Inflation in the US will not make the Fed's rate cut in September comfortable

Inflation in the US will not make the Fed's rate cut in September comfortable

The latest report on personal consumption expenditure in the US once again highlighted accelerating inflation. However, it was in line with average forecasts and did not cause an immediate strong market reaction.

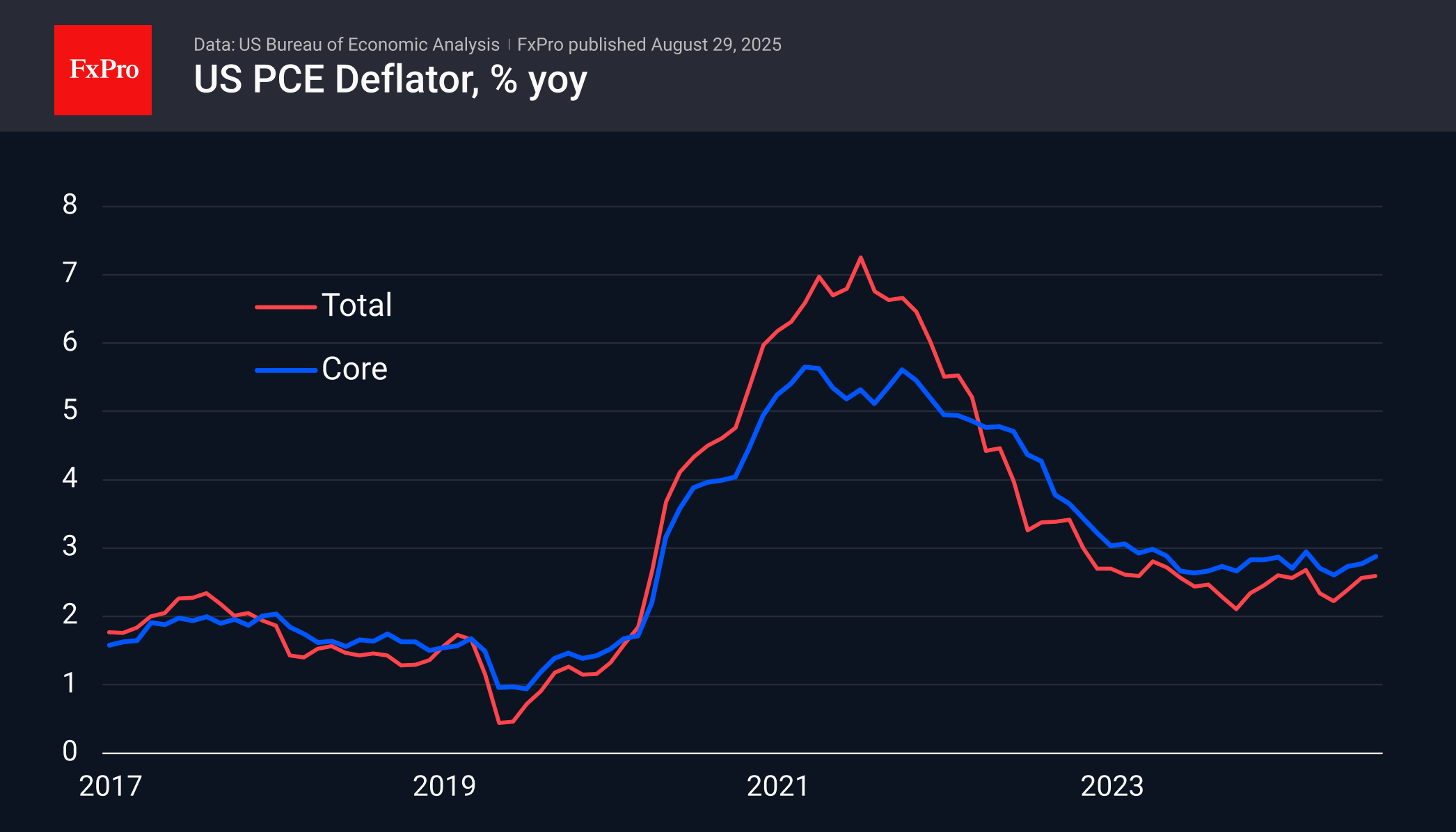

The Fed's preferred measure of inflation, the core personal consumption expenditure price index, accelerated to an annual rate of 2.9% in July, gaining momentum from April's low of 2.6%. The data is well above the 2% target. Overall inflation is also accelerating, adding 2.6% y/y against 2.2% in April. This trend is unlikely to prevent the Fed from cutting rates in September, but it raises questions about the advisability of another cut at the end of October or December. In other words, this is moderately positive news for the dollar. However, its impact needs to be confirmed by strong labour market data on 5 September.

