Crypto market stabilises after rebound

Crypto market stabilises after rebound

Market Picture

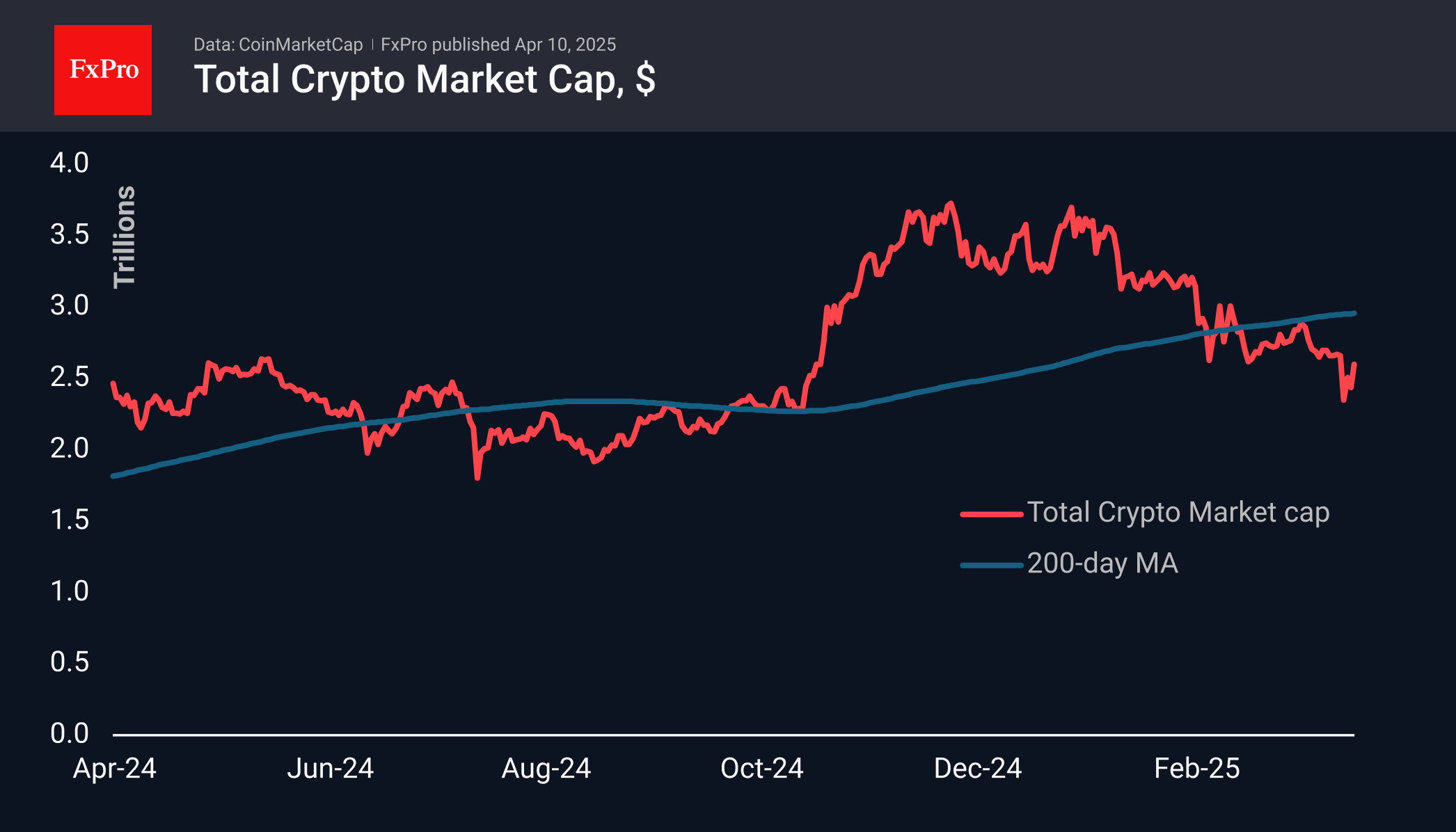

The cryptocurrency market cap has stabilised near a key level since the start of the week and went up steadily on the back of tariff news following the rise in equities. However, the spurt was half that of equities. Total capitalisation reached $2.60 trillion, pushing back from support near $2.3 trillion, the level from which the rally began late last year. So far, the rise has been met with caution as capitalisation has yet to cross its 200-day moving average, which is pointing upwards and approaching $2.96 trillion.

Bitcoin held firmly below $75K support at the beginning of the week. The recent growth spurt has lifted the price above $80K, which can be considered a comfort zone. However, the first cryptocurrency approached the upper boundary of the downtrend, and the main test of the two-month trend is just beginning.

Ethereum is showing weakness relative to the market, dipping below $1400 at the lows of the week and bouncing back later to $1600. This bounced off the lower boundary of the descending corridor, and the upper boundary was near $1900. This level will be an important point to watch for a possible upside development.

News Background

Ripple announced the purchase of the Hidden Road platform for $1.25bn. The deal will strengthen the XRP ecosystem, including the RLUSD stablecoin, the XRPL blockchain, and the Ripple Payments service.

Cardano founder Charles Hoskinson said the crypto industry needed a ‘cooperative balance’ to compete with centralised tech giants in the race for Web3. He noted that DeFi's key challenge remains the ‘closed economy.’

According to Artemis Terminal, the crypto industry has lost about 40% of active Web3 developers in a year—an important marker of the ecosystem’s bad health.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)