Stock markets flirt with record highs

Wall Street resumes rally

Stock markets staged a ferocious rally on Monday, with the S&P 500 nearly erasing all of last week’s decline to approach its record highs once again. At the tip of the spear was Nvidia, which surged 6.4% to hit its highest levels ever after the chipmaker unveiled new AI-related products.

The ‘tech fever’ that gripped markets last year is still in play. Investors continue to pile into mega-cap tech shares, viewing those companies as safer due to their clean balance sheets and their exposure to the booming artificial intelligence industry, which might shield corporate profits from a global economic slowdown.

Even so, there are some red flags. Equity valuations are expensive by historical standards and that’s under the assumption that earnings growth is going to accelerate significantly this year. Therefore, the soft landing narrative has been fully priced into equity prices, which implies that any further upside from here might be limited.

Another element to consider is the US presidential election in November. Stock markets have a tendency to underperform ahead of the vote as uncertainty rises and investors hedge some of their risk exposure. On the bright side, the market often rallies once the election has passed, almost irrespective of who wins.

Oil and gold lick their wounds

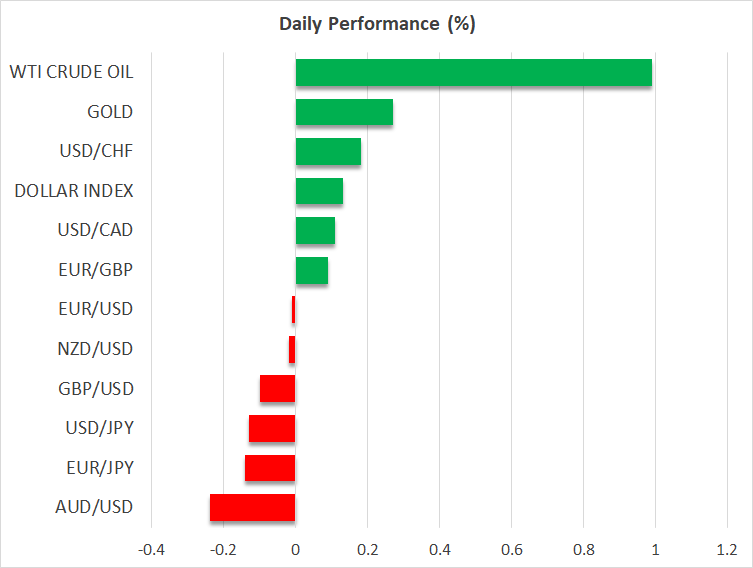

Oil prices have been under the global microscope recently, mostly because of the instability in the Middle East. Despite the tensions in the region, oil prices have still drifted lower as investors have started to worry about a mismatch between abundant supply and insufficient demand this year.

With US oil production at record highs and having the capacity to rise much further as active oil rigs remain fairly low, there is a concern that other major producers like Saudi Arabia will attempt to defend their market share by pumping even more or offering deeper discounts. The risk of another price war could keep oil prices on the ropes for some time.

Gold prices fell sharply on Monday without any clear catalyst. The selloff was strange because it happened even as the US dollar and real yields pulled back, which are normally bullish developments for bullion. Of course, we are still in the early stages of the year, so any sharp moves might reflect positioning adjustments from big investors.

Quiet on the FX front, all eyes on Bitcoin

Crossing into the FX space, the mood has been relatively quiet. The major currency pairs have been trading in wide ranges but with little direction, for the most part closing near their opening levels.

The exceptions have been the British pound and the Japanese yen, which have performed relatively well this week. Sterling has benefited from the risk-on tone in equity markets, while the yen has capitalized on the decline in global bond yields.

Bitcoin is back in vogue, with prices jumping to their highest levels in 20 months yesterday ahead of the widely expected approval of a spot ETF by US regulators this week. Enthusiasm around this ETF has been one of the driving forces behind the fierce crypto rally last year, which raises the risk of a sell-the-fact reaction once the regulatory approval actually arrives.

As for today’s events, the economic calendar is low key, with only second-tier US releases on the agenda.

.jpg)