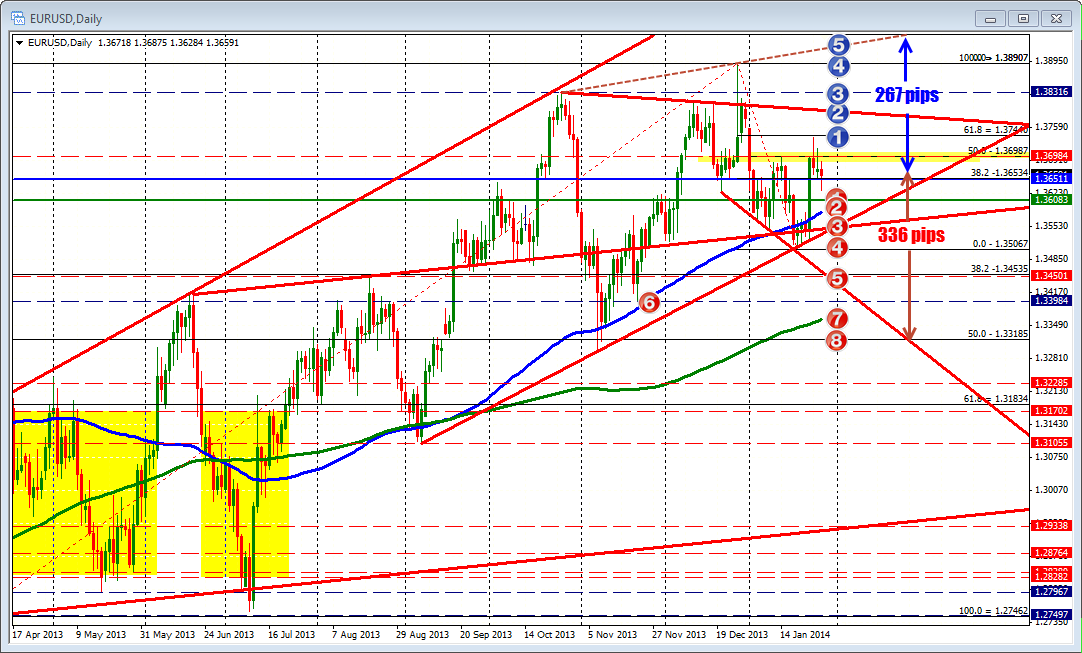

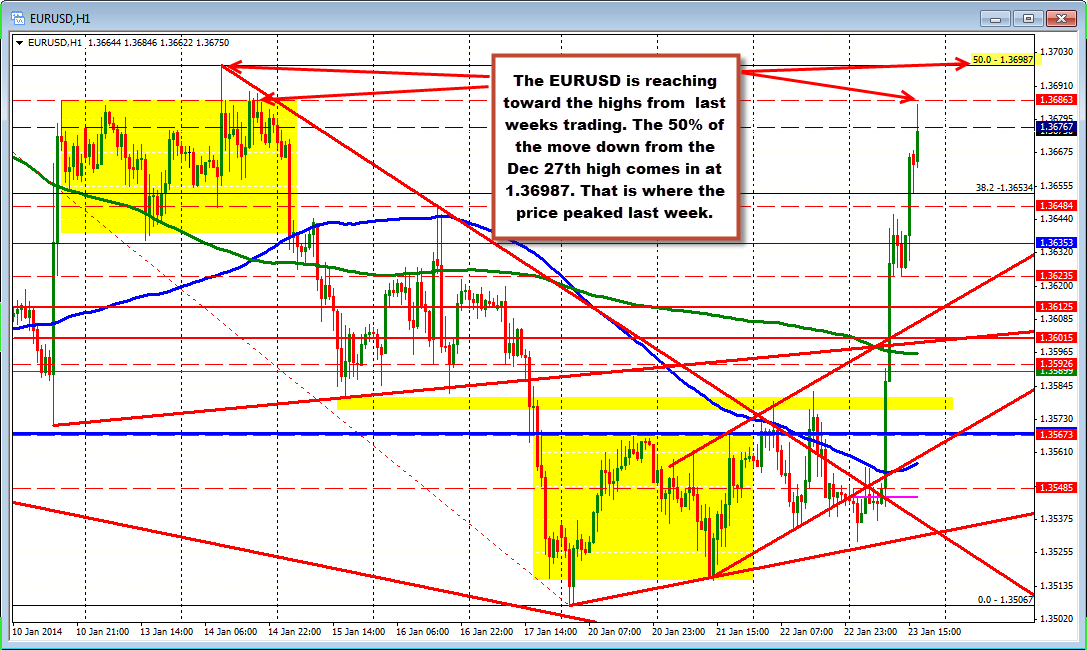

The EURUSD continues the trend to the upside with little in the way of corrections. We are, however, approaching what should be some good resistance against the midpoint of the move down from the December 27th high to the low reached earlier this week. That level comes in at the 1.36987 level. The push to that level last week was quick but did not stay up there for long. Subsequent highs after that failure could only reach to 1.3689. The high today is at 1.3684 so far.

Trading is funny. On Monday, Tuesday and Wednesday, there was little in the way of interest or range. Today, the price range is 156 pips (so far). Non trending though transitions to trending and that is what we are seeing in trading today.

forex_trader_150670

Medlem sedan Sep 12, 2013

110 inlägg

Jan 27, 2014 at 19:45

Medlem sedan Sep 12, 2013

110 inlägg

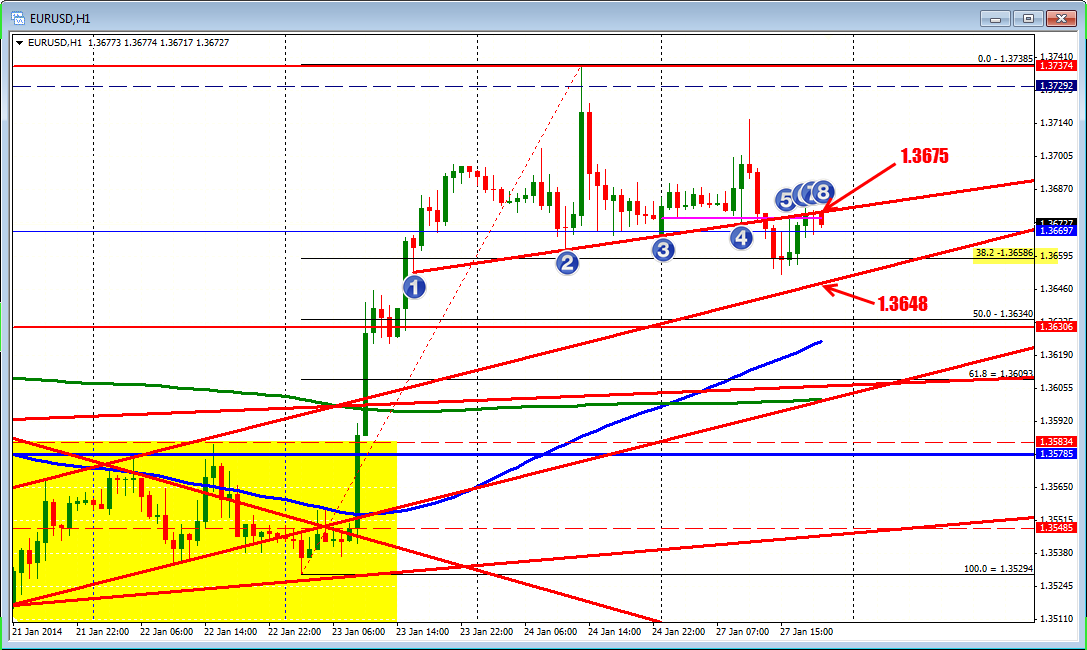

The EURUSD trades quietly. The pair trades in a 64 pips trading range. The early part of the NYsession tried to push lower, but the less than impressive New Home Sales, stopped the dollar buying and the correction started. The price tries to stay below the broken trend line at the 1.3675 level. A move above should solicit some buying.

On the downside, a move below the 1.36586 and then the trend line at 1.3648, will take pressure off the upside. However, traders had their opportunity to set the tone to the downside earlier today. That idea faded with the weaker housing data.

forex_trader_150670

Medlem sedan Sep 12, 2013

110 inlägg

Jan 30, 2014 at 20:49

Medlem sedan Sep 12, 2013

110 inlägg

*Kommersiell användning och skräppost tolereras inte och kan leda till att kontot avslutas.

Tips: Om du lägger upp en bild/youtube-adress bäddas den automatiskt in i ditt inlägg!

Tips: Skriv @-tecknet för att automatiskt komplettera ett användarnamn som deltar i den här diskussionen.