Why is EURUSD falling even though the Fed has softened its rhetoric?

Why is EURUSD falling even though the Fed has softened its rhetoric?

EURUSD has fallen back below 1.1600, quickly losing Friday's momentum and forming its third lower local peak since the beginning of July. Trade flows and expectations of weaker growth due to tariffs could bring the pair back to the lows of the end of last year or push it below parity.

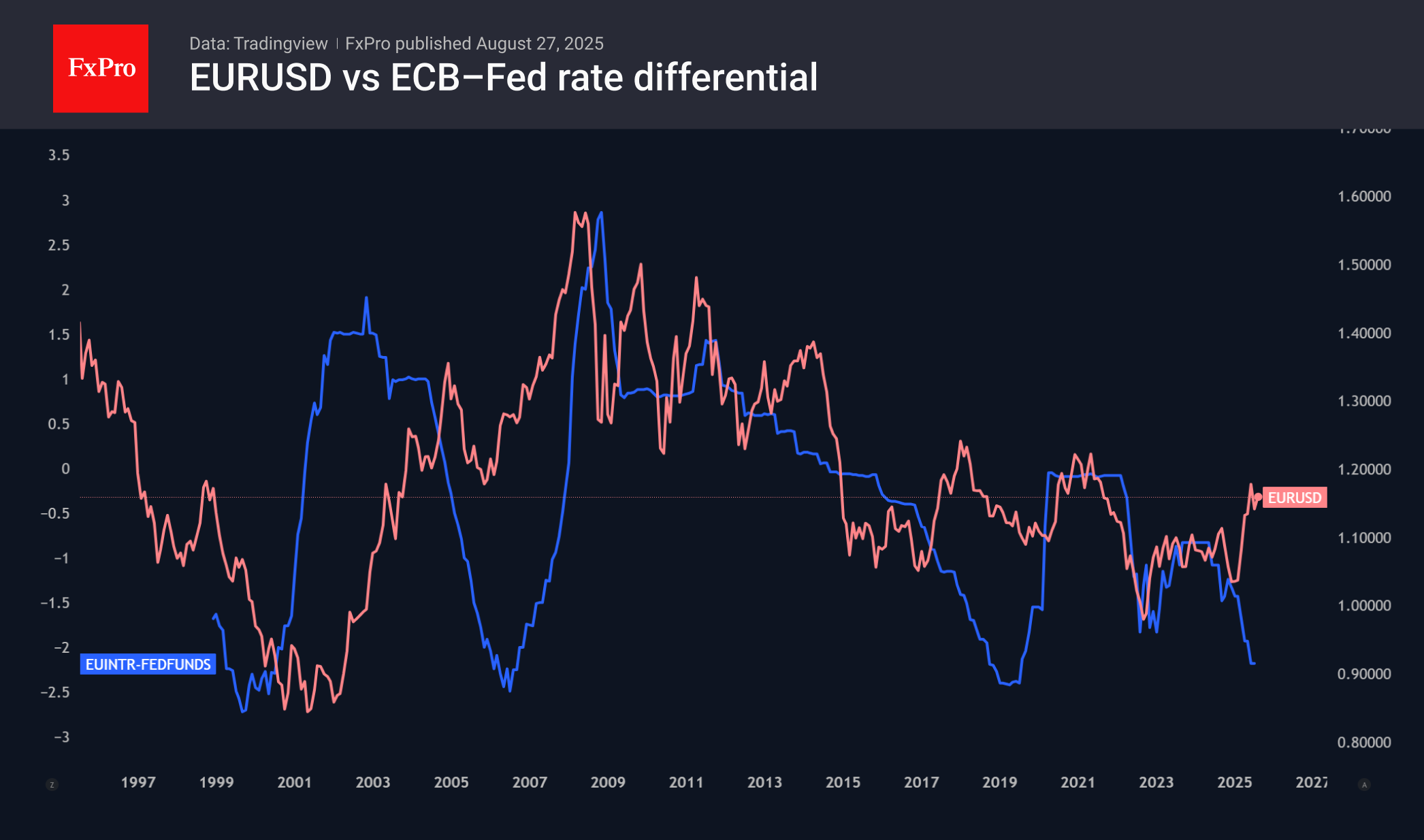

This dynamic contrasts with the news agenda, according to which the differential between the ECB and Fed key rates will soon begin to shift in favour of the former, as the ECB is close to completing its cycle of rate cuts and the Fed is ready to resume its easing.

But there is a perfectly reasonable explanation: trade flows. The EURUSD gained momentum sharply at the beginning of the year as US companies and consumers rushed to buy before tariffs were raised. Now we are at the point of the reverse process, when imports will be below the norm of recent years. Moreover, long-term fundamental factors are coming into play, such as suppressing production in Europe and supporting it in the US. The same shift from the dollar to the euro occurred in 2017, when the first trade conflicts began, and continued until March 2018, when tariffs were introduced.

The eurozone can counter this trend through further rate cuts or government financial incentives. Due to chronic budget deficits, the former is more likely. The Fed's rate is now 2.2 percentage points higher than the ECB's, above previous turning points of 2.7 points in 1999, 2.5 in 2006 and 2.4 in 2019.

This approach is supported by rising inflation in the US versus deteriorating activity in Europe. Fundamental factors alone could push EURUSD to last December's lows or even below parity, which we last saw in September 2022.

However, traders in the market are dealing with a reality in which Washington is increasing pressure on the Fed, calling for a sharper rate cut. In extreme cases, this threatens to repeat the 33% rally in EURUSD between November 2005 and March 2008. In this case, the single currency could fall to the 1.40 level, which has not been reached for the last 11 years.

Nevertheless, we consider political interference in monetary policy a risk. The main scenario is based on a balance of fundamental forces, which are currently bearish for EURUSD.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)