Bitcoin and Solana Reach New Heights

Bitcoin and Solana Reach New Heights

Market Overview

The cryptocurrency market witnessed a significant surge in volatility, reaching an all-time high of $3.72 trillion in total capitalisation on Monday morning. This growth was driven by the successful launch of meme-coins associated with Trump and his wife Melania, whose substantial capitalisation growth positively impacted the entire market.

On Monday, prior to the commencement of the active European session, Bitcoin soared to $109.9K, setting a new record high. Subsequently, the price stabilised around $108K. Consolidation at this level may initiate a new growth phase with a potential target of $133K.

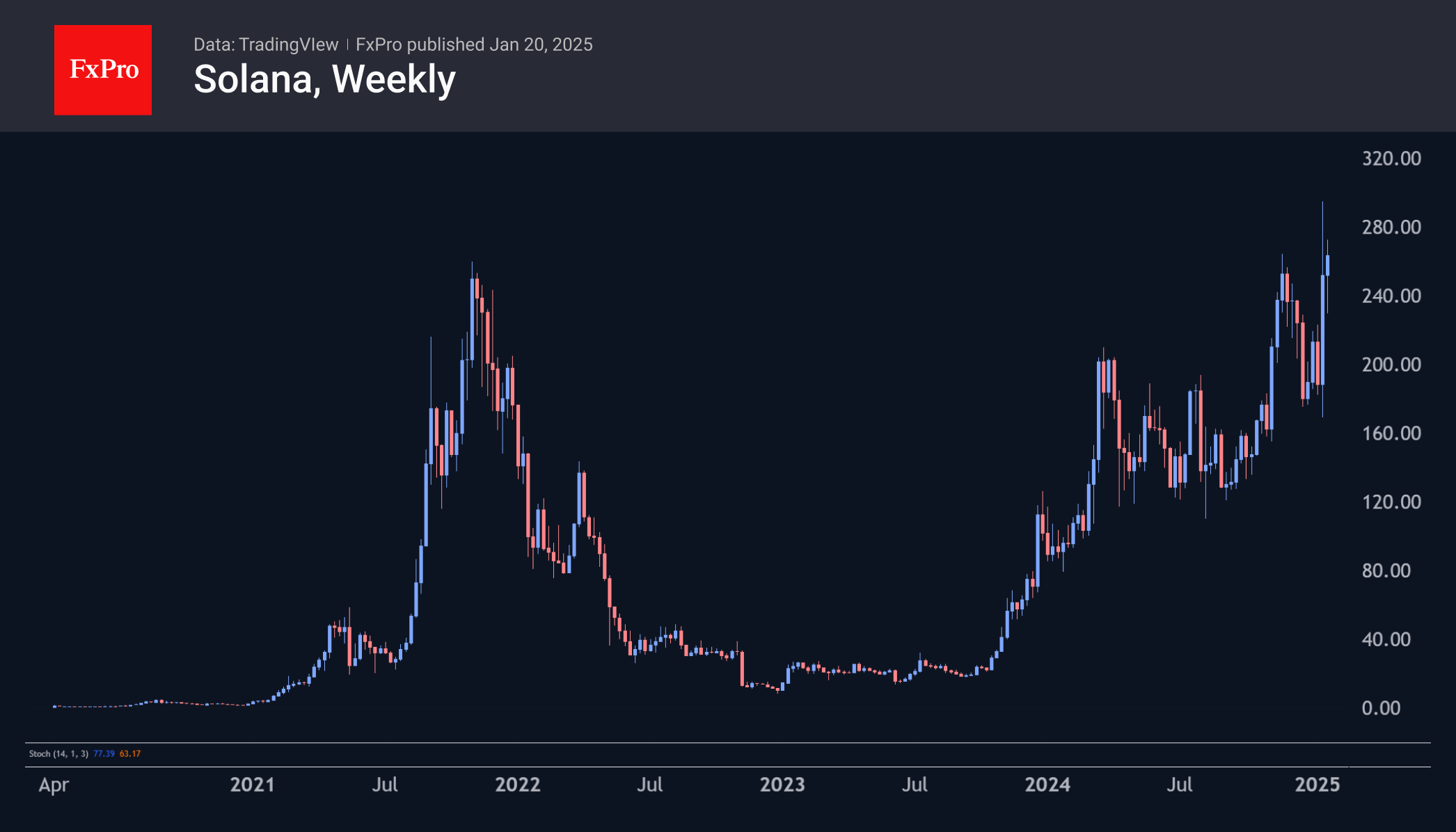

Solana emerged as an indirect beneficiary of the recent meme-coin wave. Its price peaked near $300 on Sunday, later stabilising at $270 on Monday. Despite the pullback, these levels exceed the peaks observed in late November and August 2021, dispelling speculation that the recent spike resulted from low weekend liquidity. The current scenario suggests further gains towards all-time highs and increased market enthusiasm (FOMO) with the issuance and trading of meme coins.

News Background

Activity in the XRP options and futures markets has surged significantly due to the underlying asset's meteoric rise. Key metrics indicate investor optimism, as noted by Nansen. On Friday, XRP reached an all-time high above $3.40, spurred by rumours of its inclusion in the US cryptocurrency reserve.

Public mining companies held more than 92,000 BTC on their balance sheets as of December 2024, marking an all-time high, according to calculations by TheMiningMag. This figure represents a 136% increase over the year, largely attributed to MicroStrategy's BTC acquisition strategy.

Ethereum developers have scheduled the Pectra hardfork for the main network in early to mid-March. This significant upgrade will implement a comprehensive list of improvements to the Ethereum platform.

Bloomberg reports that on January 20, the day of his inauguration, Trump intends to issue an executive order designating cryptocurrency as a national priority. This status will require government agencies to collaborate with the industry. Additionally, there are plans to establish a digital asset advisory council to advocate for the industry's policy priorities.

Market maker Wintermute reported a fourfold increase in over-the-counter (OTC) trading volume on its platform in 2024, primarily driven by strong demand from institutional investors.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)