EBC Markets Briefing | Aussie dollar stalls on US GDP beat

The Australian dollar wobbled on Friday after a report showing the US economy grew faster than expected in Q2. Importantly, a measure called final sales to private domestic purchasers jumped 1.9%.

Australian consumer prices jumped by far more than forecast in July as electricity costs spiked, while core inflation also jumped in a blow to hopes of a rate cut as soon as next month.

Markets are pricing in the chance for an easing from the RBA next month of just 22%, although they are still confident of a move in November. The central bank lower interest rates this month for the third time.

According to its latest meeting minutes, policymakers saw arguments for a gradual pace of easing and for a quicker series of moves to preserve full employment, with the outcome uncertain as yet.

Fund managers say returns on emerging-market assets are set to power ahead of their developed peers given more orthodox fiscal policy and lower valuation, signalling market sentiment is improving.

Signs of India-China thaw primes Asia for deeper integration and thus brighter outlook. Access to the Indian market can be a big boost for Chinese companies at a time when there's a slowdown in domestic consumption.

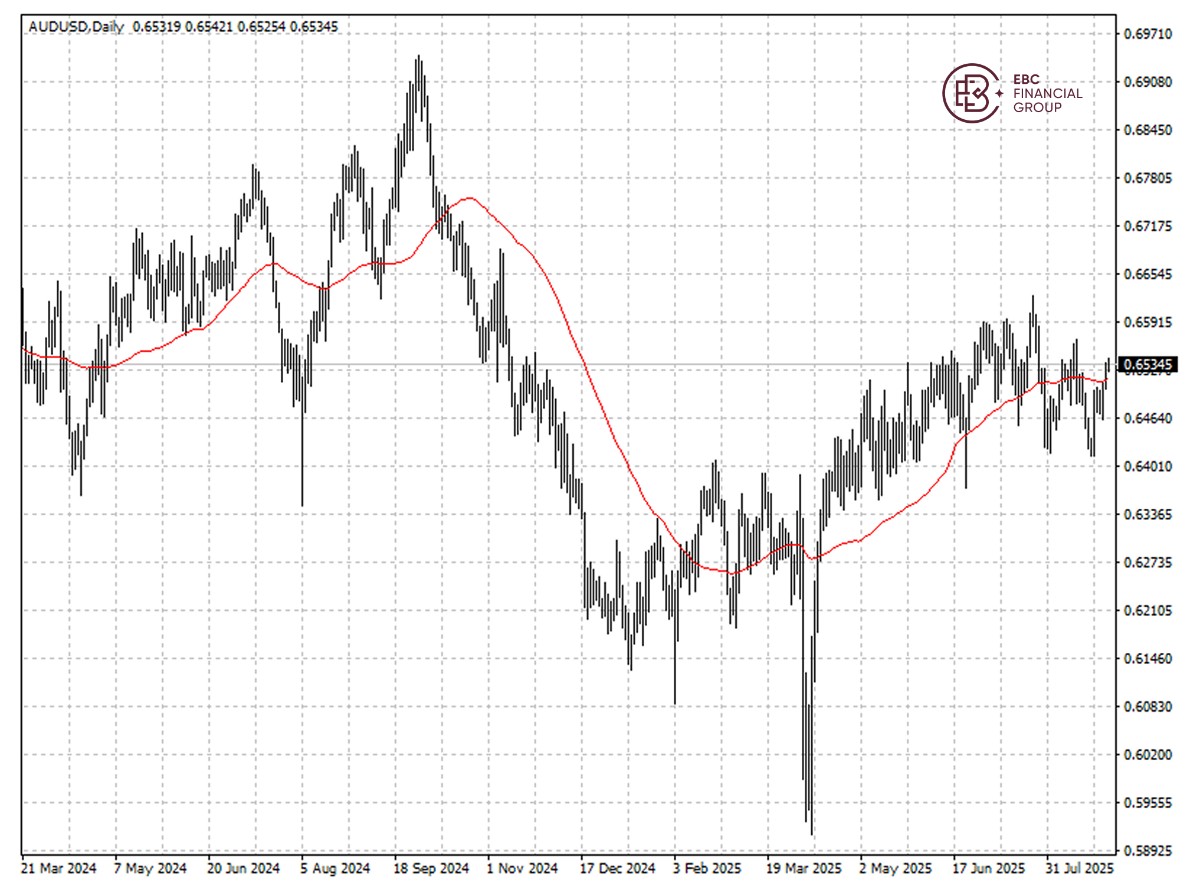

The Aussie has recently fluctuated around 50 SMA, but lower highs painted a dim picture. Descending triangle sets the currency for more losses ahead.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.