AUDUSD climbs, but overbought signals raise caution

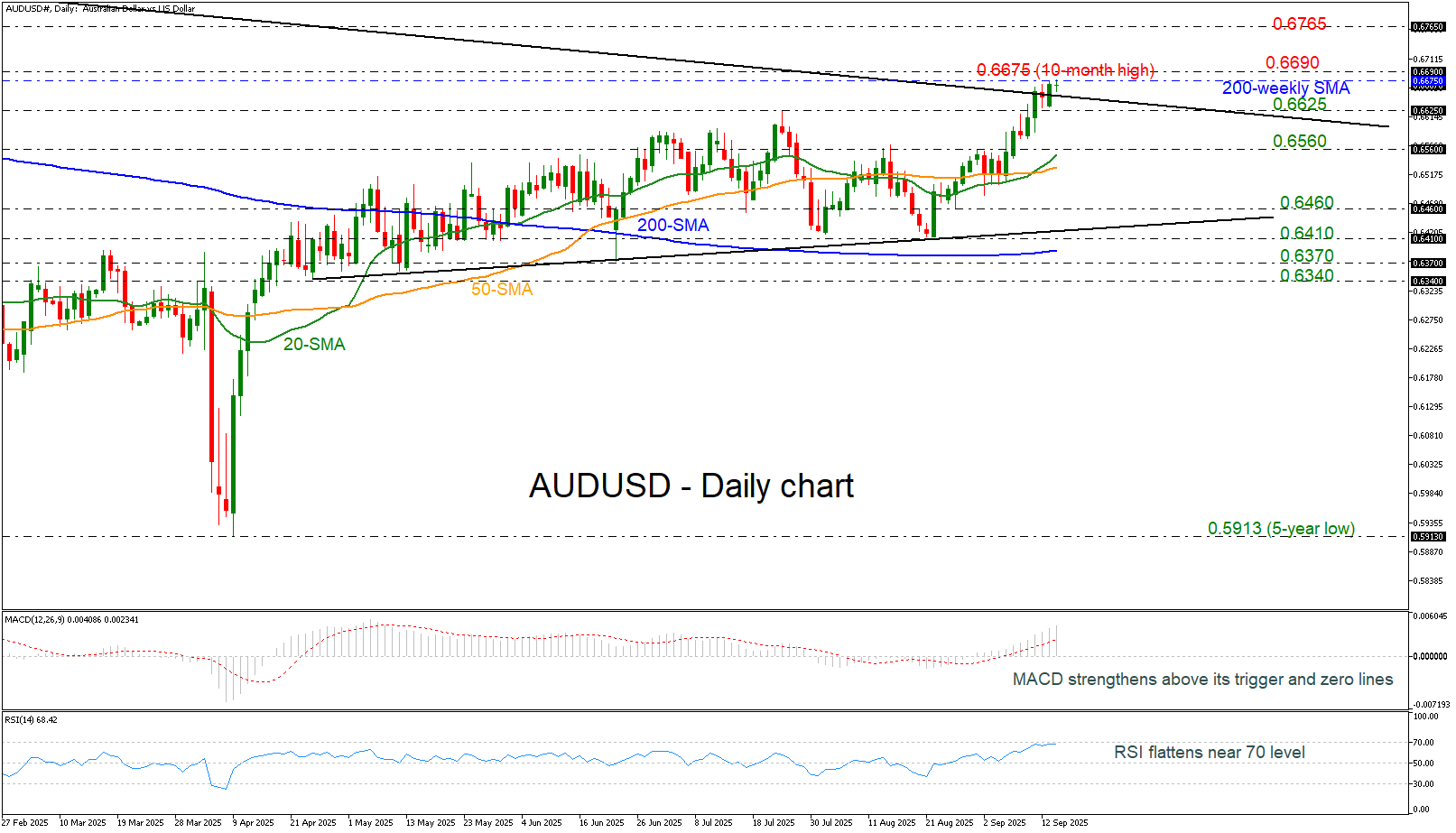

AUDUSD rose to a fresh ten-month high of 0.6675 earlier in the day, encountering strong resistance at the 200-week simple moving average (SMA) and a long-term descending trend line.

The ongoing rebound from the 0.6410 support level remains intact, with potential upside targets at 0.6690 and 0.6765.

Despite the bullish momentum, a pullback cannot be ruled out as the pair is currently testing significant technical barriers. A break below the immediate support at 0.6625 could trigger a decline toward the 0.6560 level, followed by the short-term SMAs clustered between 0.6530 and 0.6550.

From a technical standpoint, the MACD continues to extend its bullish trajectory above both its signal and zero lines, reinforcing the positive outlook. However, the RSI is hovering near the 70 threshold, indicating that the market may be approaching overbought conditions.

While the broader technical picture remains constructive, AUDUSD faces key resistance levels that may temporarily cap further gains. A sustained break above 0.6690 would confirm bullish continuation.

.jpg)