USDJPY stuck in a range, but for how long?

USD/JPY held stubbornly within the tight 146.90–149.00 range despite the recent NFP-driven turbulence that caused a flash drop to 146.29. However, with the sideways move now stretching into its eighth consecutive week and the clock ticking down to today’s release of the US Producer Price Index (PPI) for August, a shift in sentiment may be just around the corner.

USD/JPY held stubbornly within the tight 146.90–149.00 range despite the recent NFP-driven turbulence that caused a flash drop to 146.29. However, with the sideways move now stretching into its eighth consecutive week and the clock ticking down to today’s release of the US Producer Price Index (PPI) for August, a shift in sentiment may be just around the corner.

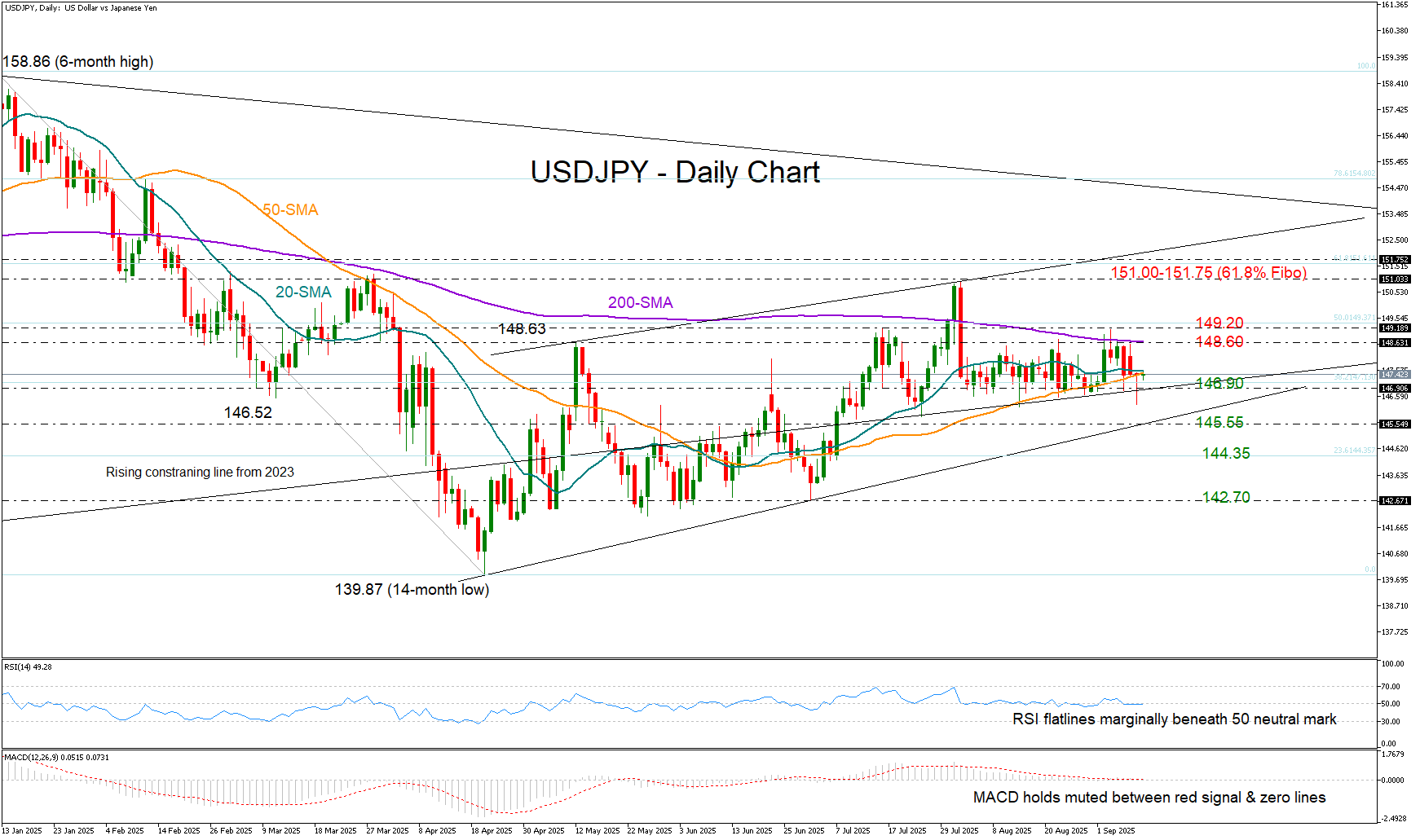

The data may reveal whether input costs continue to squeeze producers’ margins, strengthening the case for sticky inflation as the labor market shows stronger signs of cooling. From a technical perspective, traders remain indecisive: the RSI is hovering just below its neutral 50 mark, while the MACD is muted between its zero and red signal lines. Price action is also limited near the 20- and 50-day simple moving averages (SMAs).

As a result, traders may prefer to stay on the sidelines unless a clear break occurs. A sustainable move below the 146.90 floor could open the door to the 145.55 support level. Further declines might then target 144.35, followed by the 142.70 floor.

On the flip side, buyers may wait for a decisive rebound above the 200-day SMA at 148.60 and the 149.00 zone. If that resistance gives way, the pair could advance toward the 151.00 level, which the bulls failed to secure in July. Slightly higher, the tentative resistance trendline connecting the May and July highs could cap gains near 151.75.

In short, USD/JPY remains in wait-and-see mode for the second straight month. A move above 148.60 or below 146.90 could set the next directional course.

.jpg)