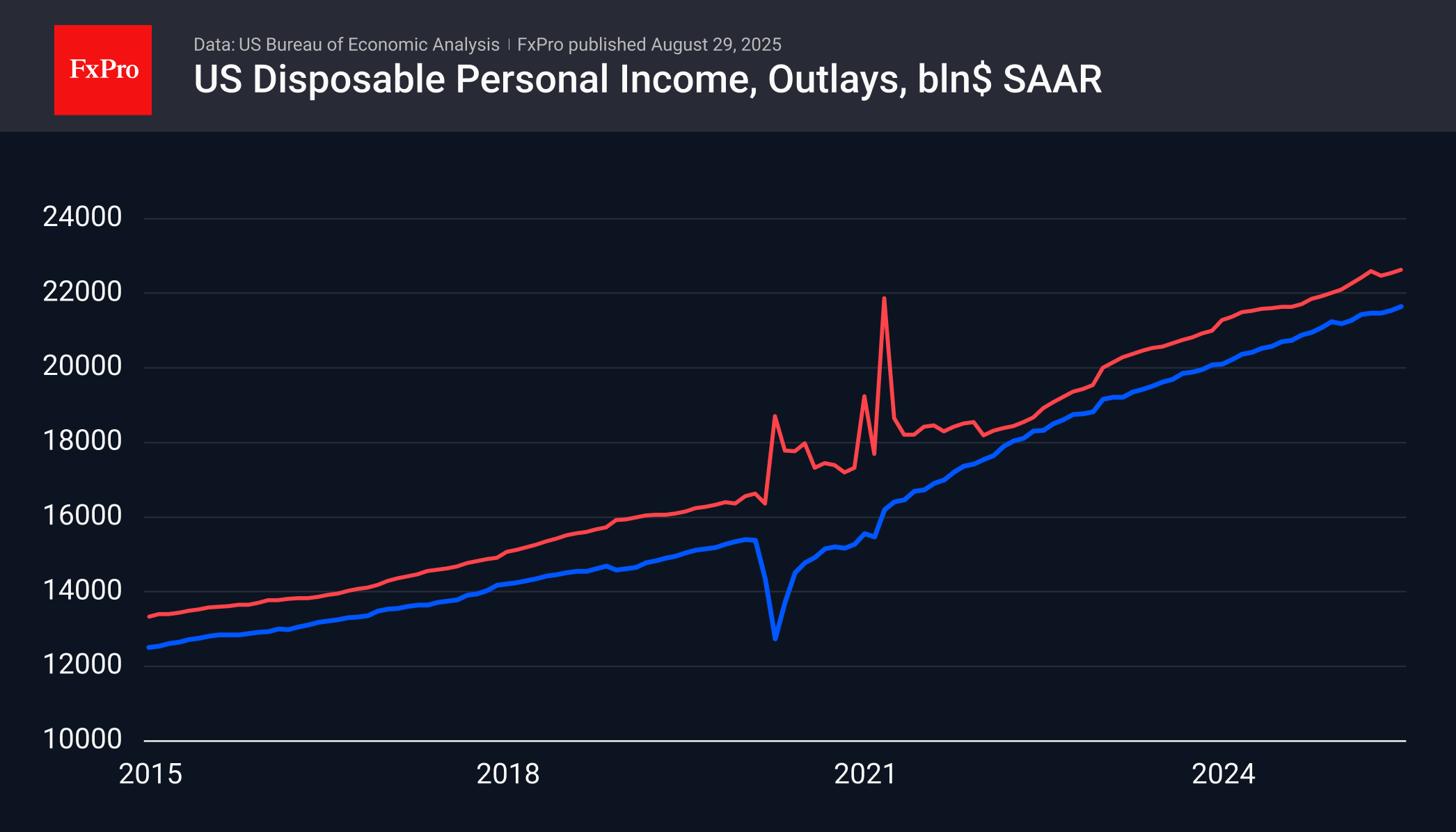

Other components of this report reflect continued healthy consumer activity, with income up 0.4% month-on-month and spending up 0.5% month-on-month. The slight excess of expenditure growth over income growth is not yet a cause for concern, as the savings rate of 4.4%, although low, is in line with the average level over the past four years.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)