Bitcoin lags S&P; Ethereum is pumping up with new money

Bitcoin lags S&P; Ethereum is pumping up with new money

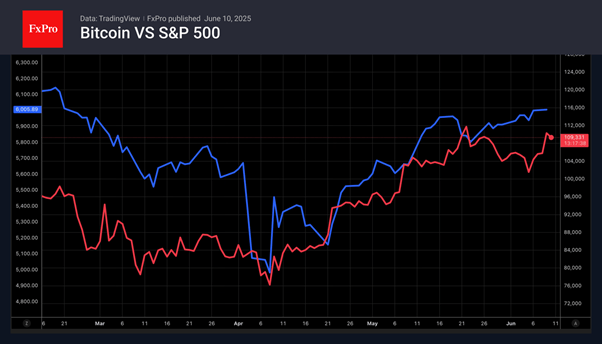

The paths of Bitcoin and US stock indices seem to have diverged in June. The S&P 500 rose for several consecutive trading sessions thanks to the de-escalation of trade conflicts, the strength of the US economy and positive corporate reporting. The first digital coin came under pressure due to capital flowing to Ether, doubts about the effectiveness of new stablecoins legislation and conflicts of interest.

Donald Trump's family is becoming increasingly involved in the crypto business. An affiliate company has announced the purchase of Bitcoin through the issuance of securities, and the president's sons intend to launch their own Bitcoin ETF. As a result, digital assets are perceived as Trump's personal interest.

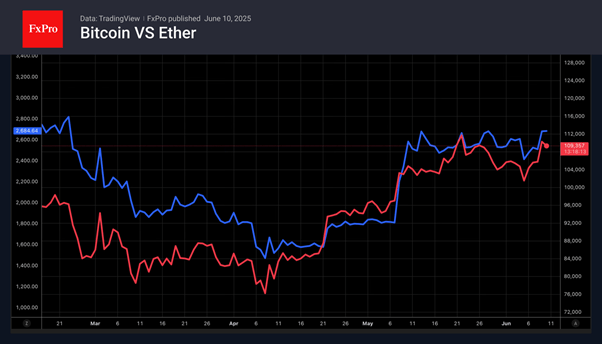

Ether, which has been in the shadows for a long time, is now leaping forward. Over the past two weeks, Ethereum ETFs have attracted $812 million, the biggest amount since the beginning of this year.

Investors are increasingly sceptical that new legislation on stablecoins will protect them from fraudsters. Despite stricter rules and regulations, Germany saw an 8% increase in reports of suspicious activity involving cryptocurrencies in 2024.

Dark clouds were gathering over Bitcoin, but the Strategy report catalysed a rebound. The company has been buying digital assets through the issuance of securities since 2020 and owns 582 thousand Bitcoins worth almost $64 billion, with an average purchase price of around $ 70 K. Strategy has many followers, fuelling demand for crypto and allowing it to grow.

As a result, the correlation between BTCUSD and US stock indices began to recover. Both Bitcoin and the S&P 500 are risky assets. Therefore, the improvement in global risk appetite against the backdrop of the resumption of trade negotiations between the US and China supports the cryptocurrency rally. The record high of around $112K is within reach. Breaking this record will attract new buyers to the market and contribute to the continuation of the upward trend for Bitcoin.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)