Above-expected inflation failed to impress Pound buyers

Another release of UK consumer inflation well above expectations has failed to take the issue off the country's agenda.

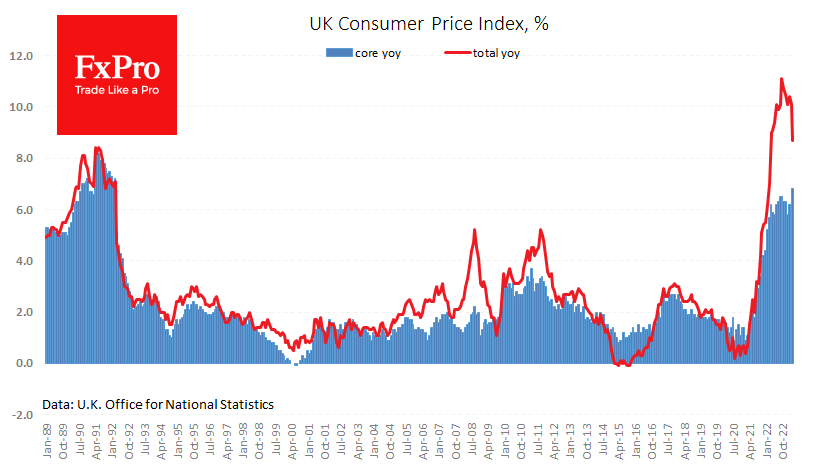

The report for April showed a 1.2% rise in consumer prices, compared to the 0.8% that markets were expecting this time and the previous month. Annual inflation slowed from 10.1% to 8.7% (8.2% was expected). This is a 13-month low, but still above the peak inflation levels in the early 1990s, when it was barely above 8% y/y.

The core CPI hit a new multi-year high of 6.8% y/y. It was widely expected to remain at 6.2%. The Bank of England is likely to take note of this acceleration, which demonstrates the depth of the roots of inflation.

In modern UK history, core and headline inflation have moved in the same direction, albeit to different degrees. Still, the current case is characterised by a sustained rise in core inflation. This divergence is due to a tight labour market and the associated increase in service prices, which continue to rise despite the reversal in commodity prices.

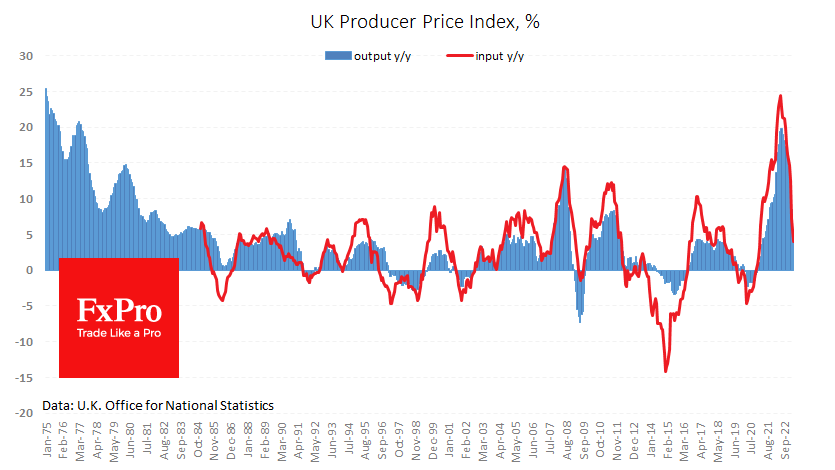

Astonishing in this story is the persistence of price rises, mainly in the final consumption stage. Producer Price Index Input fell by 0.3% in April and has now fallen in four of the last six months. Over the past year, their rise has decreased to 4.0%.

Producer Price Index Output was unchanged for the third month, and the year-on-year rate of increase slowed to 5.4%, compared with 8.5% the previous month and a peak of 19.8% in July last year.

Producer price trends tend to lead consumer price trends by several months.

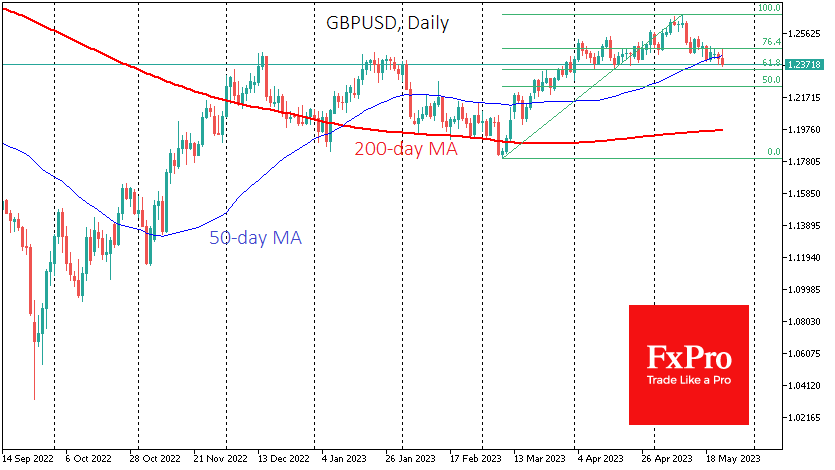

Immediately following the release of the inflation data, the GBPUSD rallied, at one point approaching 1.2470. This was likely the result of algorithmic strategies acting on above-expectation headline CPI numbers.

However, the pound soon reversed and fell below 1.2390 for a few hours. This drop brought the British currency back into the downtrend of the last two weeks and prevented the cable from staying above its 50-day moving average. Technically, the decline has a high probability of extending to 1.2340-1.2350, the area of last month's lows and the 61.8% Fibonacci retracement level of the rise from 1.18 in March to 1.2680 in early May. It is also the area of the December and January highs, making a test of this area even more cautious.

A solid move lower from current levels would signal a market shift in favour of the dollar for many weeks to come. The ability to hold these levels and move higher would signal that the Pound remains within the bullish trend that has been in place since late September.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)