Indices: An Epic Reversal

Indices: An Epic Reversal

This week saw one of the most epic reversals in the US indices. On Wednesday, the S&P500 added about 9.5% for the day, posting the third largest gain in its 75-year history and rebounding nine-tenths of the decline caused by stiff tariffs.

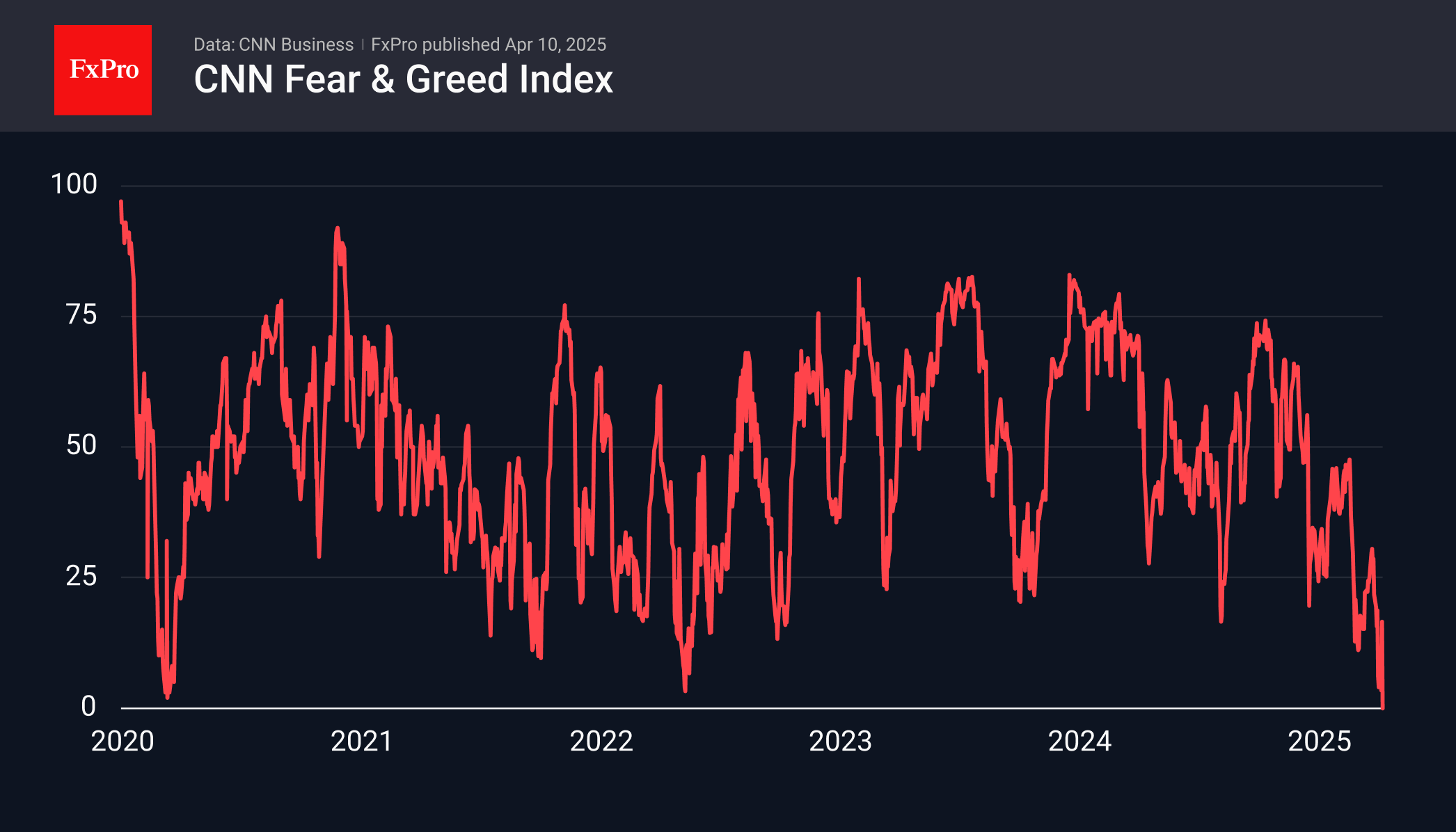

Market sentiment is still just 16, an extreme fear zone. However, this is a sharp rise out of the single-digit area (3-4 since the beginning of the week). Historically, such bounces in the sentiment index have served as an important signal of a return to growth, at least for the coming days.

Countering the absolute positivity is the example of 2022, when the Fear and Greed Index hit a low in May, and the S&P500 hit a low in October. At that time, there were several waves of declines, each leading to lower lows.

A strong buy signal over the long term requires a change in fundamentals. These could be optimistic agreements on tariffs and the recovery of business optimism.

Technically, the picture is now on the side of optimists. On weekly timeframes, the S&P500 has bounced off its 200-week moving average, an important support line of the last 10 years. The RSI index on this chart has also rebounded from its lowest point since 2020.

However, it's important to remember that market recoveries typically take 2-3 times longer than declines. For example, in 2018, it took 22 weeks of growth to recover from a 9-week decline. The current 7-week downturn may take 17-22 weeks to recover.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)