China is spreading deflation again

China is spreading deflation again

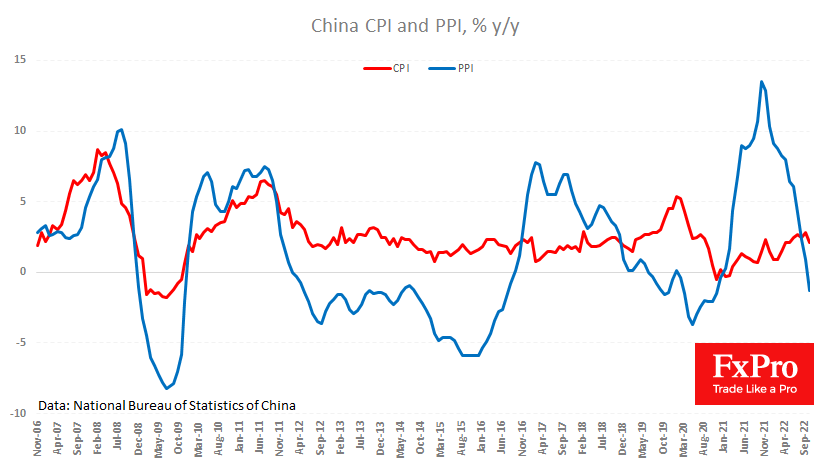

A slowdown in economic activity in China and beyond is putting pressure on consumer and producer inflation.

The consumer price index slowed from 2.8% to 2.1% y/y in October, the lowest level since May. The producer price index was 1.3% lower than in October 2021, when its annual growth rate reached a maximum of 13.5% y/y in this cycle.

Remarkably, the fall in the renminbi has failed to reverse the price trend. Although one can quickly put down the weakness in domestic prices to a tight 0-covid policy and a stronger-than-expected economic slowdown, the pace of price growth in China is still much closer to the notion of normal than in the USA and big European countries. For example, the latest data noted a PPI growth of 45.8% y/y in Germany, 41.9% in the eurozone average, 15.9% in the UK and 8.5% in the USA.

Once again, China may return to the deflationary supplier label it had after 2012. The difference is that back then, this status carried negative connotations for the developed world, which tried to push up prices. The pressure on prices can be interpreted as an aggressive attempt to fight for market share.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)