Crypto continues its retreat

Market picture

In 24 hours, its capitalisation fell 2.2% to $2.36 trillion. Bitcoin’s relatively moderate 1% decline contrasts with a much deeper dive in altcoins. Ethereum fell 3.3%, Solana plunged 7.8%, and Dogecoin dropped 9.2%.

The main momentum of the decline came in early Asian trading, and at the time of writing, the crypto market had moved away from extremes. Nevertheless, the latest momentum shows that the bears in crypto are in control. This is somewhat surprising given the impressive renewal of all-time highs by the Nasdaq and S&P500 indices.

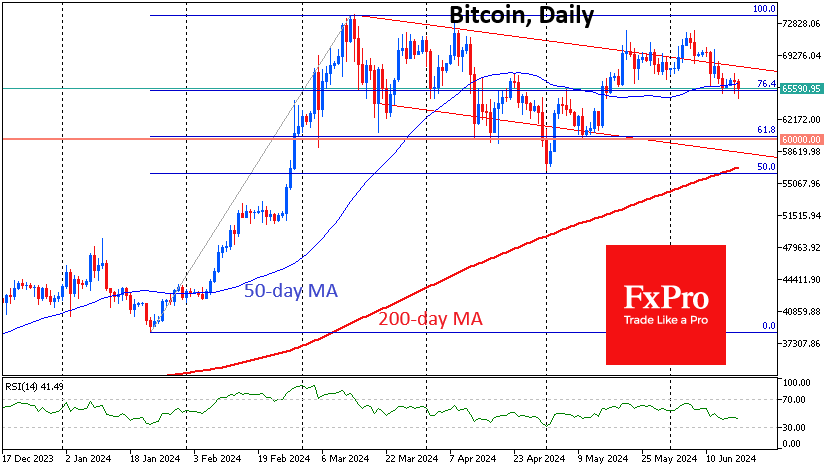

Bitcoin was down to $64.5K this morning, its lowest since 15 May. It has been declining for the past twelve days. It's also attempting to gain ground below the 50-day moving average and the 76.4% support level from the January-March rise.

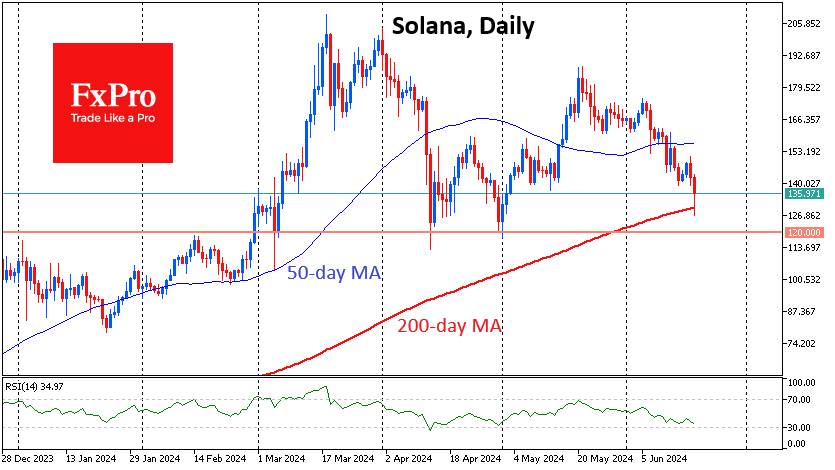

However, the leading altcoins are suffering much larger losses due to shifting market sentiment. Solana has lost over 20% in 12 days of active declines, and the selling is picking up. At one point intraday on Tuesday, losses exceeded 11% but are down to 4.5% at the time of writing. The sell-off hunters came in buying on a touch of the 200-day average. The latest slip may turn the market to the upside for the coming days, as it did in April at roughly these same levels.

News background

According to CoinShares, crypto fund investments fell by $600 million last week after record inflows of $2.038 billion over the past 12 weeks; the notable outflow came after five weeks of rising indexes. Bitcoin investments were down $621 million; Ethereum investments were up $13 million. Outflows from Grayscale's bitcoin-ETF rose sharply to $273 million for the week.

The Australian Securities Exchange will start trading the first spot bitcoin-ETF on 20 June. A product from VanEck has gained admission to trading, while applications from other issuers are still being reviewed.

The US SEC has agreed to reduce Ripple's fine for violating securities laws from $2bn to $102.6m. The SEC was responding to a recent request from Ripple's lawyers, who called the $2bn fine sought by the regulator unfair.

The total value of blocked assets in the TON network exceeded $605 million. Blockchain ranks 15th among the largest DeFi ecosystems.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)